Special needs trust planning is focused on catering to the special demands of our loved ones who have disabilities after we are no longer able to manage and speak on their behalf. We at Arnold Law believe that parents of special-needs children should make conscious estate planning decisions to organize all of their children's administrative, financial, as well as special-care needs now and for their future. Along with drafting special needs trusts in Florida, we work together with parents and carers to build well-thought-out plans for loved ones who will need special care throughout their lifetime.

What is a Special Needs Trust?

A special needs trust is any trust that features statutory provisions that safeguard a mentally or physically challenged trust beneficiary's eligibility for public benefits like Supplemental Security Income or Medicaid. These trusts have limitations on how funds can be used, such as preventing transfers from being used to cover products that are designed to be offered exclusively through public aid programs for which the recipient could be eligible.

In Florida, for instance, Medicaid benefits are only accessible to those with a monthly wage of $948 or below and quantifiable possessions of $5,000 or below. The trust contract for a special needs trust will provide that the trust's property assets can exclusively be allocated in a manner that enables the receiver to disclose assets and income under the Medicaid qualification criterion. As a result, the trustee can provide the most benefits to their recipient family members.

Although trust assets can not be taken into account for determining qualification, trust income could be used to enhance the recipient's standard of living by covering living costs that are not provided by Medicaid benefits. Medicaid covers the costs of a disabled person's basic needs, like rent, food, as well as utilities. The needs assistance provided by Medicaid cannot be replaced or duplicated by a special needs trust. When it does, the recipient's eligibility may be jeopardized as a result of the trust payments.

The Purpose of Florida Special Needs Trust Law

A special needs trust can provide extra benefits to boost the basic needs support from the government, including:

- Clothing and dry cleaning

- Musical instruments

- Electrical devices such as computer systems and Television sets

- Home maintenance and cooking services

- Companionship

- Health insurance

- Individual grooming

- Certain healthcare services, equipment, and therapies

When Special Needs Trusts are Needed

To begin with, special needs trusts are only available to persons who are considered "disabled." Here are a few common scenarios in which a special needs trust might be appropriate:

-

A Medicaid Recipient Receives an Unprecedented Influx of Cash

For instance, when a Medicaid beneficiary is injured in a vehicle accident and collects a personal injury compensation, the excess money could compromise their eligibility for Medicaid - and result in their benefits being terminated. To safeguard their Eligibility for Medicaid, the personal-injury user should be encouraged to set up a first-party also known as a self-settled special needs trust to retain the personal injury compensation.

An unexpected influx of money could also come through a divorce (for example, alimony money or the changing the title of properties from an ex-spouse to the Medicaid beneficiary) or a bequest.

-

A Parent of a Disabled Child does not Want to Disinherit Their Child, But Neither does He Or She Want To Put Their Child's Medicaid Benefits in Jeopardy

For the sake of a disabled child, the parent's attorney would recommend the establishment of a third-party special needs trust. A third-party special needs trust is a trust established through the parent's Revocable Trust or will. After a parent's death, a third-party special needs trust can be established, maintained by an administrator, and used to pay for goods and services not that are covered by Medicaid. It is also known as a testamentary special needs trust.

Similarly, consider a scenario in which an ill spouse needs nursing home assistance. The healthy spouse does not want to cut off the ailing spouse, but she also does not want to endanger the nursing home partner's Medicaid eligibility if she or he passes away first.

-

A Medicaid Applicant Makes Too Much Money Between a Pension and Social Security to be Eligible For Medicaid

Types of Special Needs Trusts

There are two different kinds of special needs trusts:

- Third-party trusts are set up by a recipient's members of the family

- Self-settled trusts set up by the recipient

Third-Party Special Needs Trusts

A third-party special needs trust can be defined as a trust, or portion of a trust, put in place for the good of a Medicaid beneficiary by a 3rd party. To put it another way, the trust contract is created by somebody other than the recipient, and they contribute their resources towards the trust. A third party who sets the special needs trusts is often the beneficiary's grandparent or parent, and the trust is created as a component of the parent's or grandparent's general estate plan.

Oftentimes, the parent or grandparent establishes a revocable living trust which contains a special needs provision throughout their lifetime. In essence, if a recipient is or with time becomes disabled and therefore is qualified for government assistance through SSI, Medicaid, or any other benefits, the trustee must withhold and reserve any transfer of funds that could impair the recipient's benefits qualification for the trust. The trustee could have the authority to distribute funds for extra benefits not provided by Medicaid.

Special needs trusts established by third parties are an essential estate planning strategy that should be incorporated in most family wills and living trusts. Parents or grandparents cannot predict future developments in their grandchildren's or children's health that could necessitate the use of long-term healthcare benefits.

Nobody would like to force a descendant with a disability to accept a bequest that may result in their losing government benefits. When a disabled recipient passes away without utilizing the money from a third-party special needs trust, the remaining trust assets pass on to the recipient's descendants and heirs.

One crucial point to remember while drafting any third-party SNT in Florida would be that the disabled recipient does not have the right to request principal or income from that trust. As long as an individual trustee holds the authority to allocate funds from the disabled recipient trust share as well as the trustee continues to follow special-needs guidelines, the trust income, and trust assets shouldn't be considered by Medicaid.

Other than that, creating a third-party special needs trust has no additional requirements. The assets are owned by a third party, who can transfer them according to their conditions through a testamentary trust or will. They can change their minds at any moment, and a third party can revise their trust or will to include or exclude special needs guidelines.

A special needs trust for a living spouse should only be drafted through a will, according to federal law. A living trust cannot be used to establish a special needs trust for a surviving husband or wife. However, living trusts or wills can be used to create a special needs trust for a child. There are a few options for creating a special needs trust for a living spouse under a living trust-based estate arrangement.

Self-Settled Special Needs Trust

This special needs trust is one created by a disabled individual who is applying for government aid. The aid seeker is both the trust's beneficiary and grantor. The self-settled trust has many of the same rules as a third-party special needs trust, the most notable being a limitation on transfers that would remove or limit the recipient's qualification for Medicaid disability assistance.

Self-settled special needs trusts are rarely used by people who already have assets. Self-settled special needs trusts are commonly set up by disabled people who seek to keep recently obtained assets out of Medicaid's asset qualification criteria.

A properly established self-settled special needs trust does not count against Medicaid's asset qualification limits. Special needs trusts are commonly used by people who obtain a large sum of money unexpectedly.

When a Medicaid user is injured in a car accident that leads to an insurance lawsuit, the insurance settlement will prevent the injured person from receiving needs-based government aid except if it is retained in a self-settled trust. A similar thing can be said about money obtained as a result of civil litigation.

When parents and grandparents do not include special needs terminology in their estate planning paperwork, their inheritance to a disabled inheritor will preclude them from receiving government benefits except if they are transferred to a self-settled needs trust by the beneficiary.

Someone qualified for Medicaid assistance may get a lump-sum settlement of assets or money as a result of a divorce. Assume the individual is mentally impaired or disabled or at the time he inherits the assets or money. In that instance, the self-settled trust could be drafted by an individual permitted by an appropriately formulated and authorized power of attorney. When there's no power of attorney, the drafting of a special needs trust by a disabled person could require judicial clearance.

Florida self-settled trusts vary from third-party special needs trusts in three ways. To begin, only disabled people below 65 years are eligible to establish a self-settled needs trust. Anybody, irrespective of the recipient's age, can create a third-party special needs trust at any moment.

Secondly, self-settled special needs trusts have to be irrevocable, such that the disabled trustor can't change or revoke his or her trust. However, third-party trusts can be altered or canceled by the third-party trustor at any moment or for any cause. If the legislation or family situations change, the trusts can be conveniently updated.

Thirdly, self-settled special needs trusts should include a repayment provision, under which all funds held in the special needs trust during the death of the disabled trustor are repaid to the state authorities to the level necessary to pay back the Florida State for the Medicaid benefits received by the grantor during his or her lifetime.

Pooled Special Needs Trust

There's also a form of self-settled trust referred to as a pooled trust that changes the payback provisions. A pooled trust is a collection of self-settled trust assets from many people. A person's contribution is recorded in sub-trust accounts. However, a nonprofit professional administrator oversees every one of the sub-trusts. A master pool trust could have numerous self-settled trusts accounts.

If an independent contributor passes away, the assets or money in his or her special needs trust account could be repaid to Medicaid or maintained in the pooled trust account for the sake of the other pool trust contributors who have exhausted their support money, depending on the recipient's preference. A pooling trust could also be utilized to separate an individual's income from his or her eligibility for Medicaid.

Self-settled special needs trusts are a new Medicaid planning technique. Before January 2017, Medicaid law did not acknowledge these special needs trusts, and only third-party special needs trusts can safeguard assets held in trusts for disabled beneficiaries.

These trusts were made legal by a law approved by Congress. So don't be confused by anything stated before January 2017 stating that self-settled special needs trusts aren't permitted.

Considerations For Self Settled Special Needs Trusts

- Consider other options for self-settled needs trusts, like investing an inflow of funds in a non-countable Medicaid asset, like a residential property

- If someone can obtain sufficient commercial healthcare coverage, an Obamacare plan is preferable to Medicaid since there are no return obligations. Medicaid is usually a last-resort option

- A self-settled special needs trust needs to utilize a professional administrator since faults in trust administration can have significant monetary ramifications for the recipient who is otherwise qualified for Medicaid assistance

- A special-needs trust should not be confused with other forms of trusts employed in Medicaid long-term healthcare planning. Assets held in special needs trusts in Florida are exempt from Medicaid asset limitations. Another form of irrevocable trust exists specifically to protect an applicant's wages from the income limitations of Medicaid. The "income trusts" are known as Miller Trusts or Medicaid Trusts. Upon joining a skilled nursing home, the Miller or Medicaid Trust is set up by the Medicaid claimant on the grounds of storing wages beyond the Medicaid income limitations in a trust. Usually, this form of trust doesn't hold or manage assets

- SNTs are legal agreements that are difficult to understand. Mistakes in trust document drafting can have substantial financial ramifications for the designated trust recipient. A skilled asset protection lawyer should draft special needs trust documents for you

ABLE Financial Accounts

This is a financial tool introduced by Congress to help disabled people ease their financial strains. The ABLE account allows eligible financial investments to grow tax-free for the good of disabled people. Article 529 of the Internal Revenue Code governs ABLE financial accounts, which is the same article of the Code that governs tax-deferred college tuition savings arrangements.

ABLE accounts allow you to save tax-free for eligible expenditures such as education, housing, as well as transport. ABLE accounts boost but do not replace, benefits provided by private coverage, Medicaid, SSI, among other sources.

ABLE accounts are taxed like a Roth IRA. Contributions are done after-tax money has been deducted. The money in the fund can be invested, and any profit earned is tax-free. All participating grantors, including family members and friends, make a total yearly donation to an ABLE account of $14,000 each financial year. The overall amount of yearly payments through time is limited by the limits set by each state's 529 savings scheme.

ABLE accounts are exclusively available to anyone who has a serious disability that began before they were 26 years. The account should also be launched before the age of 65. The beneficiary has to be at least 26 years old when the ABLE account is established. Nonetheless, the beneficiary's disability should have begun before his or her 26th birthday.

For disabled people receiving SSI, there are additional account limitations. Individual resources limits on SSI are waived for the initial $1000,000 in ABLE account balances. If the amount in an ABLE account exceeds $100,000, the recipient's SSI cash benefit is stopped until the balance in the account goes under $100,000, either through distributions or a drop in the valuation of account holdings.

It's essential when the account balance surpasses $100,000, the recipient's SSI cash qualification is stopped but not forfeited. The amount in the beneficiary's ABLE account has no bearing on his or her eligibility for Medicaid.

Balances in ABLE accounts are liable to "pay back" in the same way as self-settled Medicaid trusts are. This indicates that the state Medicaid provider is reimbursed from the outstanding balance at the recipient's demise for any sums spent on the beneficiary's treatment once the ABLE account was set up.

ABLE account law is passed at the state levels in response to a federal requirement, and the restrictions vary to some degree between states. For example, the Florida ABLE United program, which was passed by the Florida state, stipulates that only Florida residents who live in the state are allowed to set up ABLE accounts. ABLE programs in other jurisdictions accept applications from other jurisdictions, and Florida citizens can participate in just about any state's ABLE program.

ABLE accounts provide benefits over other disability planning instruments, like special needs trusts. The charges for establishing an ABLE account are significantly lower than those for establishing a trust. Owners of ABLE accounts have direct management over their cash and investments, rather than depending on a third-party grantor.

A Special Needs Trust Trustee's Responsibilities

The trustee serves a critical function after a special needs trust has been appropriately drafted, approved, and funded. The trust will direct the administrator to spend the special-needs trust assets only on the recipient/ beneficiary (the individual with a disability).

If another administrator spends the money on anybody else (even the trustee himself or herself), infringing the conditions, the special needs trust's Medicaid eligibility could be jeopardized.

When the trustee inappropriately spends funds from the special needs trust, such as replicating services already given by Medicaid rather than strictly paying for things or services not covered by Medicaid, Medicaid payments may be decreased, if not terminated. The trustee must be aware of the tax implications of their decisions and the moral obligations they have to the beneficiary.

Because of their diverse limitations, risks, and administrative intensive role as a guardian, it is advisable to use a qualified trustee for special needs trusts. The trustee should also be cognizant of any other government benefits that may be accessible, like Medicare or SSDI. This will keep the trustee from misusing funds on items that could be covered by public entitlement plans or benefits.

How Much Does It Cost to Set Up a Special Needs Trust?

Special needs trusts can come in a multitude of distinct forms. A knowledgeable attorney in this subject can assist you in choosing the right special needs trust arrangement for your case. The cost of establishing a special needs trust varies based on the kind of trust you as well as your attorney chooses. A professional law firm can assist you in gaining a better understanding of your alternatives and making the best decision for your loved one.

The objective of a trust is to protect loved ones when the grantor is alive and also when he or she dies. There are numerous types of special needs trusts that can be used to guarantee that your recipient (or recipients) receives trust assets while still being eligible for government benefits like Medicaid.

Assets Considered By a Florida Special Needs Trust Attorney

There are no restrictions on the kind of assets that could be transferred in special needs trusts in Florida like in several other states. Common examples include estates, securities, stocks, bonds, among other highly valued assets and properties. As your Florida special needs trust lawyer will explain to you, each type of special needs trust has its own set of advantages and varying degrees of flexibility.

One advantage of a third-party trust would be that the holdings of the trust don't have to be repaid if the beneficiary dies. Pooled trusts, on the other hand, enable several recipients to combine their funds while keeping their accounts. If one of the recipients dies, the funds in their fund are either distributed to the organization managing the trust fund or to the government.

Find a Florida Trust Attorney Near Me

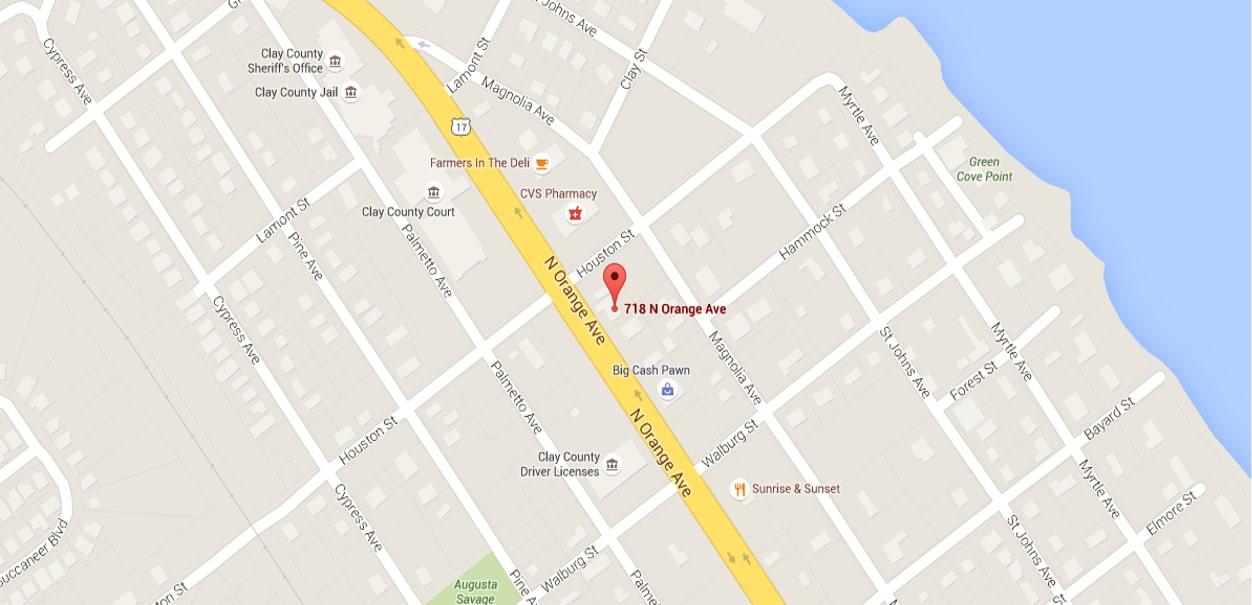

Special Needs Trusts are a crucial component of estate planning when you have a loved one with disabilities and you wish to provide for them after your death. We invite you to book an appointment with Arnold Law to discuss which solutions are best for your situation. Our attorneys can assist you in establishing the legal framework needed to safeguard your loved one. Call us today at 904-264-3627.