Florida is one of the nine states that do not have an income tax. When coupled with the tropical climate, Florida's attractive taxation policy, which provides for no death or income taxes, makes it a wildly preferred retirement destination.

However, as any Florida resident can assure you, this does not mean you are exempt from paying income taxes. Simply put, you do not pay income taxes, but the IRS is still after your money.

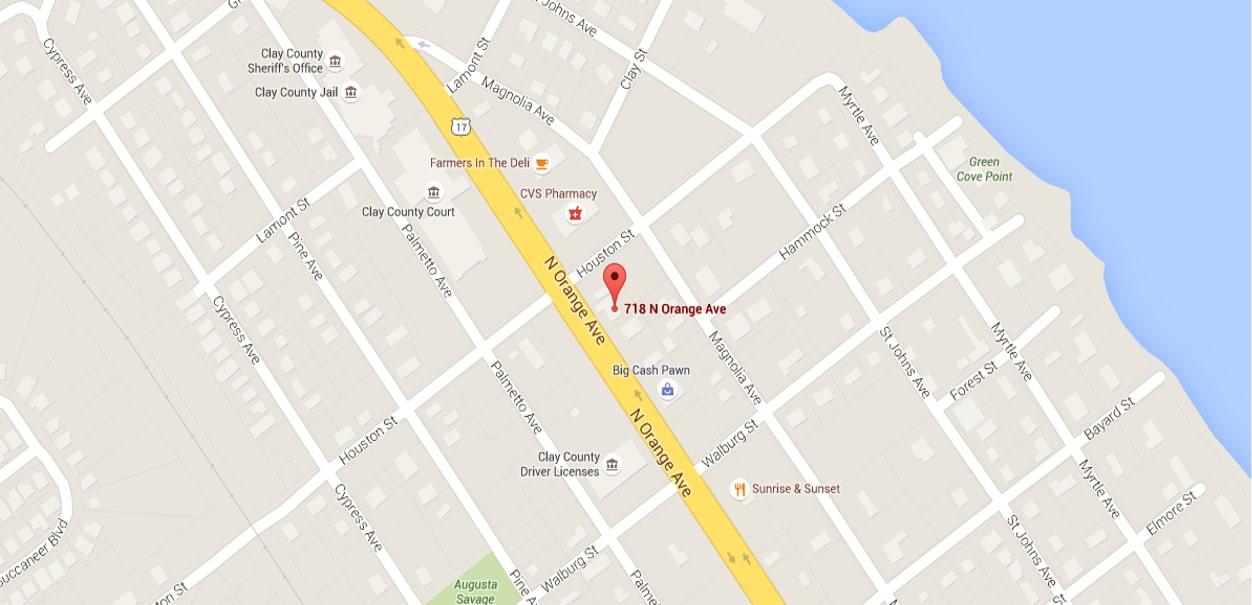

If you have concerns regarding the taxes levied on your estate, or if you are confused about your alternatives for minimizing taxes or optimizing your tax benefits, we at Arnold Law can assist you. Our firm is committed to helping our clients with various estate planning problems, including tax-related issues. Please contact us right away to speak with one of our attorneys about your options.

Florida Estate and Inheritance Tax Laws

The Florida Constitution safeguards its residents and all heirs from Florida state taxes levied on the deceased's estate. Even though the deceased’s main residence is outside of Florida, the heirs won't be required to pay state taxes. However, any inheritance could be eligible for federal estate taxes. Some of these estates include IRAs, cash, CDs, life insurance policies, stock, property, businesses, brokerage accounts, as well as other properties.

Inheritance taxes are not levied in Florida, but they are in six other states. Inheritance taxes will be levied on estates in Nebraska, Kentucky, Iowa, Maryland, New Jersey, Nebraska, and Pennsylvania. People who reside in Florida and inherit assets from the mentioned states may be subject to an inheritance tax. When Florida residents inherit money or assets, they need to consult with an attorney to explore their tax implications.

What Is an Inheritance Tax and How Does It Work?

Inheritance taxes are taxes levied by certain jurisdictions on people who have inherited or bequeathed property from a deceased person's estate. The value of the bequest, the deceased's relationship with the recipient, and the jurisdiction where the decedent resided or possessed property, are all factors that determine the taxes imposed.

The federal government does not levy inheritance taxes. However, only six states do. As of 2021, Maryland holds the unenviable status of being the only jurisdiction to levy both an inheritance tax and an estate tax. Iowa, New Jersey, Nebraska, Kentucky, and Pennsylvania are among the other states that levy an inheritance tax.

The state constitution of Florida, on the other hand, expressly prohibits estate taxes. As a result, enacting estate taxes in Florida would necessitate a full-fledged constitutional amendment rather than simply new laws. The estate tax laws in Florida are especially beneficial for anyone worried about avoiding estate taxes, thanks to this constitutional provision.

Transfers to living spouses are not subject to the inheritance taxes in the six states that levy them. Likewise, transfers to children or grandchildren are exempt in Maryland, Kentucky, Iowa, and New Jersey. However, properties going to children or grandchildren in Pennsylvania and Nebraska are liable to the states' inheritance tax.

This tax is usually imposed on distant heirs like aunts, nephews, uncles, nieces, or even friends. Here, the rate keeps rising as the level of kinship lowers. Inheritance taxes are generally exempt from taxation in many states. Only gifts with a specified monetary value are subject to taxation.

An estate tax is paid by the property executor, or by a Florida personal representative, with revenues from the property in Florida or somewhere else; an inheritance tax is paid by individual beneficiaries, while last wills in Florida often arrange for settlement of any inheritance taxes from property assets.

In any case, Florida does not levy taxes on inheritances or estates. However, as we have previously seen, if you live in Florida and inherit assets from someone who lives in a jurisdiction that levies inheritances, such as Pennsylvania, then you may pay an inheritance tax to the state.

How are Inheritance Taxes Calculated?

When an inheritance tax is levied, it is only applied to the fraction of the estate that surpasses the exempt amount. In most cases, rates begin in the single digits and rise to between 15% and 18%. Your relationship with the person who died, rather than the value of the properties you are going to inherit, could affect the exemption you will obtain and the levy you pay.

In general, the closer the connection between you and the deceased, the greater the exemptions and the lower the rates you will pay. Surviving spouses are usually exempt from any inheritance tax throughout all the states mentioned above.

In New Jersey, domestic partners are also exempt. In Pennsylvania and Nebraska, the deceased's children do not have to pay inheritance taxes. In most cases, life insurance paid to a designated beneficiary is not subjected to inheritance tax. If the policy's beneficiary was a revocable trust or an estate, it could be liable for an estate tax.

Inheritance vs. Estate Taxes

The main distinction between an inheritance tax and an estate tax is the person obligated to pay them. Even though they are different, the phrases "estate taxes" and "inheritance taxes" are almost always used as interchangeable terms when a person has passed away.

An estate tax is established on the total value of all assets possessed by the deceased at the moment of his or her death. The total taxable estate is calculated by subtracting the estate's liabilities from the net worth of the deceased person's assets. That estate could also be responsible for any tax liabilities that arise.

On the other hand, an inheritance tax is determined depending on the value of individual inheritances obtained from a deceased person's property. The recipients are responsible for the payment of this tax. However, a will may dictate that the property bears some of the obligations.

An inheritance tax differs from an estate tax since estate taxes are estimated on the estate before properties are transferred. In contrast, inheritance taxes are imposed on a recipient after assets are received.

Both taxes are calculated on the appropriate market valuation of a deceased person's assets at the time of death. However, estate taxes are imposed on the value of the deceased's estate and are therefore deducted from it. On the other hand, inheritance taxes are levied on the value of the bequest obtained by the beneficiaries and paid by the recipient.

If you are the single recipient of an inheritance, the value of the property and the value of the inheritance may appear to be the same. However, they are theoretically taxed differently. In certain cases, an inheritance may be taxed both as an estate and as an inheritance.

As per the IRS, federal estate taxes are only imposed on estates worth more than 11.70 million as of 2021. There is no estate tax levied if the deceased person's property goes to his or her spouse.

The recipient is subject to the taxes if they inherit an estate large enough to be subject to federal estate tax or if the deceased lived or possessed an estate in a jurisdiction that levies inheritance taxes. The estate will be taxed before it is transferred, but the inheritance will be subsequently levied by the state. They could also be subject to state estate taxes.

How Much Can You Inherit in Florida Without Paying Taxes?

Several states charge inheritance taxes on a deceased person's estate. The excellent news is that there are no state inheritance taxes in Florida. Furthermore, since the inherited property is not considered income for federal income tax purposes, inheritors and recipients in Florida don't pay income taxes on any funds earned from an inheritance.

Estate Planning Considerations for Out of State Properties

It is not unusual for residents of Florida to hold actual and tangible private properties in either of the other states, either indirectly or directly. It is much less customary for these properties to be included in a general estate planning strategy that accounts for the extra probate as well as state inheritance and estate tax difficulties that could arise as a result of the ownership.

Even though the challenges posed by such possession and the resolutions available may vary widely depending on the circumstances, we will discuss some of the most essential estate planning factors to consider when handling non-Florida asset proprietorship by a resident of Florida.

Domicile Planning

Florida does not levy a state estate tax, and this stands in stark contrast to other states, which levy estate taxes on top of the federal estate taxes. When you relocate to Florida from any other state and want to avoid (or minimize) the state estate death taxes, you need to guarantee that you are not only domiciled in the State of Florida but also that you have renounced domicile in your previous state.

An individual's "domicile," according to Florida laws, is the location where he/she has established a residence with the existing aim of rendering it their permanent residence. Furthermore, Florida law states that an individual's domicile is decided by his/her desire, as evidenced by contemporaneous expressions of intention and affirmative overt acts demonstrating intent.

A domicile in any other state would be less favorable for inheritance or estate tax considerations than a Florida domicile. Opposing probate procedures after death and income or estate tax demands brought by another jurisdiction are all concerns of an unclear domicile. When a domicile is unclear, actions may be taken to define it. However, because residency is a subject of intent, ambiguity can persist despite the person's best efforts.

In such situations, it could be prudent to strategize flexibly to account for the chance that a third party (like a taxing entity) will be able to establish a non-Florida domicile effectively. The domicile issue is often addressed over time, allowing the planning procedures to be updated.

Avoiding Ancillary Probate

The majority of people are aware that avoiding probate is usually a positive thing. It is especially true when it comes to actual and physical private property that is located outside of the state. The traditional probate avoidance strategies, coupled with the privilege of survivorship proprietorship, will also operate to prevent ancillary probate.

Furthermore, any strategy that changes actual and physical private property into a non-physical property (like putting the assets in an FLP or an LLC) can help to prevent ancillary probate. Probate might be eliminated for actual assets but is still needed for the physical private property if measures taken concerning the actual property are simultaneously taken concerning an associated physical personal property.

The State Estate Tax

We have had several years to become accustomed to estate taxes being "decoupled" from federal estate taxes. However, most property owners are still surprised to discover that their out-of-state estate could be subject to estate taxes, even though the property is not subject to federal estate taxes.

Even though the federal threshold is at $5 million, a $3 million legacy could be liable for estate taxes, and a property with a complete marital exemption for federal considerations may still be liable for estate taxes. In addition, state estate taxes are not imposed throughout every state, but the exemptions for estate taxes vary across each state. State estate taxes are routinely revised in states that impose them. An estate planner in Florida should be ready to complete the necessary research to figure out the concerns.

Once the concerns have been recognized, hiring local attorneys to offer state-specific guidance on local taxes and evasion tactics is usually the best option.

It is impossible to predict the implications of estate taxes on non-Florida physical properties quickly. However, the principle is straightforward: the estimated taxes are a percentage of the potential estate taxes on the overall estate, which is computed by splitting the value of the in-state estate by the total value of the estate tax.

However, exact estate tax calculations may require filing a federal estate tax report using a separate applicable exclusion level than the existing federal exclusion rate. The computation would then entail filing an estate tax report to determine the estate tax liability resulting from the non-Florida actual and physical personal properties.

The ensuing estate tax obligation could be shockingly high—or unexpectedly low—based on the property value levied in comparison to the estate not levied by the state. A smaller estate with all non-Florida real estate could pay significantly more tax than a much larger estate with only a small portion of non-Florida real estate.

Ways to Protect Your Inheritance from Taxes

As previously stated, even assessing the scale of the prospective tax could be a burden and a cost that the ordinary estate planning person does not foresee or understand. However, the tax amount is simply one issue to consider when deciding whether to prepare to minimize the taxes; the cost and inconvenience of paying the estate taxes for the inheritance could be worth eliminating.

If the taxes and accompanying charges are deemed worthwhile in general, the property owner must weigh the expenses and complexities. The convenience or difficulties with which estate taxes can be avoided vary greatly based on the jurisdiction as well as the situation of the owner of the property.

An out-of-state estate owner can avoid paying the taxes by legally gifting the asset to his/her children (although this might entail additional complexities to prevent federal estate taxes when the owner wants to keep using that property). Additional elaborate planning could be costly and time-consuming.

For federal tax reasons, inheritances, whether money, assets, or assets, are not regarded as earnings. However, all additional revenues on the bequeathed properties are taxable, except if they arise from tax-free sources. For instance, interest earned from an inheritance and profits on acquired stocks and mutual funds must be included in your declared income. Any gains from the sale of inherited assets or properties are usually levied. However, you may deduct any losses.

Gifting

One sure way to evade inheritance and inheritance taxes is to consider making a gift while still alive, whether directly or even in trust (with no holding on to any strings that will result in inheritance taxes). The federal exclusion amount of $5 million opens up the possibility of making gifts to people or trusts.

Gifting, on the other hand, is not without drawbacks. To start with, the jurisdiction in question might impose state gift taxes, or the federal exclusion level for tax-free gifts could be inadequate. Since the taxation foundation of the bequeathed property carries over, the grantor's ultimate future gain tax liabilities could increase.

Despite its limitations, a gifting approach may be effective in some situations. If applicable, the owner of the property might want to contemplate using an eligible personal home trust to leverage the gifts for estate tax reasons.

Think of a Different Valuation Date

The foundation for assets in a deceased person's estate is usually the estate's actual market value at the moment of death. However, in certain situations, the executor may opt for the alternative date of valuation, which is six months following the death.

The date of valuation would be only applicable if it reduced the gross value of the property as well as the property tax liabilities; this generally results in a greater bequest to the recipients. Within the same six-month window, any asset transferred is evaluated at the time of purchase. The date of valuation is the date when the deceased passed away if the property is not subjected to any estate tax.

Place Everything in a Trust

If you expect to inherit from your parents or any other relatives, advise them to create a trust to manage their possessions. A trust lets you distribute properties to heirs without needing to deal with probate following your death. Wills and trusts are similar. However, trusts typically bypass state probate procedures and associated costs. A revocable trust allows the giver to transfer possessions if needed. The assets under an irrevocable trust are normally locked up till the grantor passes away.

While it could be alluring for parents or caregivers to deposit their possessions in their children's names, this might raise the taxes that the child has to pay.

If the owner of an account dies, the subsequent holder receives the possessions as well as the foundation, which is employed to calculate the taxable gain of the asset over time. If the child sells any long-held property, it can result in a substantial tax bill.

Reduce Distributions From Retirement Accounts

Before they are distributed, bequeathed retirement funds are tax-free. However, if the recipient was not a spouse, some regulations would apply to the time when the distributions should be made.

When one spouse passes away, the remaining partner can normally claim the IRA when one spouse passes away. The needed minimum distributions could start when he or she is 72 years old, just like the living spouse's IRA.

Consider using the "single life" approach to determine the needed distribution sum when you are not older than the deceased. Your minimum payouts will be lower, which implies you'll incur fewer taxes, and the funds will have more time to grow and become tax-deferred.

Distribute Some of the Funds

In some cases, leaving a portion of your estate to others makes logical sense. On top of assisting individuals in need, the tax credit you get for contributing to a charity organization might offset the gains eligible for taxes on the inheritance.

If an heir inherits a retirement fund from someone other than his or her spouse or husband, the money may be transferred to a bequeathed IRA in the heir's name. Even if he or she is not 72 yet, they must start taking small distributions during the first or second year following the inheritance.

If you plan on leaving money to your heirs when you pass away, consider making annual donations to your heirs while you are still alive. You can offer each recipient a specified amount without paying gift taxes.

Giving away gifts not only benefits your family members instantly but also minimizes the value of your inheritance, which is significant if you are approaching the taxable threshold. Consult an estate planning expert to help ensure you are up to date on the ever-changing estate tax regulations.

Find an Inheritance and Estate Tax Attorney Near Me

The laws surrounding inheritance and estate taxes in Florida are complex, and it could be hard to understand your options without the assistance of an inheritance attorney. You can contact us at Arnold Law to explore your options for navigating the estate and inheritance process. Call us at 904-264-3627 today.