The foreclosure process can be very inconvenient, primarily because it threatens your ability to retain your home. Sometimes, foreclosures may also affect your business premises or any other property under a mortgage agreement. Therefore, you need to understand the foreclosure process, and all timelines related to it for the best chance at retaining your home. Moreover, the information you gather will help you prepare to meet with your lenders for negotiation meetings that extend the foreclosure period.

Working with a foreclosure attorney is the best decision you can make, as the attorney is well experienced and knowledgeable about the field. As a result, your lawyer will have a smoother time initiating different operations to help you avoid facing foreclosure or holding your lenders off until you are ready to complete all payments. Moreover, your attorney job is to provide professional guidance on various issues that could be unclear to you. At Arnold Law, we dedicate ourselves to giving our clients the best services for real estate issues. Our services are open to all clients in Florida, to help you prevent a foreclosure with quality legal services.

What is Foreclosure?

A foreclosure is a legal process that allows a lender to seize and sell your property. The process arises when the borrower defaults in making loan payments, leading to accumulated debt. Since most money lending institutions request for a collateral property, you will have given the lender some authority over your home after taking out a loan. Consequently, the defaulting borrower risks losing his/her property possession through eviction or possession by the lender.

Most lending processes occur in the form of a bank mortgage, whereby you will apply for a mortgage loan to finance your home or office suit. Under the terms of the agreement, the financial institution allows you to charge your home as collateral for the loan repayment, as you continue to make regular payment installments.

The agreement should last until you complete the final installment in repaying the loan for the bank’s charge over your home to terminate. Therefore, you should note that defaulting in making loan repayments puts your home at risk of foreclosure, as the bank will hold the charge against you. When the financial institution notices a recurrent non-payment trend, it will move to file for the foreclosure of your home.

The Foreclosure Procedure

Upon a looming foreclosure on your home, you may face challenging circumstances, primarily when you are unable to keep up with monthly payments. However, learning about the process will help you expect different procedures. This way, you remain calm as you understand the outcomes of each step.

What Happens During the Foreclosure Process?

Typically, the process may take some time, depending on different circumstances. However, it is often a long procedure that may last for eight to fourteen months before you lose your home. However, you can extend the duration to your advantage when working with an, especially if you would like some extra time to satisfy the lender’s demands. The general overview of the procedure leading to foreclosure is as follows:

Falling Behind on Mortgage Payments

When you begin making late and inconsistent mortgage payments, your lender will notice the inconsistencies and prepare a written notice alerting you of the consequences of defaulted payments. You should note that the risks of an ensuing foreclosure are possible, even when you fail to make only one payment.

Therefore, we recommend presenting understandable reasons for falling behind on making the payments, as it will support your case. However, the best step is to wait for official communication from the lender, as it helps you seek further advice from your lawyer.

Receiving a Letter from your Lender

Afterwards, your lender sends a letter indicating his/her intention to begin the foreclosure processes on your house. The contents are also likely to include any other specific terms of the agreement you have reached and their possible repercussions.

Further, the letter will include timelines that you should note, especially the period before your lender officially files for foreclosure. The details should help you purpose to clear your balance before the specific date if possible. However, if you are in a dire financial situation, you may have to let the lender file and defend yourself during the court hearing.

Lender Files for a Lawsuit Upon Non-Payment

The duration between receiving the letter and the lender filing for foreclosure should be thirty to ninety days. During the period, the lender expects you to make repayments or provide credible assurance of paying the balance. Therefore, you should expect the lender to file a lawsuit if you are still unable to make the outstanding payments.

Upon completing the court filing process, the lenders will receive a court case number for the pending matter. This number is useful to them because they can now serve you and expect a response. The service should occur within a short period after filing for the case. Some borrowers may choose to avoid the service by leaving their homes for some time. However, it may not be the best option as the lender could post the service in a publication.

Therefore, you can accept the service and forward it to your attorney as soon as possible. He/she will determine how to respond to the lender’s claims and demands while observing all requirements. Your response should reach the lenders within twenty days of receiving their submissions, and any late responses could cause significant delays.

The format of your response also matters, as you are expected to either admit or deny the lender’s accusations. Mostly, accepting the claims is easier because the lender will have evidence to show your defaulted payments. Hence, denying the allegations would only discredit you in court and lead to a faster foreclosure.

The Lawsuit Procedure

Before arguing your case in court, you will have the chance to serve discovery documents to the other party to satisfy legal procedures. The discovery process allows both parties to exchange legal information and go through the relevant case facts. With the availability of discovery service, you can anticipate the opposition’s arguments and prepare adequately.

When both parties are ready to proceed with the motion, the court sends you a chamber summons. Upon reception of the documents, you can then contest the foreclosure in a court hearing. If you dispute the content, you can provide justifications that may persuade the court to let you retain your home. You may cite various reasons, including unforeseen medical expenses or the sudden loss of a job.

During the ongoing foreclosure process, the creditor should inform you of his/her intention to sell your home through a letter. You should note that you have a chance to make outstanding payments for your home before the lender executes the intention to prevent foreclosure. However, you should act quickly as any delayed settlements will only push the lender to hold auctions or find a suitable buyer.

If you still cannot pay the outstanding balance, the creditor can auction your home in a licensed auction event, and the home will end up with the highest bidder. However, sometimes auctions are unsuccessful, especially if the event is not adequately advertised. Hence, if no one buys your home, the lender retains the property as the owner.

Eviction

Since the auction results in a new property owner, you will receive an eviction notice. Usually, it requires you to vacate the premises as soon as possible. Nevertheless, most eviction notices give a reasonable duration to allow you to pack your belongings. However, adverse cases may have the lender acquire a fast-tracked eviction notice that increases the pressure to move out immediately.

How a Foreclosure Attorney Helps

Based on the different procedures discussed above, you will find the process of avoiding foreclosure easier with a lawyer’s help. The defense lawyer will help your case by:

Provide Reliable Information on Your Questions

Naturally, you will be concerned about the possibility of losing your home or how long you have before accumulating enough money to stop the foreclosure. With your attorney’s support, you can make realistic financial estimates that help you choose a reasonable course of action.

For example, if you lost your job and have no immediate loved ones to offer financial support, your lawyer may advise you to follow through with a short sale of your property. The move is more convenient in your case as you can clear the debt with your lender and move into a more price-friendly house.

Examine mortgage documents to analyze the terms

Additionally, your lawyer should go through all legal agreements you signed with your lender to look for any inconsistencies. Sometimes, financial institutions like banks may present bulky and verbose agreements to their clients that they expect to sign within a few minutes for the loan agreement to begin. Since you may not have ample time to scan through important clauses, you could miss crucial information that binds you to unfair obligations.

As a result, we strive to conduct our due diligence when going through these documents to identify possible statements that could relieve you of all liability you face. When your attorney discovers possible argument strategies that could increase your chances of avoiding foreclosure, he/she will inform you of the developments.

This way, you get a chance to go through the legal arguments and determine whether it aligns with your case facts. If successful, you could successfully delay foreclosure or convince the court to grant you relief.

Communicate directly with your lender

Moreover, you may have a difficult time trying to maintain communication with your lender, primarily if they begin to include hostile tactics.

Sometimes, the lenders may also choose to have an intermediary handle communication between both of you to avoid further complications. Thanks to your lawyer’s services, you do not have to worry about contacting the relevant parties by yourself.

On top of that, you are likely to be more confident in the foreclosure avoidance process when your lawyer communicates with the lender directly. This is because he/she drafts concise documents that capture all essential details before sending them. Hence, you will be happy to know that your lawyer has included your concerns and counter-claims for the lender to address.

Also, your lawyer will keep all communication records with the lender for future reference. The information often comes in handy during a foreclosure hearing, as your attorney can easily refer to specific details. This way, he/she can highlight any unfair or non-procedural undertakings linked to the lender.

Defend you in court

Retaining an attorney for representation in court is also crucial, as it sets you in a better position to raise valid arguments. Your attorney should also handle all evidential preparations to create persuasive presentations against the opposing party. Since he/she will have to find and consolidate multiple documents, you can participate by availing useful information on sources of proof.

For example, providing any documents that show inconsistencies in the loan interests during your repayment deposits are useful in proving the lender’s inaccurate claims. Additionally, your attorney can raise several defenses to counter the lender’s arguments. Valid defenses could save you from severe consequences like losing your home while persuading the court to nullify the foreclosure motion.

Negotiate the Terms of Your Mortgage Agreement

An attorney can also be beneficial in negotiating with your lender for mortgage term adjustments. Usually, the lawyer will present genuine facts and shortcomings on your side that could convince the bank to settle for a new agreement.

Since your attorney is experienced in handling these matters, he/she also understands the best strategies to apply, creating a chance for positive outcomes.

What can be done to avoid home foreclosure?

Finally, you can explore other options that help you avoid foreclosures by employing different strategies. Usually, these options involve a compromise between you and the lender. Therefore, they do not waive you of the responsibility to complete your loan payments but only eases the process by reducing time pressure. Common ways to avoid a home foreclosure include:

-

Make a Forbearance Agreement

A forbearance agreement is a mutual consensus to relieve you of making monthly loan repayments for some time. Alternatively, the agreement may lead to the lender issuing lower mortgage repayments than earlier agreed upon. Mainly, the agreement provides a reasonable compromise for you as the borrower to organize your finances or seek external help in clearing the outstanding mortgage balance.

A forbearance agreement would be ideal where you have proof of losing your job without notice. If so, the bank can give you three to six months to make subsidized repayments or none at all until you are back on your feet.

However, you should note that you will still have to repay your debt. The repayments for the full amount will begin after you receive monetary support or get a new source of employment. Therefore, showing an initiative to create better financial circumstances for yourself soon is crucial. For example, the bank may need to see ongoing job-searching efforts before entering the forbearance agreement.

When you can afford to make the full repayments, your lender will lay out several repayment options. Firstly, you may have to pay a cumulative down payment that covers all reduced costs, on top of resuming payments in the regular interest rate. Alternatively, you could pay a lump sum to cater to all the missed payments before resuming the regular schedule.

-

File for Bankruptcy

Sometimes, your financial situation may remain challenging for a long time, meaning you will struggle to make a full mortgage loan repayment. Hence, your best option may be to file for bankruptcy and allow the courts to appoint trustees to handle your debts. Two main options are available depending on your financial bracket and preferred repayment strategy.

The first option is chapter 7 bankruptcy, also known as liquidation. When the court approves you to file for chapter 7, trustees will take over the specific property and liquidate it to pay off your debts. Discussing the success rate of chapter 7 bankruptcy with your lawyer is necessary, as bank lenders may also want to exercise their right to seize.

However, chapter 7 bankruptcy is a better option than having the lender seize property, as you will not lose all your possessions. Moreover, the court may order the trustees to repay the bank a lower amount than you took out.

Alternatively, you could file for chapter 13 bankruptcy, also known as restructuring or reorganizing finances. Chapter 13 is available for people with a steady source of income or a reasonable ability to make repayments consistently after restructuring. Hence, you will not lose your home after filing for chapter 13, as long as you satisfy all requirements to comply with repaying your lender.

-

Put Your Home Up for a Short Sale

Another option involves giving up the home that could be foreclosed in a short sale. The move aims at acquiring a significant amount of money from the sale to avoid actual foreclosure. Before choosing to undertake a short sale, you should confirm that your lender consents to receive an amount less than the balance you owe.

Since the primary goal will be to reduce the unpaid mortgage loan, the lender is more likely to settle for the short sale proceeds instead of more outstanding balances. During the short sale, your attorney can help you find buyers willing to give up enough money to meet the lender’s threshold amount.

-

Loan Reinstatement

You can also choose to reinstate your loan by making a lump payment of your defaulted installments at once. Like in forbearance, the large repayment sum will help you catch up with all expected repayments and prevent you from facing foreclosure. However, several procedures apply before you can reinstate your loan. We recommend understanding all the necessary regulations to help you avoid missing important steps.

The first undertaking is finding out the total amount that your lender expects you to pay back. Sometimes, your estimates may be inaccurate as you will not have included defaulting fees and any other expenses that the lender incurred during the foreclosure process. As a result, it helps to request an official quote before making a reinstatement.

At this point, the bank will have conducted various activities in preparation for a possible foreclosure of your home. For example, the lender may have ordered your home’s inspection by a professional to provide a report on its possible valuation.

Moreover, the bank could have already engaged an attorney on retainer to petition a motion to foreclose. If the process had begun, the court could have also appointed a group of trustees expected to handle your home. The reinstatement quote will, therefore, include all these expenses on top of your outstanding balance. Hence, we recommend making adequate preparations to avoid unexpected eventualities.

-

Negotiate for Modification of Loan Terms

You can also negotiate for modified loan repayment terms, especially when you have an attorney to spearhead the discussions. Your agenda is to convince the lender to reduce the money to be paid monthly for a more achievable repayment plan. When presenting your negotiation, it helps if you present justifiable reasons for the request.

The sources of proof can help prevent the lender from prejudicing you as someone seeking to take advantage of different terms. For example, you can present any previous loan repayment plans you completed without delays to support your position as a genuine borrower. Additional negotiation strategies are available for use, depending on your specific goals.

Contact a Foreclosure Attorney Near Me

Dealing with home foreclosure on your own is extremely hard, as you must satisfy numerous requirements. Sometimes, you may have lenders foreclose your home based on minor oversights that undermine your credibility. Therefore, partnering with a legal team that is well experienced in real estate foreclosure is a great decision.

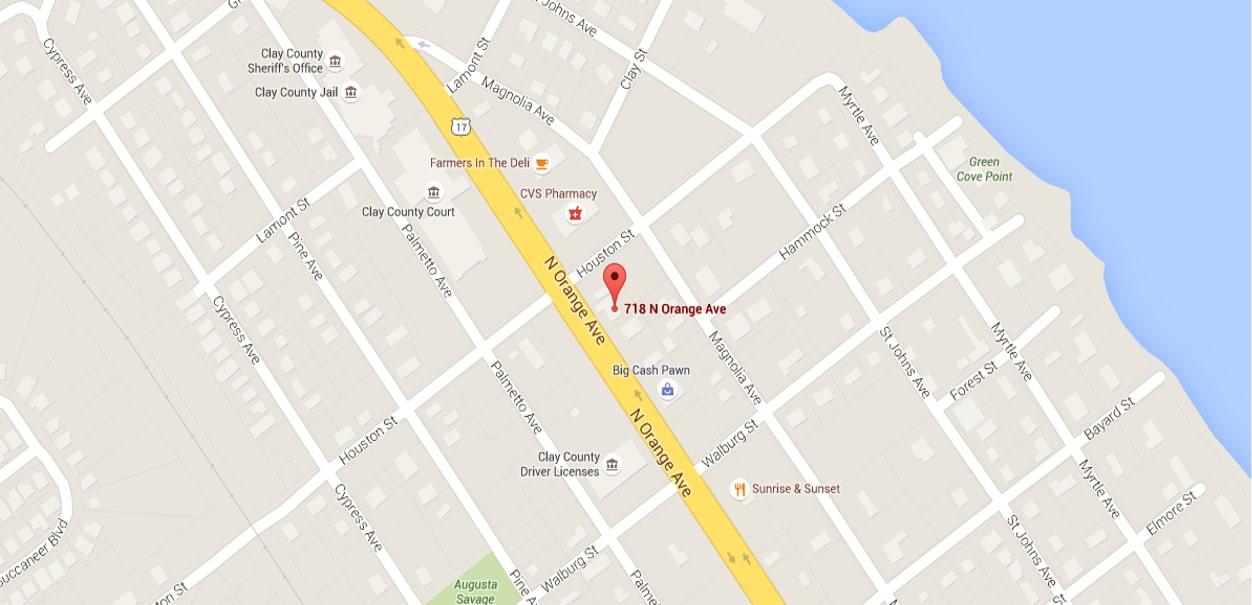

At Arnold Law, we will fight to help you keep the home that is rightfully yours. Our dedicated team is also happy to cater to any inquiries or concerns you have pending the finalization of court procedures. To get in touch, call us today at 904-264-3627.