After a loved one’s death, his/her property should be distributed among the dependants and other beneficiaries as indicated in the will. However, property distribution may elicit conflict and dissatisfaction if not done in a procedurally fair process. Moreover, the deceased's survivors should also factor in payments to creditors who require their debts to be paid.

Working with a probate attorney can help divide the deceased’s estate among the listed beneficiaries and survivors. With the help of an attorney, your family will avoid dealing with unrecorded creditors and conflicts among beneficiaries. Moreover, the deceased's directions should be executed in line with Florida laws.

At Arnold Law, we provide probate services to our clients. Thanks to our many years of experience, we handle asset distributions as directed by the law to cater to all listed beneficiaries. Moreover, our services enable you to receive court clearance before distributing the deceased's property. Subsequently, you can rely on us for high-quality and certified legal assistance.

Understanding the Nature of a Probate Process

After the death of a close family member who was also a breadwinner, distributing his/her property is essential. Most deceased people with substantial wealth will prepare a will in their lifetime. Using the document as a reference point in the probate procedure is advisable, as it provides the explicit wishes of property division.

Nevertheless, probate may proceed in cases where the deceased died intestate, meaning without a written will. The circumstances make the family seek legal counsel on intestacy. With the information, you will learn of the different expectations to satisfy before the deceased's property is distributed.

There are also different types of probate processes that you can undertake. The main determinant of the categories available for you is the amount of money to be distributed. They are:

Summary Administration

If the deceased's estate does not exceed a total of $75,000, you can choose to undertake a summary administration process. Essentially, you will only require approval for property distribution from the court. Afterward, your representative can use the will document to assign different assets to the listed beneficiaries.

However, you will have to meet several requirements before proceeding with the summary administration. For example, the deceased should have been dead for at least two years before the administration.

Having creditors restricted from presenting claims in the deceased’s property and assets is also crucial. The restrictions help the process proceed without complications, meaning that distribution will be done sooner.

Formal Probate Procedures

Alternatively, the amount to be distributed may exceed $75,000, meaning that you will need a professional's help to conduct fair distribution. Upon choosing a formal probate process, you will have to follow court directives that eventually lead you to receive the court's approval.

Since most court requirements involve the compilation of technical documents, working with an attorney and other certified professionals is advisable. This way, you have better chances of meeting the court's standards and securing a probate approval within a short time.

Regardless of the chosen probate process, you should remember that the deceased's will is the guiding document used in distributing assets. In its absence, the executors of the will should consult an attorney for intestacy regulations.

On top of this, a probate process helps clear off any debt that the deceased left. This is included in the process to prevent subsequent wranglers between the beneficiaries and creditors, especially after the assets are already distributed.

Therefore, it is important to understand the probate process, as you will know what to anticipate at each stage. In return, you will be well equipped with the documents, certifications, and approvals you need to promote a smooth court process.

The Probate Process

Like any other legal process, the probate procedure should follow established guidelines for its success. Hence, we recommend following the steps discussed below to promote a smooth process before the deceased's property is distributed:

Schedule a Meeting with a Probate Lawyer

Consulting a probate lawyer is a crucial step to take because he/she will provide a general outline of the entire process. Firstly, you will inform the attorney about the pending property distribution so that he/she can classify your matter in the appropriate probate category.

Afterward, he/she will request all the relevant documents required for the probate process. For example, he/she will need to go over the original copy of the written will. Analyzing the different clauses in the will provides the attorney with an outline of the estimated assets and number of beneficiaries listed.

On top of this, the lawyer will also need to verify the deceased’s different assets and real property. Doing this will prevent complications in the future, especially where property ownership by the deceased was not fully proven. Hence, it helps to present the original titles of ownership to your lawyer, who will include them in the list of documents to present in court.

Since the assets to be distributed are substantial informal probate processes, your lawyer's work will be easier if a list of the assets is available. By creating a comprehensive list of properties, the attorney and personal representative working on your probate process will avoid duplication errors when distributing the property.

Further, your lawyer should be aware of pending debts and any costs incurred by the family from the death of their loved one. By going over the different losses and debts, your lawyer will make deductions from the available assets. The move will provide a more accurate result on the expected monetary payments to be distributed to the heirs and other beneficiaries in the will.

For example, if the deceased left debts in three different creditor accounts, the attorney will account for part of the assets to repay them. Additionally, expenses on funeral services and the deceased's medical bills before his death should also be considered and assessed in the initial stages of the probate process.

Drafting an Administration Petition

After your attorney receives all the information and supporting documents needed to ascertain the deceased's assets, he/she drafts the administration petition. The drafted petition details will request the court to allow the lawyer and your representative to exercise their administrative responsibilities over the deceased's property.

In this case, administration involves distributing the estate to all entitled beneficiaries following the will’s directions. However, the judge in a probate court must first ascertain that the lawyer filing the petition has the mandate to do so. Thus, the judge will require several documents to determine whether the formal administration is ideal and whether the will provided for it.

Subsequently, your attorney must present the requisite documents in court within the stipulated time. The most important document to present is the original will for the judge's assessment. Subsection 732.09 of the Florida Statute directs parties to present the original will in court within ten days for the petition to proceed. Thus, you want to work with a reliable lawyer who will follow through with the deadlines to prevent delays.

You should also remember that your probate lawyer and your representative must also sign additional documents to be filed in court. Their signatures indicate their willingness to take on legal responsibilities for your estate.

Compensation for your Attorney and Personal Representative

After concluding the probate process, your attorney and personal representative for the estate are entitled to compensation. Usually, the compensation fees are included in catering to all the costs spent to fulfill the probate process requirements. The duty to compensate these professionals is also provided in the Florida Statute under sections 733.617 and 733.6171.

For example, if your attorney or personal representative had to consult a professional accountant, you should indemnify them for the costs incurred to hire the accountant. Similarly, obtaining copies of original documents on time to present in court may be costly. This is the case, especially if the documents are only produced upon request and payment.

Moreover, filing documents in court also requires the payment of court fees. While the charges vary depending on your case, your attorney or personal representative will still have to provide the necessary payments before a court clerk can include your matter in the cause list. Therefore, compensating your lawyer and the personal representative is important.

Sometimes, your attorney can double up as your representative, especially if the deceased had worked with the legal team before. If you have access to this advantageous option, you can save on additional costs that would otherwise be spread separately between your lawyer and the personal representative. Moreover, since the role of a personal representative involves technical duties, having an experienced attorney to take on these roles is beneficial.

Court's Approval of your Petition

When the judge goes over your petition and is satisfied with the presented documents, he/she will issue an approval letter. However, your attorney will have to wait for several days before a final administration letter is issued, during which he/she should prepare the documents required for presentation.

For example, the judge will require the personal representatives of your estate to make several determinations involving the ownership and distribution. To do this, they must first separate the probate assets from the non-probate ones. This procedure should enable beneficiaries to understand the types of property that they cannot access. In return, the heirs and beneficiaries will manage their expectations during the property distribution process to successfully complete the probate procedure.

Hence, the judge’s letter of administration will grant the personal representative authority over the estate administration. He/she can then engage the interested parties in a detailed report on the probate and non-probate assets.

You should note that probate property entails all assets that the deceased owned individually, meaning that he/she had absolute ownership. These probate assets cannot invoke a contest of ownership because the deceased’s survivors have the required documents to prove ownership.

Examples of probate assets may vary because different people own property in various ways. Nevertheless, common assets like real estate, businesses, and tracts of land can form part of probate assets to be divided equally.

On the other hand, non-probate assets consist of any property that the deceased owned jointly or in common with other parties. In this case, the deceased’s ownership was not absolute, as other parties had equal rights to the assets. Even if the deceased had a larger share of the non-probate assets, the judge would exclude this type of property from formal administration.

Non-probate assets also include properties held in trust for beneficiaries who may or may not be named in the will. If the will does not reveal the beneficiaries’ identity, they can still claim their share of assets under a secret trust. Since property distribution by holding it in trust leads to an automatic entitlement, the assets are non-probate.

Common examples of non-probate assets include bank accounts left for specified beneficiaries as listed in the will. Upon the testator’s death, the named beneficiaries will be entitled to returns from these accounts, despite having a trustee to invest and run them on their behalf.

If the deceased had a brokerage account for investments, beneficiaries would also be entitled to receive income or returns from these accounts under a trustee relationship. The non-probate assets will be transferred to the named trustees through the will for the beneficiaries’ interests. Upon distinguishing between the different types of assets, your lawyer or personal representative will be ready for the next step.

Sending Notices to the Deceased’s Creditors

Since the probate assets are now identified, your representative should send a notice of intention to administer over the estate to all creditors. The notices should be published in accessible channels like newspapers or online to give all interested parties the chance to react on time.

Moreover, the probate judge should include a mandatory two-week duration for the notices to remain within public access. In doing so, creditors cannot claim that they lacked enough time to present their debt claims to the personal representatives handling your probate matter.

In the meantime, the appointed personal representative should identify all creditors who intend to file claims against the deceased's estate. Typically, your assistance will be necessary for this step because you may have access to information that the personal representative and attorney lack. After creating a list of creditors, your attorney will retain it for future reference in court. This may be helpful if additional creditors who were unaccounted for present claims without your knowledge.

After learning about the notice, any creditors with claims should present them within three months from the initial publishing date. The court will receive these claims and verify their validity before approving the creditors to receive their share of debt repayments.

When the three-month duration is complete, creditors are barred from presenting any more claims unless they have credible reasons for failing to meet the court deadline. Usually, the court will direct your probate attorney and the personal representative to handle the creditor’s claims accordingly.

You should note that the judge will only issue these directives if you do not object to the creditors and if they have rightfully proven their case. However, if no creditors filed claims with the court to begin with, the probate process may continue without a formal cessation of accepting the creditor’s claims.

Petitions to Handle Non-Probate Assets Separately

Although non-probate assets are distributed separately, your representative should liaise with your attorney to prepare a court petition for their administration. The reason for this is to ensure that these assets are still accounted for and distributed according to legal directives.

Additionally, filing a petition to determine how to handle non-probate assets is also an effective way to minimize confusion and possible conflict. The challenges may arise in secret trust cases, especially if the direct heirs of property do not know who the other beneficiaries are.

Accounting and Filing Taxes for the Deceased’s Property

Before the heirs and beneficiaries can receive the divided assets, it is crucial to file tax returns for the deceased’s accounts. Filing the returns will prevent the beneficiaries from dealing with tax claims in the future, especially if they are unexpected. Moreover, filing the tax returns will update the deceased’s account, as it will be the last time the process is conducted.

Subsequently, your probate attorney should fill a special document called form 1040. It is issued to representatives handling a deceased’s estate to distinguish them from other running accounts.

Your attorney may also advise you to work closely with an accountant who will handle the family’s assets in preparation for filing them in court. Moreover, your representative should be involved in the process, as he/she is responsible for consolidating all the accounting details and presenting them in court. Once the judge goes over these accounting documents, he/she directs your representatives and attorney to prepare a distribution strategy for all named beneficiaries.

Distributing Assets and Receiving Discharge Orders

Finally, the judge will approve your representative to distribute the assets according to the stipulated plan. This means that all heir and beneficiaries receive their share of the property and provide documents of receipt as proof. Afterward, the personal representatives should avail copies of these receipts in court to show that the process is complete.

Afterward, your probate attorney can then file for an order of discharge which officially concluded the probate process. By obtaining the orders, your representative and lawyer are not liable for any issues that may arise after the distribution process is complete.

The Duration of a Probate Process

Apart from learning about the probate process, you can also have an estimated period for the entire procedure. This way, you can plan around other events in your life, especially if they depend on the probate hearings’ successful completion.

Typically, a probate process may last for seven months to one year, depending on the court processes. If you file all documents on time, the hearings will start sooner, and you may have less waiting time.

Additionally, creditors can influence your waiting period depending on whether they raise their claims within thirty days. A failure to comply with the set time limit can complicate the probate process, primarily if the creditors request a time extension.

Another factor that may influence your waiting period is the competence level of the professionals you work with. For example, having an attorney who understands the probate process and prepares adequately before presenting documents will save you time.

This is because he/she does not need to seek extensions to retrieve missing files or seek confirmation from people before submitting the paperwork to the judge. Similarly, your representative must be ready to undertake his/her multiple duties efficiently.

For example, he/she is responsible for preparing the accounting documents for all persons eligible for property distribution. Thus, he/she can work with a certified accountant to reduce the workload and prevent making errors that cause delays.

Overall, seeking the services of a well-experienced lawyer will be highly beneficial in a probate process. You and all other beneficiaries will be satisfied with the property distribution process, meaning that conflict is less likely to occur. Additionally, all procedures are done according to the law, so you do not have to worry about subsequent audits and scrutiny on your finances.

Contact a Probate Attorney Near Me

Dealing with the stress and challenges that come with property distribution after a loved one dies is difficult. Therefore, you need a probate lawyer’s help for a legal, fair and efficient probate process when distributing a deceased person's assets. Hiring a certified probate attorney is an excellent choice. With his/her help, you will meet all the court requirements, meaning that the probable process will be legally executed. Moreover, you will avoid conflicts with creditors and beneficiaries, as all assets are validly distributed.

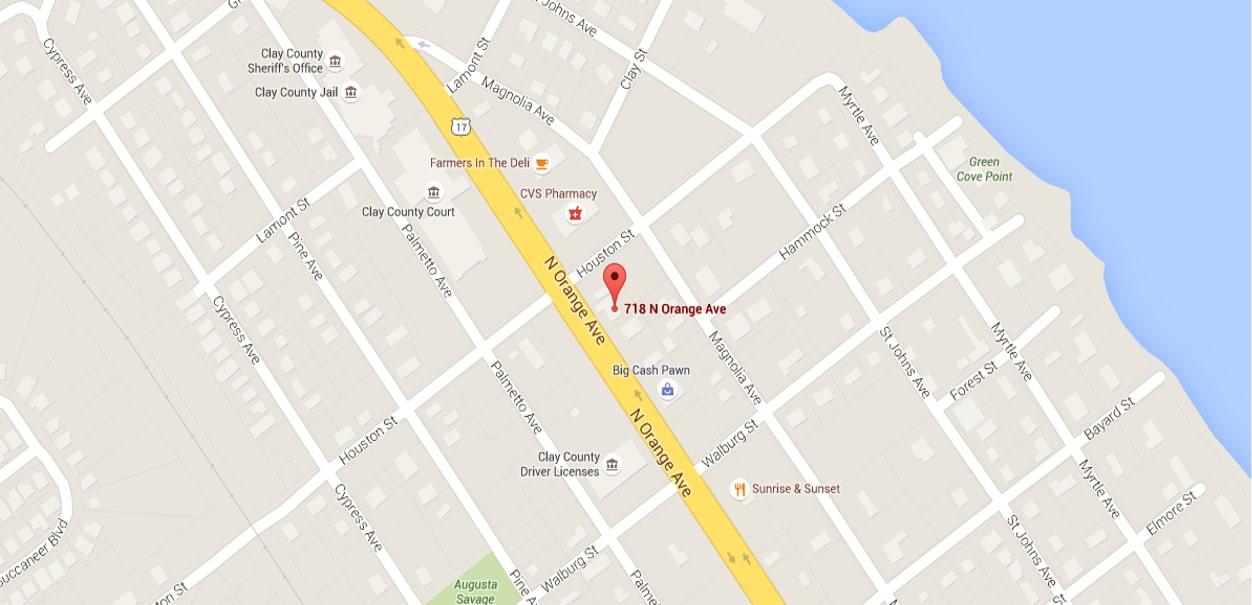

Partnering with Arnold Law is a great option if seeking probate services. Our years of experience serving our clients has equipped us with high-quality legal skills for proper service delivery. Moreover, we handle each case uniquely and provide specially crafted legal advice to suit your needs. If you require the services of a Florida probate attorney, call us today at 904-264-3627.