Throughout our lives, we work hard to ensure that we acquire the resources essential to support the life we choose and the heritage we would like to leave for our dear ones. Some people are extremely wealthy and have amassed large sums of fortunes during their lives. In this case, estate management tools might be needed to guarantee that your money is distributed to your beneficiaries and heirs according to your wishes.

Federal estate taxes might eat up a significant chunk of the estate if it has an estimated total value of $11.7 million by 2021. While Florida does not have a state inheritance tax, an estate or trust that exceeds the state threshold shall face income taxes. Additional taxes, such as property taxes, gift taxes, or generation-skipping taxes, could be applied. Using the help of a skilled estate planning attorney, you may strategically organize your property so that taxes do not dramatically reduce the quantity of inheritance you pass on to your beneficiaries and heirs.

Our attorneys at Arnold Law, who specialize in estate planning, have the skills and experience necessary to develop tax-saving methods to assist in safeguarding your assets. Our lawyers can set up a variety of gifting and trusts arrangements to eliminate those properties from the estate and minimize their taxable worth.

Estate and Inheritance Taxes in Florida

In Florida, both inheritance and estate taxes function similarly. Although the state does not levy a "federal inheritance tax," certain Florida properties are however accountable for governmental estate taxes. In addition, a Florida citizen who inherits an estate from outside Florida may be subject to that state's inheritance taxes.

Understanding Estate and Inheritance Taxes

Death taxes, such as inheritance and estate taxes, are levied by a government on the possessions of someone who has just passed away. Although the words "inheritance tax" and "estate tax" are frequently interchanged there is a small difference distinguishing the two. The main distinction between an inheritance tax and an estate tax is who is accountable for paying.

The net worth of all the assets owned by a deceased until they die is used to compute the estate tax. The net value of the taxable estate is calculated by subtracting the estate's debts from the overall worth of the deceased's asset. The estate is then responsible for any tax liabilities that arise.

The value of individual bequests received from a deceased person's estate is used to compute inheritance tax. The recipients are responsible for paying this tax, though a will may stipulate that the estate bears some of the burdens.

Inheritance taxes are imposed against the particular shares inherited by heirs when the estate owes the estate tax. Estate taxes are payable by its estate executors, or State's representatives, with securities from the property in Florida or somewhere else; inheritance taxes are payable by single heirs, while Florida's last will frequently arrange for payments of inheritance taxes from the estate property.

In any case, Florida doesn't levy any inheritance or estate taxes, whereas other states do.

Federal Estate Taxes

Florida doesn't have an additional inheritance ("death") tax, as previously stated. The national government, on the other hand, levies an estate tax on all inhabitants of the United States. The estate tax is calculated by multiplying the deceased's possessions by a progressive rate of taxation. The “taxable estate” of a deceased refers to the possessions that are subject to taxation. The national estate tax begins at a rate of 40%. The federal estate tax is only applicable if the total worth of the property reaches $11.7 million as of 2021, and also the tax is payable by that estate/trust, not the heirs. Few individuals or estates should be concerned with the federal estate tax because the exemption amount is so huge, and rises to $23.4 million for married couples.

Potential Tax Concerns for Inheritances

As previously stated, an estate tax solely applies to persons who die with a net worth of more than $11.7 million as of 2021. Single heirs are often not accountable for the estate's taxes because the executors or successor Trustees are in charge of collecting and paying the property taxes. Other scenarios wherein Florida heirs could be required to repay taxes on their inheritances are:

Taking Money Out of a Retirement Account

While no taxes are due on the transfer or inheritance of a 401K, IRA, annuities, or any other eligible plan, income taxes may be due when funds from such accounts are released following the demise of the account holder. The argument behind this is that while the person who died could be responsible for his or her income taxes upon withdrawal, the heir is equally accountable. Income from certain retirement funds and mutual funds may also be taxed. Before taking cash from these kinds of accounts after the loss of your loved one, it is best to consult with a lawyer or an accountant. When somebody dies, any withdrawal from Roth Insurance Regulatory Authorities is not taxable.

Getting Money from the Property

If an heir gets the income-generating property, the earnings may be subject to taxation even before the property transferal. If the decedent possessed an apartment block and the occupants paid rent to the heirs throughout the trust settlement or probate process, the beneficiaries could be obligated to settle income tax on the income from the rent.

The Inheritance is Not Income

Whereas the property may make revenue throughout its settlement period, the heir does not pay taxes on that inheritance. For example, suppose your mother left you $10,000 in insurance coverage. For you, the $10,000 isn't taxable income. Nonetheless, if the insurance generated money before its distribution, the beneficiaries would've been taxed on that income. If insurance is claimed soon, any earnings are likely to be less.

Selling Inherited Assets

Income taxes do not extend to property obtained straight from a trust or an estate, as previously stated. If you transfer an inherited estate, however, the gains may be liable to federal income tax when the item has increased in value following the deceased's death. For instance, if you receive stock valued at $30 on the day of passing and trade it for $40, you will owe $10 in taxable income. The gains in the asset could be a capital gain should you have retained it for 1 year following death. The good news is that taxation on income would be calculated solely on the rise in property worth since the deceased's passing if any. The bequest is not a source of income for you.

Inheriting from a Non-U.S. Citizen

If the decedent was not a US citizen, or when any of the heirs was not a US citizen, there could be tax implications. If an individual isn't a US permanent resident yet possesses estate in Florida, that property could be taxable following their passing, and non-citizen partners will not be entitled to acquire that property tax-free. This is when things become a little problematic.

Calculating the Value of Taxable Estates

Just remove liabilities from your assets to get a property's taxable value, with "assets" broadly defined to also include much above what passes through probate. A taxable estate includes real land, financial holdings, financial interests, properties owned in a trust managed by the deceased, and death payments of life insurance. The proceeds of the life insurance policies could be held outside the property if it is kept in an Irrevocable Life Insurance Trust (ILIT) for a minimum of 3 years before death.

What Is the Process for Paying Federal Estate Taxes?

The estate owes the federal tax, which should be settled in cash by the trustee. This can be problematic for large estates with a high percentage of illiquid properties, such as land. Executors are sometimes required to dispose of properties to settle taxes.

A common approach for resolving this dilemma is taking out life insurance for property planning, and for settlement of administrative costs and estate taxes.

Irrevocable Trusts and Gifting Strategies

Estate tax liabilities can be reduced to some extent by withdrawing properties from the potential estate before death. It could be done using irrevocable trusts and, more effectively, by transferring property to beneficiaries or charity during one's lifetime. Since this value is simply shifted to another form, selling off assets is often not an effective technique for decreasing the estate tax burden.

Annual Gifts

The tax law allows gifts annually of a maximum of $15,000 per beneficiary each year (twice the amount for couples) from gift tax. Therefore, when you gift every one of your 4 children $15,000 in possessions, you'll have decreased your overall property by $60,000 without paying additional gift tax for both your children and yourself. If the contributions are made over several years, the potential estate tax penalty can be drastically lowered, if not eliminated.

Asset Appreciation

Since the recipient receives the giver's taxable value together with the transferred property, the gifting method is especially successful with growing assets. If the property is ultimately transferred, the receiver will face tax on capital gains at maximum percentages of 20 percent on the increment. When the asset stays in the property (assuming the property passes for tax), the tax may apply at the maximum percentage of 40 percent of the property's current value, without deduction for costs basis.

Form 709

A Form 709 gift tax form is required for a gift of more than $15,000 to a single receiver in one year. Although no gift tax will be payable at the moment, the cost of the donation exceeding $15,000 will be subtracted from the donor's lifetime threshold of $11.18 million, which is connected to the estate's tax-exempt status. Your lifetime gift exclusion is exactly that, a lifelong limit. You can not take it back after you've used it up, therefore gifting carefully is a smart idea.

Gifts for Spouses

The gift tax does not apply to gifts between spouses or contributions towards medical or educational expenditures. The gift tax does not apply to gifts between spouses or contributions towards medical or educational expenditures. As a result, if you gift your son $60,000 to help him pay tuition, your exemptions will be lowered by $45,000, the value of the transfer less the $15,000 yearly limit. Your exemptions will not be impacted if you paid directly to the school.

Retirees

Florida is widely regarded as a tax-friendly jurisdiction for retirement owing to the estate, bequest, as well as income tax rules. Even though Florida's policies do not safeguard inhabitants from federal estate taxes or government estate taxes, an organizational strategy established with the assistance of a trained Florida estate lawyer could go toward lowering tax liability as well as guaranteeing that your estate is transferred to your dear ones rather than the IRS.

Avoiding the Unified Estate and Gift Tax

The tax or exemption value on the gift and estate tax is reduced as gifts are declared to the Internal Revenue Service during one's life. As a result, yearly gift planning is just as critical as inheritance tax planning.

A bypass trust is a way that estate planning might assist you to reduce your gift and estate tax. Partner A chooses property up to the estate's tax-free status to go to the credit shelter or bypass trust when he or she dies, whereas the rest of Partner A's property goes to Partner B or immediately into a spousal trust. The trust's recipient, typically the remaining spouse, receives trust earnings throughout their lifetime, once that partner dies, the principal inside the bypass trust is distributed to the beneficiaries in the trust document, rather than being regarded as part of the remaining partner's estate.

This sort of trust might postpone paying inheritance taxes till the other partner passes away, allowing that partner to reap the full benefits of the inheritance. It could also secure the bequest of kids from a previous union for someone who was remarried or when a remaining partner remarries or divorces afterward.

A credit shelter trust sometimes called an AB trust, or family trust is one option to minimize the estate's tax all while paying for your partner and securing bequests for your beneficiaries. An irreversible life insurance fund, which decreases the value of the property liable to tax, is yet another useful option. A charity trust could also be supported without paying taxes.

Protecting Your Inheritance from Taxes

Noone lives indefinitely. That's why it's critical for Residents of Florida to have a solid estate strategy in order in the event anything unexpected happens. If an individual passes away without properly drafting their estate plan, their heirs could face a slew of unexpected expenses. As a result, it's a smart suggestion to get your estate planning assessment regularly to ensure that everything is in place for efficient property transfer at the right moment.

One motive for estate plans could be to prevent probate, which is a judicial process that verifies the authenticity and validity of legal property planning paperwork. If a property plan is properly drafted, probate isn't required. Setting up a trust as well as putting all property not required for retiring into it is one excellent tool. Probate can result in 6% of the total property, thus evading it could save beneficiaries a significant amount of money.

Distributing Assets by Making Tax Free Gifts

From 2019, anyone could give gifts of $15,000 per year to as many individuals as they choose without incurring any taxes. It's one way to downsize a huge estate as well as distribute possessions to others while you're still alive. A person can also give any sum of cash to charity without having to pay a gift tax. Furthermore, any gifts made in the name of a relative to medical and educational establishments for educational and medical expenses might be reduced from the valuation of your property. Offering gifts as means of obtaining tax deductions, on the other hand, must be undertaken with the counsel of an estate planning lawyer as well as an accounting professional to avoid possible traps or unforeseen consequences that could counteract the advantages.

Reduce the Amount of Money You Take Out of the Retirement Accounts

Until they've been released, inherited retirement funds are tax-free. If the recipient isn't a partner, however, specific regulations might be applicable if the payouts must be made. When one partner passes away, the remaining partner can normally claim the IRA to be their own. The living partner's IRA's minimum threshold withdrawals could start at 72 years, just like the remaining partner's personal IRA.

You could move cash to an acquired IRA under your name if you inherited a retirement fund from somebody else besides your partner. Even though you're not 72 years yet, you can start taking minimal payments the first year of or following the bequest. Try using the "single life" technique of determining the necessary payout sum depending on your age if you're not older than the deceased. Your minimal payouts will be much less, which implies you will pay lower taxes and the funds will have more time to mature tax-deferred.

Creating a Trust to Avoid Estate Taxes

You could move funds from the estate to prevent possible tax implications by using various forms of irreversible trusts. These properties won't be yours after they are moved to a trust as they'll be managed by that trust. You can, however, continue to profit from that trust when you're still living. Some kinds of irrevocable trusts that could be utilized to lower the taxable amount of the property are mentioned below:

Trust for Qualified Personal Residence (QPRT)

Your property is the sole property in an eligible personal residence trust. Although the ownership of your residence is handed over to the irreversible trust, you maintain the freedom to live there. With this trust, you can transfer the home outside of the estate for a reduced gift tax amount.

Bypass Trust

The purpose of a bypass trust is usually to assist your children or partner. A spousal bypass trust removes properties from the estate while allowing your partner to withdraw from your trust, keeping the trust's earnings inside your home. When your partner passes away, the trust could be handed to their beneficiaries without incurring any inheritance taxes. A comparable trust for your kids could be set up, and the trusts are termed "sprinkle trusts"/ "spray trusts."

Irrevocable Life Insurance Trust (ILIT)

An Irrevocable Life Insurance fund is established only for the aim of obtaining insurance coverage. The profits from a life insurance payout aren't taxable to the heirs, however, they are included in the estate. The estate's worth is reduced by forming an irreversible life insurance trust as well as letting it acquire the policy since this coverage is not included in the property, and your family members are still covered as the plan's beneficiaries.

Intentionally Defective Grantor Trust (IDGT)

An Intentionally Defective Grantor Trust has ownership in inexpensive privately owned enterprises and lets them grow. The growth of the assets isn't taxable because they belong to that trust.

To prevent probate as well as the death tax, it's critical to pick the right estate planning finance instruments and resources. This could necessitate the services of both a financial advisor and your estate planning lawyer. Most of the paperwork required for effective finance as well as estate planning might be hard to draft. In some situations, engaging legal specialists in Florida could be essential to guarantee that the estate planning takes into account all crucial financial difficulties and that all paperwork is properly created. In the end, might save you plus your successors more money.

Find a Skilled Estate and Inheritance Tax Attorney Near Me

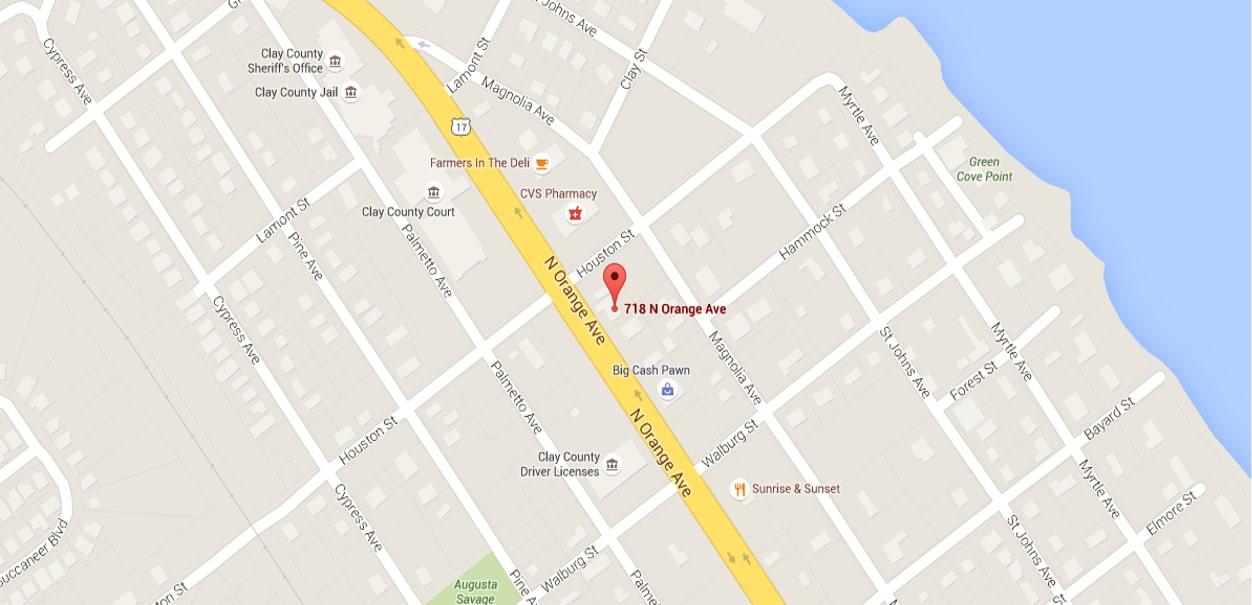

With years of expertise in Florida estate planning, the attorneys at Arnold Law are well equipped to provide you with the assistance you need to arrange for your estate. Give us a call today at 904-264-3627 to set up a free appointment or to learn more about how we can help you protect your possessions for your dear ones.