As cryptocurrencies such as BitCoin, Ripple, and LiteCoin gain popularity and longevity, attorneys may expect to see a surge in the number of clients who acquire these assets and incorporate them into their plans. The IRS is also taking a closer look at these types of assets. Even though there is limited guidance on the taxation of cryptocurrencies to date, your estate planning lawyer should be aware of the intricacies of this type of property.

This would enable an attorney to design a solid estate plan for your cryptocurrency and properly administer the properties of deceased individuals who possessed cryptocurrency at the time of their death. Our estate planning lawyers at Arnold Law have the knowledge and experience to devise Florida tax-saving strategies and can help protect your assets.

Understanding Cryptocurrency

A cryptocurrency is a type of digital currency that makes use of blockchain technology to establish an immutable, decentralized, digital ledger. These currencies are only accessible in digital form. This implies that to use your cryptocurrency, you'll need to have access to a smartphone device or a computer.

The blockchain system involves a decentralized network of several independent computers that maintains and updates the public ledger. This way allows any individual to verify that the document is uncorrupted and complete. Individuals can buy, sell, and earn cryptocurrency using this ledger via a network of unrelated computers that keep track of all the transactions using advanced algorithms.

Blockchain technology is used to facilitate cryptocurrency transfers. The transferor keys in the transferee's public address, where the cryptocurrency would be delivered, as well as the amount to transfer and an optional note, into the ledger.

Once all the information is inputted, the transferor only needs to confirm, and the decentralized network will validate the transfer. The transferee, in this case, will only need to provide his/her public address. After the transfer has been approved, the ledger gets updated to reflect the transaction. The transfer does not require any additional documentation.

Although cryptocurrencies can be regarded as traditional fiat currencies (such as cash) under certain regulations, the IRS currently treats cryptocurrency as a property rather than a currency for taxation purposes.

An Overview of Cryptocurrency Holdings and Florida Estate Planning

People often ask what will happen to their crypto assets if they leave. Therefore, when cryptocurrencies and their effect on your estate plan are concerned, you will have to choose a legal professional who has advanced to handle this challenge.

A competent attorney will be able to assist and understand the benefits and negative effects of your cryptocurrency on your estate planning. You might have heard several stories about individuals becoming wealthy through cryptocurrency investments.

Cryptocurrency has the potential to make people wealthy if invested correctly and at the proper time. Despite several problems on the horizon, Bitcoin remains the top-rated cryptocurrency among crypto investors after several years of investment.

Volatility and Valuation

It's fair to say that most people today believe cryptocurrencies are valuable and powerful digital assets. However, in terms of value, the cryptocurrency bubble could be highly volatile, making profits often unpredictable.

In addition to its potential value, the blockchain technology—that underpins Bitcoin—operates independently of cryptocurrency exchanges. Blockchain technology is poised to significantly change the way that contracts are made, deeds are recorded, and medical data are maintained.

After all, the public distributed ledger offers enhanced security, cost savings, and transparency, which attracts the attention of investors.

The Importance of Including Cryptocurrency in Your Florida Estate Planning

Cryptocurrencies are considered assets by nature, and having an estate plan establishes a course of action in the event of your passing. If you do not have an estate plan, then your crypto investments would be subject to Florida probate proceedings.

Therefore, when dealing with cryptocurrencies, Bitcoin, and their impact on your Florida estate plan, you'll need experienced legal counsel. The inheritance process of these one-of-a-kind assets might take several months or even years if you lacked a comprehensive plan. Not to mention that you will have to pay the attorneys' expenses. It is critical to understand and acknowledge that the courts can seize digital assets even if your loved ones are aware of the access accounts and passwords.

Keep in mind that an estate plan involves more than just the power of a lawyer and your last will. It involves vital information that enables your family to easily take ownership of your estate. Additionally, losing your digital asset's passcode means that your money is permanently lost with no hope of recovery.

You can prevent this from happening to your family by establishing an estate plan. With this, you could be able to breathe a sigh of comfort knowing that your cryptocurrency will be safely transferred to your loved ones in the event something happens to your health. You should be able to rely on a professional Florida estate planning attorney to handle the intricacies and create an estate plan that caters to all of your digital assets.

Techniques Used in Estate Planning

Some techniques for protecting your cryptocurrencies in estate planning include the following:

Seek the Decedent's Information

When preparing an estate plan, it is important to acquire information on any cryptocurrencies held by a person. Additionally, it should contain the provision from the estate planning documents that enable fiduciaries to hold, access, and manage cryptocurrencies without incurring additional liabilities.

To find out whether the deceased possessed cryptocurrencies at the time of death, fiduciaries would inquire from the decedent's relatives and financial advisors as well as inform them of the existence of any crypto holdings in the estate.

Have Properly Drafted Documents

Well-prepared estate planning documents would also allow fiduciaries to have access to the deceased's digital assets, like cell phones and laptops. This document may provide details about any crypto holdings owned by the deceased at the time of death. It's important to grant these permissions to estate fiduciaries so they have access to the deceased's cryptocurrencies after death.

If the decedent gives the fiduciary his/her crypto password while alive, the fiduciary's usage of the passcode after death without the required authorization in the decedent's estate plan documents and applicable laws could violate federal and state privacy laws, computer fraud, and data protection provisions or terms of service agreements.

Secure your Passcode

It's generally not advisable to share your passcode with other people for security concerns. However, once you lose a passcode, it is nearly impossible to recover it. Therefore, those who hold crypto assets should consider jotting down the code and keeping it in one or more secure yet accessible locations.

Ensure That the Funding Complies With State and Federal Laws

In theory, it would be simple to directly finance a trust using cryptocurrencies by giving the trustee access to accounts and control of the cold storage device or the passcode for the crypto account. However, it's crucial to check that you are not violating any service agreements or applicable laws.

A crypto investor who seeks to form a trust that only holds cryptocurrencies should, at the very least, relieve the trustee from any obligation to diversify and give him/her the appropriate indemnification. If a financial organization held the trust's cryptocurrencies as part of a larger portfolio, then the institution would alter the trustees on the forms as required.

Currently, there isn't a law in place that restricts the funding of trusts with cryptocurrencies or that specifies how these transfers ought to be recorded for taxation. As a result, it's crucial to create a contemporaneous memorandum documenting every transfer and making sure the donor surrenders all authority over the transferred crypto.

Create an Irrevocable Family Trust

Aside from the all-important fact that the value of cryptos has been highly volatile to date, several factors have proven unreliable, rendering the regulatory framework uncertain. If you are a crypto investor who believes in the future of specific cryptocurrencies, then you may find this well-suited in an irrevocable trust that would convey the appreciated assets to future generations.

You have the option of creating an irrevocable family trust with your children, grandchildren, and future generations as beneficiaries, and funding it with a range of assets, including your crypto holdings. If the value of cryptocurrencies rises over time, the trust would allow the grantor's successors to inherit the appreciated worth of the cryptocurrency without being subject to estate or additional gift taxes.

Greater wealth could therefore be passed down to future generations while avoiding costly death taxes which would otherwise be imposed if the crypto holdings were not held in a trust.

Using a GRAT

Given the volatility of cryptocurrencies, a grantor-retained annuity trust, also known as GRAT, may be a valuable instrument. A GRAT financed using crypto is relatively simple for a trustee to manage. You can finance a GRAT using cryptocurrencies by following the best practices for crypto transactions. This can involve obtaining a qualified assessment of the crypto's value transferred to the GRAT on which the GRAT's annuity amount would be determined.

If the trustee additionally opens a bank account for the grantor-retained annuity trust at the time of financing, then the trustee could take the benefit of substitution. This involves exchanging the money in the bank account for crypto in the GRAT that has appreciated significantly. Thus, locking in the cryptocurrency's increased value.

Determine the Annuity Amount

A trustee sends cryptocurrencies to the grantor's public crypto address to make an annuity payment. Once an actuary calculates the annuity amount in standard currency, your trustee would be required to determine the amount of cryptocurrency required to cover the annuity payment.

According to IRS Notice 2014-21, cryptocurrencies qualify as property for tax purposes. For this reason, they would be priced at a value that would be accepted between the willing seller and buyer on the transfer date. The best practices for establishing the worth of the cryptocurrency required to meet the annuity include taking the weighted average of the mean of the highest and lowest crypto values from different crypto exchanges.

Purchasing Cryptocurrency and the Benefits of Having a Good Estate Plan

Cryptocurrency has elements that appeal to some groups of risk-taking traders, speculators, or investors. Due to the semi-anonymous feature of the crypto space, users using cryptocurrencies often have little to no privacy issues when making transactions.

Some of the benefits of cryptocurrencies and having proper estate planning include the following:

-

Decentralization

Cryptocurrencies are decentralized by nature, which eliminates the involvement of central banks. This simplifies and secures the transaction process. However, since there isn't a governing entity for decentralization, cryptocurrencies often encounter legal problems.

Some professionals believe that it could take several years for legislation to catch up with modern-day cryptos. In some instances, cryptocurrency laws do not exist, which makes it even more important to adopt basic security precautions and secure your investments and assets through an estate plan.

-

Using Blockchain Technology

Crypto account holders have fewer reporting obligations for taxes and other types of regulations than those for bank accounts. This in itself has attracted the attention of several investors. Cryptocurrency is based on blockchain technology's distributed ledger, which shields the holders from dangers associated with cyberattacks on financial institutions such as banks.

A proper estate plan should be developed for your digital assets due to the significant implications of blockchain technology. To access your crypto assets, you'll need a private key known as a passcode. A good estate plan that includes pertinent details would ensure that your cryptocurrency investments are secured and accessible to your family.

-

Avoid Probate for Your Family

Avoiding having your family go through the probate process is yet another reason to choose estate planning for your cryptocurrency investments. Contrary to popular belief, knowing stored passwords and accounts is not enough to gain access to digital assets. Instead, you require an estate plan that incorporates current information about your cryptocurrency holdings. Additionally, you don't want your loved ones to go through a lengthy and costly legal probate procedure.

-

Collateral Security and Investment

Individuals have started to embrace cryptocurrencies as a versatile store of wealth. For instance, You can acquire secured loans using cryptocurrencies. Loans secured by cryptocurrencies enable crypto owners to utilize their digital assets without cashing out and possibly suffering unfavorable tax repercussions as a result. Another way to invest in cryptocurrency while avoiding paying taxes is through individual retirement accounts (IRAs) that own 100% of a cryptocurrency-invested LLC.

Using Online Estate Planning Platforms and Tools

When you're dealing with technology, cryptocurrencies, and their effect on your Florida estate plan, you could use an online estate planning tool to prepare a will or establish a new trust. Some systems also exist that provide a comprehensive asset management estate plan centered on digital assets.

In the past, it was considered illegal to transfer private passcodes or other digital public assets to third parties. When you analyze this idea from the perspective of succession planning, you'll discover how vulnerable the family's custody of digital assets could be.

Experienced investors usually spread their cryptocurrency investments and come up with a plan of action in case of illness or loss of life. However, beginners who invest a little amount in cryptocurrencies often lack an estate plan, thus exposing their digital public assets to risk.

Using Cryptocurrency to Make Donations and Gifts

Some people could be interested in giving away cryptocurrencies to lower the income taxes that will be owed on their investments. Even better, by transferring the appreciated cryptocurrency to an eligible charity, the individual can deduct the received amount from his or her income taxes while avoiding taxes on capital gains on the increased value.

Charitable organizations often accept cryptocurrency donations since the transfer involves less red tape than a traditional wire transfer. The IRS currently views cryptocurrencies as property. As a result, gifts of cryptocurrencies should be viewed as gifts of property, with the recipient receiving the donor's cost basis in the asset.

Therefore, it's crucial to accurately identify the base price of the donation when gifting cryptocurrency. According to the provisions of Notice 2014-21, the basis price of cryptocurrency received in exchange for goods or services is equivalent to the crypto's market price value on the date the person received it.

For taxation purposes, the best measures for gifting cryptocurrencies include obtaining an assessment of the crypto's market value and writing a contemporary memorandum. Since blockchain activities are anonymous, it contains details about the donation, such as the transfer date, the donor's base in the donation, and the gift's market price at the time of transfer.

Although there's no regulation on the subject, the memorandum should indicate that the donor has relinquished dominion or control over the recipient's cryptocurrency address to ensure that the gift or donation is complete. If the donation is sent to a charitable foundation, it must meet the standards of IRC 170f to qualify for an income tax deduction.

Develop an Estate Plan Tailored to Meet Your Digital Assets

When analyzing your cryptocurrencies, and the effects on your estate plan, you could be considered to have a complicated crypto case. In such cases, you could use additional assistance in selecting a Florida custodian or trustee for your cryptocurrency. To make your estate plan reliable and useful, you can opt for a simple solution or a variety of options.

To begin with, you can disclose the seed phrase and share your private keys with trusted family members and friends. Additionally, make sure you divide the seed phrase and private keys among several dependable friends or family members to guarantee that no one person has complete control over your cryptocurrency assets.

You can also open up a different Florida trust and transfer ownership of your crypto holdings to it. As a cryptocurrency investor, you can name a business, friend, or family member as your trustee. Following that, you can secure your digital assets, like hardware wallets or software applications.

Tax and Wallet Consideration

A multi-signature crypto wallet is preferable to a self-sovereign one. Your cryptocurrency-asset estate plan should include information regarding your beneficiaries and their plans for crypto holdings after full ownership transfer. Before transferring and selling your digital assets as part of your Florida estate plan, you also need to consider any tax implications.

Regardless of the type or size of cryptocurrencies you own, it is critical to speak with your friends and family about how to access your digital assets. It could seem difficult at first glance. Therefore, ensure you observe best practices and seek the guidance of a professional estate lawyer who can assist you with a wide range of crypto holdings.

FAQs about Cryptocurrency and Estate Planning

Here are a few of the most frequently asked questions about cryptocurrencies and estate planning:

What Counts as a Taxable Event in Cryptocurrency?

If an individual exchanges cryptocurrencies for cash or opts to exchange a digital asset for another, the transactions would be taxable. There are no tax penalties if a person changes virtual platforms or buys more cryptocurrency such as Bitcoin. Individuals who receive virtual currency as compensation from their employer, on the other hand, would be taxable at a fair market price.

How Can You Get Access To Digital Currency?

When someone purchases digital currencies, they are granted a "wallet." This wallet, unlike other wallets, stores the user's private and public "keys." You can't access the wallet without a key, and no access to your wallet implies no access to the digital currency. The digital currency also has no third parties to rest or control the key access. That's why a wallet is so crucial for someone to store their "keys" safely.

Find a Probate and Estate Planning Attorney Near Me

As cryptocurrency grows more popular, it sounds reasonable to consider creating an estate plan that covers your digital assets. In retrospect, it is important to provide clear instructions while owning crypto holdings. You can set up an accurate cryptocurrency estate plan with the help of our lawyers at Arnold Law.

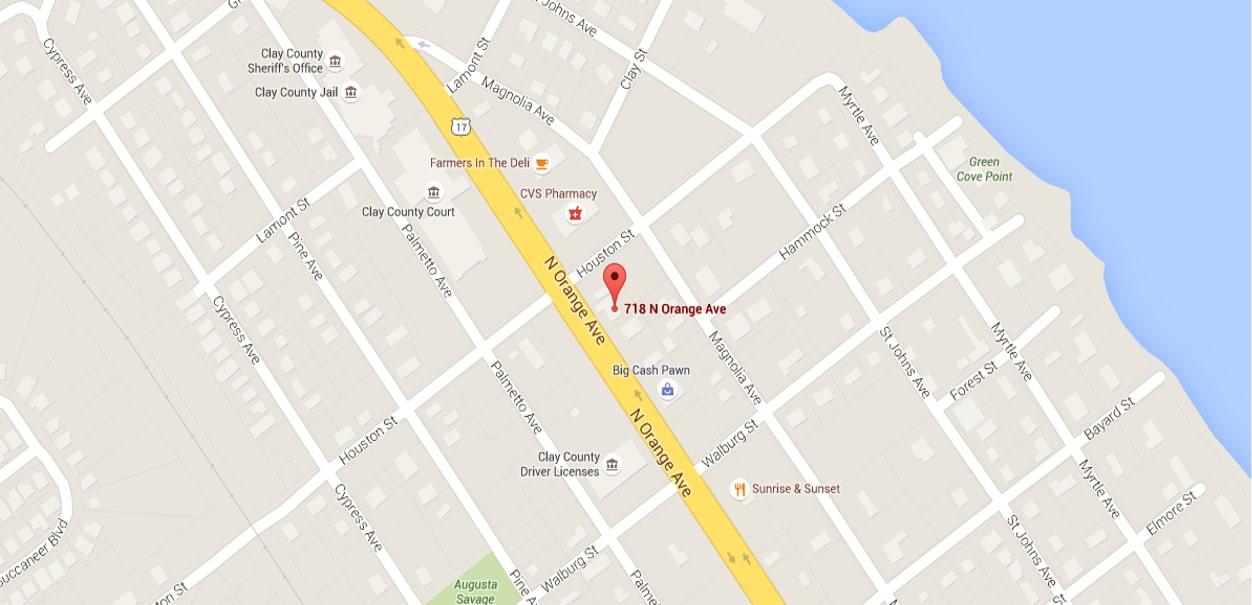

Developing a plan for your crypto assets requires little money and time. With the estate plan, you can relax knowing that your digital wallets are secured and transferred to the people you care about. Our attorneys are well-equipped to give you the support you need to make estate plans in Florida. Call us at 904-264-3627 right away to schedule a free consultation.