As a gun owner, you may have heard about the gun trusts. A gun trust owns particular firearms subject to federal regulations. Transferring firearm ownership to your beneficiaries is not as easy as transferring assets, and failure to follow the correct procedure in the transfer of firearm ownership could attract serious felony charges. A gun trust makes it easier for your heirs to inherit and manage firearms without breaking the law.

If you want to create a trust for your firearms, it would be wise to consult an estate planning lawyer skilled in the State and federal laws governing firearms possession, use, and transfer. At Arnold law, we provide legal guidance for all our clients who are hoping to create a gun trust in Florida.

Overview of Gun Trusts in Florida

When you die, your assets will go to the person or people named in your will or trust. However, this is not the case for firearms. Gun inheritance is quite complicated, and whether or not your wishes regarding inheritance will be followed depends on where you live, the person who is meant to inherit the guns, and the type of firearms you own. Broadly, guns fall into two different categories.

Some firearms are subject to the National Firearms Act. The firearms may include fully automatic weapons, Silencers, and barrel shotguns. These guns must have a serial number and be registered with the federal Bureau of Alcohol, Tobacco, Firearms, and explosives.

The other category of firearms is the unregistered NFA weapons. These are contraband weapons, and ownership cannot be passed to an heir. If an executor of an estate discovers unregistered firearms, they must contact a local ATF officer and turn over the weapons to law enforcement. Some firearms not covered by the NFA may include shotguns, semi-automatic pistols meant for home protection, and hunting rifles.

The best way to transfer unlicensed firearms is through an entity that possesses a Federal-Firearm License. After the heir files the required forms, the FFL will hold the firearms while carrying out a background check. If the heir passes the background check, they can collect the firearms.

A gun trust is a recoverable trust that you can create to take the title of your firearms as a separate legal entity. In Florida, the gun trust can take the title of any legally owned firearms. When you use a gun trust, the trust will take ownership of the firearms. The names of beneficiaries or trustees can change during your lifetime. Putting your firearms in trust often helps avoid the long firearm transfer process described above.

When creating a gun trust, you can name multiple individuals who will share ownership of all firearms covered in the trust after your demise. Since a trust stays in effect after your death, the executor of your estate will not transfer the firearms, and they do not need to go through probate. Although gun trusts are not aimed at breaking the law, some gun owners view it as an opportunity to avoid breaking the law in future transfers and inheritance of the weapons.

Unlike the recoverable living trust that ends once your assets are distributed after your demise, a gun trust may be designed to last multiple generations while considering the State and Federal gun laws. If you wish to create a gun trust for your firearms, working with an attorney who better understands Florida gun laws would be wise.

When you want to create a gun trust, you should avoid falling into the simple online trusts. Often these trusts may lack the most basic language needed to ensure your protection, your family and your firearms. By consulting an attorney that is knowledgeable about the National Firearms Act, you can create a trust that protects your needs.

A gun trust will be a helpful scheme for you if you wish to share your weapons with other people in your lifetime. However, some advantages regarding gun inheritance have been eliminated with the current ATF rules. Before setting the gun trust, you should carefully consider the advantages and disadvantages.

NFA Firearms allowed in Florida include:

- Machine guns. Machine guns are commonly known as fully automatic weapons designated to shoot more than one shout automatically without a manual reload. However, a civilian can only possess such a weapon if manufactured before May 1986.

- Short barreled rifles. A short-barreled rifle with a rifle whose barrel length is less than sixteen inches.

- Short barreled shotguns. Any shotgun with a barrel length not exceeding eighteen inches is considered a short-barreled shotgun.

- Silencers. A silencer is a device attached to your firearm, and it reduces the visible muzzle flash and voice from the firearm.

- Other weapons. Any other weapons that can be discharged through explosive energy and concealed can be placed in a gun trust.

Benefits of a Gun Trust

Without a gun trust, the firearm applicant can legally possess or use it. If you die, your children or spouse will not use your guns without violating the law. A gun trust gives you the much-needed flexibility to add or remove people with whom you wish to share ownership of your Title II firearms. A gun trust is specifically designed to hold your firearms. As a grantor, you can remove or add beneficiaries throughout your lifetime. After your death, any person in the list of beneficiaries can take control of the weapons.

Some of the benefits associated with creating a gun trust include:

- Avoiding future restrictions on gun transfers. However, such a rule has not been passed. Some gun advocates fear that a day will come when it is illegal to transfer firearms to your inheritors during life. Therefore, placing their ownership in trust makes transferring them to your heirs easier.

- Avoiding probate. The process of retransferring firearms to another person can be long and tedious. It would be best to go through probate, and all the background checks involved can delay the process. When your firearms are held in a gun trust, you will not need to go through probate to transfer them to your loved ones.

- Lessening the burden for the executor. The executor of your estate is the person who is responsible for gathering the assets you leave behind, paying your debts, and distributing what is left to your beneficiaries. Often, most executors ask for the necessary knowledge regarding the ownership or possession of NFA weapons. If the executor of your estate does not follow the correct procedure of transferring the weapons’ ownership, they risk facing criminal charges and landing the receiver of your weapons in trouble. The gun control act makes it unlawful for some people to possess firearms or send weapons to certain States. When you place your firearms in a gun trust, the executor will not be involved in their transfer.

- Keeping the weapons in the trust even after your death. When you place your valuable weapons in a gun trust, you can arrange for them to remain there even after your death. Whether you are alive or dead, your trustees will have the rights you grant them regarding the possession and ownership of the weapons. Since the firearms ownership is on the trust, your trustees will not need to go through the transfer process. When firearms are not in the trust, an heir may need to pay a transfer tax of up to $200.

- A gun trust allows more than one person to use firearms. As the owner of the gun trust, you have the authority to name as many trustees as you want. When you have multiple trustees, each one of them will have the right to possess and use the firearms in the trust.

- Maintaining privacy. A gun trust is a private document in Florida. Guns placed in the trust are not registered and cannot be looked up. Ownership of valuable weapons could put a target on your back. Therefore, placing them in the trust will ensure a confidential transfer to your beneficiaries.

Using a Gun Trust to Avoid Probate

In Florida, probate is a legal proceeding that administers the provisions of a decedent’s last will after their death. Probate is designed to pay all the creditors of the deceased, and a general rule requires all assets in the decedent’s name to be included. Often probate will not involve property transferred to another person following a contract. The probate process is long and involves estimating the value of the probate estate and identifying the deceased creditors.

Often probate can be summary or formal depending on the value of the property left behind. The timeline of formal probate includes these steps:

- File a petition to admit the original will to probate

- Notification of all beneficiaries

- The court will then issue letters of administration

- Issuing a notice to the creditors

- Consolidating the assets

- Payment of taxes

- Distribution of the assets to the decedent’s beneficiaries

- Formal discharge

Probate may take up to ten months which could be a long and tedious process. When you create a gun trust for your weapons, your beneficiaries will not need to go through the probate to acquire ownership of those weapons when you are deceased.

Crossing State Lines for the Gun Trust

If you leave a collection of non-NFA guns to an heir who lives outside Florida, the Federal law will not prevent them from driving across the State lines to claim their inheritance. However, an individual who inherits firearms from another state must comply with state laws on transportation and registration. Laws regarding guns are always changing, and therefore, it is important to always research and consult your attorney before moving forward.

Prohibited Persons for Gun Ownership

State and Federal laws prohibit some individuals from possessing weapons. You can leave your firearms to anyone you wish by indicating them as beneficiaries in your gun trust. However, if the individual is prohibited from gun ownership, they cannot take possession of these firearms. The gun control act makes it unlawful for the following categories of individuals to receive, ship, or possess firearms and ammunition:

Individuals who have been convicted and sentenced for a crime punishable by a prison sentence of one year or more

- Individuals who are fugitives of justice cannot inherit a gun trust.

- A person who has an addiction to controlled substances.

- Persons who have been adjudicated for mental illness or have been admitted to a mental institution.

- Illegal aliens.

- Individuals who are subject to a restraining order for stalking, harassing, or threatening an intimate partner or the family members of the intimate partner cannot inherit firearms.

- Persons who are serving a sentence for a misdemeanor domestic violence conviction.

- Individuals who have had a dishonorable discharge from the armed forces.

Even when a person qualifies to possess a firearm, they have no obligation to keep the guns they inherit. If you are not interested in keeping the firearms that are [assed to you through a gun trust, you can sell them to a licensed dealer. If the firearms are not valuable or the heir is not interested in selling them, it would be wise to surrender them to the local police department. Guns placed in a trust are easier to transfer and dispose of than contrabands.

Frequently Asked Questions on Gun Trust in Florida

The issues regarding ownership, possession, and passing ownership of firearms can be very complicated. If you are not careful, you or your heirs may land into serious legal trouble for the illegal transfer of firearms. The following are some frequently asked questions regarding gun trust construction, functionality, and desirability:

-

What is a living trust?

A living trust is made during your lifetime to benefit your spouse or loved ones following your death. Often a living trust is a revocable living trust agreement used for estate planning. Under chapter 736 of the Florida statute, living trusts have the following essential parts:

- The trust maker is the person that establishes the trust and designs its provision.

- The trustee who takes the legal title of the assets and ensures that the directions of the trust maker are carried out.

- Lifetime beneficially. This individual has full access to the income and benefits from the trust.

- Death beneficiary. A death beneficiary is a person that benefits from the resources in the trust after the grantor's

A living trust created for estate planning is revocable in part or full. As a trust maker, you can amend the trust while you are alive and mentally competent. When a trust maker dies, the living trust will become irrevocable. A recoverable living trust is significantly different from a gun trust.

-

Why is a revocable living trust not a substitute for a NFA gun trust?

A revocable living trust is used to transfer your assets to your beneficiaries upon your death. Although a Florida gun trust is a revocable trust, the gun trust is governed by special provisions that comply with NFA. The Term NFA refers to Title II weapons under the National Firearms Act. As an individual, you must apply for permission to receive a weapon to the BATFE, and the process could take up to a year. Also, your application to receive the weapon must be signed by a law enforcement officer and should contain your fingerprints to aid in background checks.

Additionally, you can file the trust applications when you purchase a weapon from a licensed dealer. One of the most significant reasons people opt to create a gun trust is to share their weapons with their loved ones while decreasing the risk of breaking the law during the transfer. Often an unapproved transfer of an NFA weapon is a felony punishable by a prison sentence of up to ten years and $250,000 in fines.

In such a case, a transfer may be used to mean anything from loaning the weapon to selling it or allowing someone else to use it. Fortunately, placing ownership of your weapons in a trust will help you establish a law stating the individual with whom you want to share your weapons. A properly drafted NFA gun trust will extend the use of your weapons to your beneficiaries.

With the revocable living trust, it is easy for your beneficiary to be caught up in legal issues by attempting to use or take ownership of your guns. On the other hand, a gun trust drafted competently is set to address the shortcoming and reduce the risks associated with inheriting firearms from an LRT.

Many issues could arise when you decide to use a traditional trust for your firearms. The beneficiary reaching a certain age is not the only issue when distributing firearms like you would other property. When dealing with firearms regulated by the NFA, you must be sure where the beneficiary lives. Also, you must be sure that the beneficiary is eligible to possess the firearms legally.

One of the essential parts of gun ownership is training to use it. Transferring ownership of a gun through the traditional living revocable trust is like handing a weapon to someone without providing the right instructions.

-

What is the downside of a gun trust?

Since the gun trusts are gaining popularity, the BATFE has not decided whether or not to allow for a tax-free transfer of the firearm upon the grantor’s death. Although the BATFE does not allow the tax-free transfer if the weapon is registered in trust, no regulation states that they must do this. Therefore, the BATFE can either allow you to transfer the firearms tax-free or deny the tax-free transfers.

-

Are there benefits of placing Title I firearms into a gun trust?

Often a gun trust is used for securing title II firearms. Although many gun owners prefer to place all their firearms into a single estate plan for easy distribution, it is not entirely necessary for title 1 firearms. Some gun owners are concerned that there may come a time where passing non-NFA firearms becomes illegal. Although this allowed the current owner to keep it, the firearm may be confiscated upon their death. A gun trust does not cease to exist, and therefore, there will be no issues on a transfer of their ownership.

-

Can I form a joint gun trust with a friend or relative?

While no law prevents you from forming a joint trust with another firearm owner, it is not advisable. If you and your friend create a joint trust, both will be grantors for the trust and can transfer the firearms to another person leaving the other grantor with an empty trust. Instead of forming a joint trust, you can each form a separate gun trust and name the other party as a trustee. If the friendship fizzles out, you can change the trustee by amending the trust.

-

Can an infant be named a beneficiary in a gun trust?

Yes. However, the trust document must be designed to hold the firearms until the beneficiary is at least eighteen years old. Also, the trustee must be sure that the heir is of the correct moral character to understand the personal and legal responsibilities associated with possession of firearms.

Find a Skilled Attorney Near Me

A gun trust is a planning tool for gun enthusiasts or collectors interested in arranging a smooth and legal transfer of their weapons’ ownership to multiple people after their death. By placing your firearms in a gun trust, you will be able to avoid the legal consequences that accompany improper transfer and ownership of firearms for your beneficiaries. In Florida, gun trusts have several requirements to be legally effective, and the NFA has strict fines and criminal penalties.

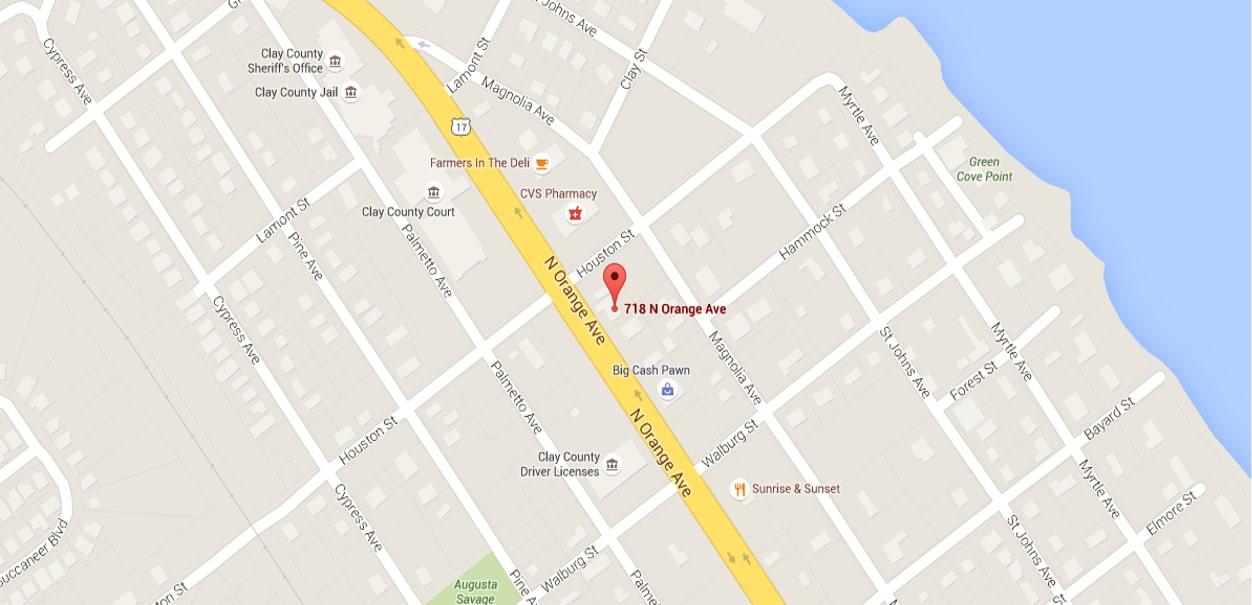

As the grantor of the gun trust, you can name as many beneficiaries as you want, and these individuals will have the authority to access the weapons after your demise. Creating and managing a gun trust can be very complicated. Therefore, guidance from a skilled attorney is crucial. At Arnold law, we can help you evaluate your options regarding a gun trust and create a plan to ensure the smooth passing of your treasured firearms to your beneficiaries in Florida. Also, we can work with your beneficiaries to help them navigate the transfer. Contact us today at 904-264-3627.