The probate and administration process requires involved parties to understand the intricacies of various deeds. With the right information, you can claim your rights to property or exercise the right to amending deed documents as the life estate holder. Although information regarding deeds is available, it may be technical to many. Hence, working with an attorney is advisable to help you achieve your expectations. With Arnold Law, you have an excellent opportunity to work with some of the best probate attorneys who help clients with probate issues in Florida. Thanks to our years of experience in the practice area, you can count on us for high-quality service delivery, on top of elaborate explanations on technical issues.

What a Lady Brid Deed Entails

There are many ways to ensure property transfer to beneficiaries upon death based on legal provisions. Among the acceptable ways in Florida is using Lady Bird Deeds. The documents play an essential role in providing a straightforward and simplified way to ensure the property transfer while still ensuring that the life estate holder exercises control.

A Lady Bird Deed is structured to allow the life estate holder to retain control over their property and then transfer it automatically under the law to beneficiaries. The format in property transfer entails various elements further discussed below. Overall, a Lady Bird deed is an excellent choice for life estate holders looking to avoid extra costs involved in the probate process and retain control over their property during their lifetime.

The Main Elements of a Lady Bird Deed

Several similarities exist between regular deeds and a Lady Bird deed, so you must understand its main elements. The information can help you access the form of property transfer easier while also using the knowledge to draw a comprehensive document.

The general Lady Bird format includes two main elements. They are:

Continuous Rights to a Life Estate

Once a regular life estate holder draws a Lady Bird deed, they can include all property they intend to pass upon their death without any repercussions. The deed allows the estate holder to retain their control and ownership in their name.

As a result, while the beneficiaries will have disclosed or undisclosed rights during the estate holder's lifetime, they cannot exercise them until the deceased passes on. By extension, the life estate holder, therefore, retains the right to change the terms of the Lady Bird deed if needed. Since they have the ownership rights in their lifetime, a remainderman aware of their property ownership rights upon the estate holder's death cannot dispute any changes.

The retained access to a life estate is beneficial to the holder because they have more liberty to improve and alter their possessions as required. For example, if you would like to renovate your home and increase its value, you can do so without implications for the Lady Bird deed provisions. Nevertheless, if you used real valuation figures to estimate the house value, you want to adjust it in the deed to avoid confusion at the time of succession.

Provisions to Transfer Property Upon Death

Furthermore, Florida law allows property listed under the Lady Bird deed to transfer to beneficiaries soon after the deceased dies. Thanks to the provision, you do not have to worry about pursuing the probate process that requires a judge's intervention in property distribution.

Additionally, the authorization for direct property transfer upon the testator's death helps prevent any emerging issues regarding unnamed beneficiaries. After averting the probate process, you can expect to receive property rights sooner than probate procedures.

Differentiating Between a Regular Deed and a Lady Bird Deed

Differentiating a regular life estate deed from a Lady Bird deed is also essential in helping you make an informed decision. Among the best ways to access the details is by consulting your probate attorney for professional guidance.

The distinguishing features between a life estate deed and a Lady Bird deed are identifiable from the various properties. Hence, your lawyer will disclose various details to help you choose the best format applicable for your case.

Properties of a Life Estate Deed

One of the main features of a life estate deed is that the property holder does not exercise exclusive rights to the possessions. Therefore, they will need to consult the remainderman to ensure they obtain their consent on any matter involving a change in property rights.

For example, if you intend to mortgage a house included in the property transferable upon death, the remainderman you assigned should be aware of it and authorize the transaction. Similarly, any considerations to sell property must be done upon receiving consent from the third party for the process to be considered fair.

If any inconsistencies are noted regarding the lack of involvement of the remainderman, a court of law may rule against the transaction in question. Hence, outcomes like reversing the effects of property ownership may apply to revert possession within the remainderman's access.

Alternatively, the court may require you to use the proceeds obtained after making a transaction to reinstate the status quo regarding property ownership. Usually, the court will allow involved parties to seek a solution by themselves, as they try not to compromise the liberty required in formulating deeds.

Properties of a Lady Bird Deed

Conversely, Lady Bird deeds provide more flexibility and accessibility to its users, particularly the property owner. For example, they do not require anyone's consent before proceeding with a transaction involving their property. Therefore, any sale, mortgage, or property transfer completed during the holder's lifetimes will be acceptable according to legal provisions.

Further, the property holder can alter the Lady Bird deed provisions at will, including revoking any property rights previously issued to beneficiaries. Hence, the property can easily revert to your complete control without worrying about third-party disputes. The feature may be useful where a beneficiary dies before you do or where a party openly expresses their disinterest in acquiring your property as a beneficiary.

Moreover, providing beneficiaries rights to your property does not take effect until upon your death. Subsequently, you can continue benefiting from the possessions until ownership transfers. For example, if you own commercial real estate that generates revenue every month, you are entitled to the proceeds until the property is transferred to beneficiaries under a Lady Bird deed.

How to Avoid the Probate Process Using a Lady Bird Deed

The probate process is the official means applied in court to distribute a deceased person’s property to the named beneficiaries. Although the probate procedure is effective and promotes fair means of property distribution, it often presents various challenges and expenses.

For example, you have to be ready to aloe courts to handle the property distribution. This will then require you to wait for a court date, which may take several days or weeks, depending on the court station. Additionally, you want to ensure that all requirements are met before the probate court hearing to avoid unnecessary delays.

Some elements assessed by the presiding judge include:

Whether the Deceased Died Testate or Intestate

While many probate matters involve persons who died having written a will(testate), various cases require the judge to verify whether intestate circumstances apply. For example, if the validity of a will is disputed and later proved to have been fake, the judge may rule that the deceased’s estate should be distributed in an intestate format.

The decision applies to avoid using falsified terms to distribute property, as it may potentially lock out eligible beneficiaries. On the other hand, intestate probate cases involve distributing the property to immediate family members first before the remainder can be issued to third parties.

Whether the Will Complies with Legal Requirements

Usually, a life estate holder is free to include any content in their will, as the law allows property distribution to any person of interest. However, several format requirements must be fulfilled before the court can authorize its execution. For example, the deceased person’s signature must be appended to conclude the document and to indicate that they actively participated in drafting the will.

On top of this, the judge will check for witness signatures from two independent witnesses. The term independent in this case means that their interest in the property should be limited, if any. Where the document does not include these format requirements, the probate process may be delayed until an executor complies with the court directives.

The Beneficiaries Listed in the Will

Further, the probate process should ensure that all beneficiaries listed in the will understand their position and are ready to exercise their rights to the property upon receiving it. They also have the option to revoke their entitlement to the property left for them, which will then be distributed according to how the executors deem fit.

Probate processes also require you to work with an attorney who will help you navigate the court procedures and meet the set requirements. As a result, you also want to factor in lawyer retention fees to cover the legal considerations applicable to your case. Hence, some parties may choose to forego a part of the property listed in the will to cater to legal fees. This may be disadvantageous because the entitled beneficiaries stand to acquire less.

Based on the numerous requirements, interested parties in a deed will seek alternative means like the Lady Bird deed to avoid the long process of accessing their property rights. The advantage of the deed is that it is recognized under the law as a valid means of transferring property, so the beneficiary will not need to undertake additional court procedures.

Homestead Rights in Relation to Lady Bird Deed Provisions

Although Lady Bird deeds include comprehensive rights and easy formats to transfer property to beneficiaries, exceptions apply to the type of transferrable property. Among them include the life estate holder’s rights to home property, also known as the homestead. Subsequently, your attorney will ensure that your rights are well factored in before the Lady Bird deed is executed.

Among the homestead rights exemptions applicable under a Lady Bird deed include:

Tax Exclusions

Florida applies several tax mandates on homeowners to promote revenue collection. Thus, all persons with property rights to homes are expected to meet the taxation requirements to avoid penalties and additional consequences. However, imposing the tax mandates on beneficiaries under the Lady Bird deed would be disadvantageous, as they may not have the required capacity to uphold the payments.

Due to this, tax exemptions apply in situations involving homestead acquisition through the deed, as the remainderman falls within the specified category. Furthermore, any penalties issued from the previous owner’s non-compliance may be exempted, provided the taxing authority authorizes the property transfer to the new beneficiary without any objections.

Exemptions from Creditors

Moreover, as a beneficiary, you will enjoy exemption from creditor claims, primarily because their demands would be linked to the life state holder’s debts. For example, if the life estate holder had signed their house as collateral for payment, the court may issue special orders to deter creditor claims.

Similarly, any pending requirements to satisfy creditors can be reviewed in court to ensure the new remainderman is not overwhelmed by the property. For example, a lien is an authorization over property, regardless of whether it is currently in your possession. With an order to exercise a lien, creditors have control over the property they claim, meaning they can decide to sell it and recover their money.

Thus, if the court had authorized a lien over any property listed in a Lady Bird deed, the lien control can be reviewed or eliminated. In doing so, you as the beneficiary will have a better starting point to the new property.

Demerits of Using a Lady Bird Deed

Although a Lady Bird deed may present excellent features that are advantageous to users, you also need to learn of its disadvantages to help you decide on the best step to take. Common disadvantages noted by persons who opt for a Lady Bird deed include:

Constitutional Provisions Can Restrict Property Transfer

Despite a property owner having the liberty to include property transfer provisions as they want, the constitution can create limitations where required. For example, a party may discriminate against their children or spouses benefitting from their funds and property. If so, constitutional provisions will revoke the provisions under the basis of promoting equality and the family unit.

Furthermore, this category of persons is primary beneficiaries, meaning that they are a priority consideration when distributing a deceased person's possessions. Subsequently, the law will come first and ensure that the parties rightfully gain from the deceased's estate.

Flexibility in Changing Provisions Involves More Drafting Work

As mentioned, a property owner retains the right to alter Lady Bird deed provisions as they intend without any interference from third parties. Due to this, they may end up incurring additional costs in reviews and re-drafts, as well as in attorney fees. Overall, if you chose a Lady Bird deed to avoid considerable expenses and long court processes, you may end up in the same position if you require to make additions or changes to your document.

How Your Attorney Helps with a Lady Bird Deed Issue

As discussed, issues regarding the Lady Bird Deed may arise for various reasons. As a result, working with your attorney to prepare for the subsequent outcomes is highly advisable for a chance to retain the intended terms of the deed. Hence, understanding your attorney’s role gives you a chance to present your expectations and discuss the various ways you can be involved.

Some of the roles your attorney takes on include:

Comparing the Lady Bird Deed to Other Estate Documents

Usually, an estate holder will leave various provisions for all persons entitled to the property upon their death, including a Lady Bird Deed. As a result, some inconsistencies may arise if the different documents include provisions to the same property but different beneficiaries.

Your probate lawyer can help prevent the possibility of these mishaps by assessing all available documents and highlighting potential issues. In doing so, you and any other named beneficiaries can discuss the implications in the documents compared to the deed and reach an amicable solution.

Furthermore, comparing the documents before any execution will save you from any additional costs spent in litigation. This is common where parties do not agree on dispute resolution mechanisms, meaning that the court has to preside over the matter.

Informing You of the Merits and Demerits of the Deed

A prudent lawyer will also take the initiative to inform you of the advantages and disadvantages of a Lady Bird deed to ensure you make an informed decision. Further, they will elaborate on the benefits and disadvantages in relation to your case, as it helps create a clearer picture of the matter at hand.

For example, this may be advantageous since the life estate holder has a right to sell or transfer their property to a different entity within their lifetime without the remainderman’s consent, this may be advantageous. However, the remainderman seeks legal guidance on the same matter; the provision is to their disadvantage. Therefore, the attorney will need to seek alternative solutions.

Help in Drafting Documents and Refining Current Provisions

Additionally, your attorney should spearhead the drafting exercise to ensure that the deed includes the necessary features. Thus, a life estate holder can approach a probate lawyer, inform them of the required deed provisions and leave the drafting duty.

Although life estate holders can opt to draft the Lady Bird deed themselves, they might be unfamiliar with the different legal requirements to meet. As a result, their provisions can create disputes among the beneficiaries when the recovery period comes. In comparison, working with an attorney eliminates the need for subsequent reviews and re-drafting.

Maintaining Communication with Interested Parties in the Deed

If the Lady Bird deed involves interested parties, your attorney can help maintain contact with them through official communication. Staying in touch will help you learn of any emerging issues with the deed provisions and give all parties an avenue to express their concerns.

For example, if creditors have a right to access the property listed in the Lady Bird deed, your attorney will communicate with them to seek alternative means of settling debts. This way, the creditors do not have to recover their money through property possession. Additionally, your attorney may succeed in requesting additional time within which payments will be made as a settlement with the creditors.

The Cost of Obtaining a Lady Bird Deed

Typically, Lady Brd deeds require an attorney’s involvement to properly draft and record them as a final document. Despite the various preparations required to ensure the deed is comprehensive and drafted within the necessary provisions, it is not expensive to obtain.

This is because your attorney will only charge a standard flat rate to undertake the drafting and compiling duties, then submit the document for your approval. However, you should note that your legal fees vary depending on the attorney retained for the duties.

Subsequently, you want to ensure you work with a lawyer who prices their services reasonably to prevent you from paying excessive service fees. You should also remember that any errors requiring reviews may introduce additional fees to your total costs. Hence, you should provide accurate details where necessary to prevent unnecessary costs in reviewing and re-drafting the deed.

Contact a Competent Probate Attorney Near Me

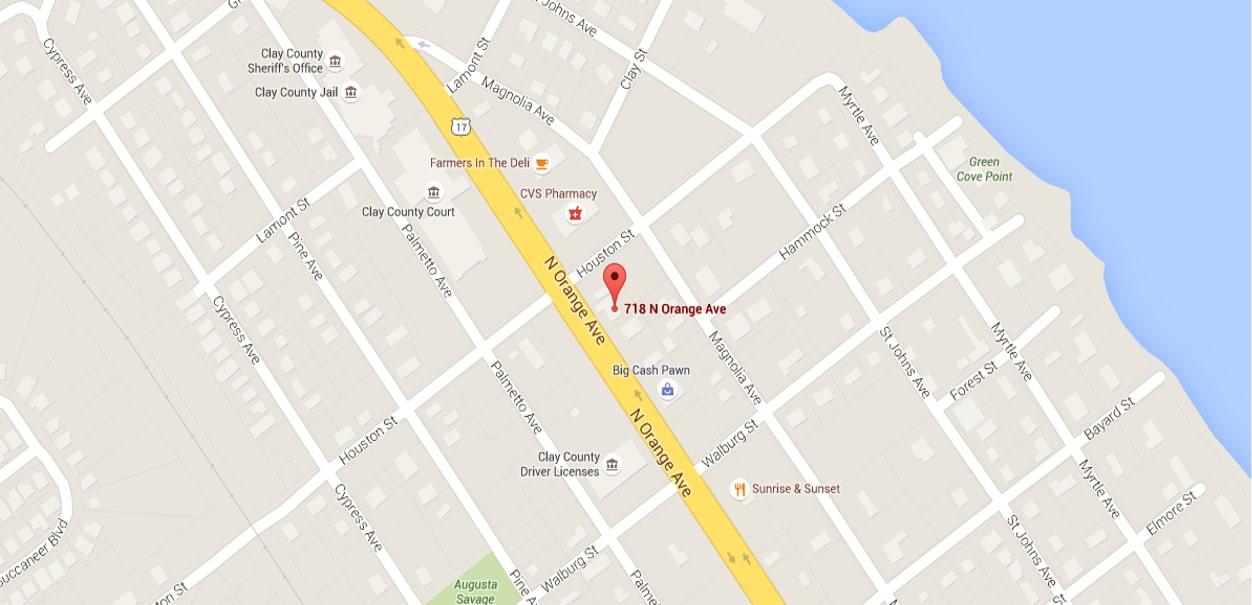

Upon the death of a loved one, issues regarding probate and succession may arise, creating hardships for the members involved. You can overcome the challenges by consulting an experienced probate attorney for the best chances of resolving issues accurately. With Arnold Law, you can access excellent legal services tailored to meet your needs. Our team is highly skilled and experienced in handling matters relating to Lady Bird Deeds. Therefore, any clients looking to acquire knowledge or solve Lady Bird Deed issues in Florida can schedule a consultation with us by calling 904-264-3627.