When you lose a loved one, you must figure out how to handle their property according to the law or per the defendant's wishes. In Florida, a deceased person's property is placed in an estate and handled according to probate laws. Setting up an estate involves taking care of all the debts and distributing the remaining assets to the heirs.

Being held liable for a descendant's debts is unpleasant, and some creditors can take advantage of the death to harass you and other heirs to the deceased estate. Additionally, delays caused by different probate laws could make the estate's opening and closing long and costly. At Arnold Law, we help you deal with issues like harassment from creditors, government benefits, and other factors that could delay or affect the settlement from the estate. We serve clients seeking legal guidance and representation to navigate probate laws throughout Florida.

Settlement Agreements and Probate Lawsuits

Facing disputes with probate is not uncommon when you are an heir to a descendant's estate. If you are in the middle of a lawsuit and your probate attorney discusses the issue of settling the lawsuit, you will probably need to sign an agreement. In Florida, probate lawsuits that do not go to trial are resolved between the parties by signing a settlement agreement.

As a Beneficiary to an estate in Florida, you need to consider these tips when settling a probate lawsuit include:

- Never feel pressured to sign something. If you are not satisfied with the settlement you stand to receive, it would be wise to avoid signing an agreement. If you are in the middle of a probate dispute, the court can accept or reject settlement agreements each day. You should not be a part of an agreement that does not meet your needs.

- Read through documents before signing when you seek to collect the benefits for a deceased loved one. Liable parties and insurance providers will quickly make an offer and coerce you into signing an agreement. Therefore, you must have a probate attorney look through the documents and explain the contents before you decide on the right course of action.

- Understand whether or not you are leaving disputes on the table. Probate litigation is common in Florida. A resident of Florida who dies could leave behind a will, a revocable trust, or bank accounts that go to you if you are the beneficiary. If there are issues that are left behind, you must ask your attorney whether signing an agreement will resolve all the issues. This lowers the burden of having to return to these disputes.

- Have a global settlement. If you wish to settle all the disputes at once, you must have a global settlement. This means that all individuals involved in signing the agreement have resolved all issues.

- Recognize the implications of signing the agreement. Signing an agreement has serious implications. After the agreement is signed, all the legal issues will no longer hold water. The most important thing, in this case, is whether you have settled your probate lawsuit according to the written agreement.

Estate Administration for personal Representatives in Florida

Under Florida law, one person close to the family could be appointed to handle the financial or legal duties before closing the deceased's estate. If a deceased loved one chose you as their representative during their lifetime, you must follow through with their will and other instructions on managing their estate.

Before opening formal probate as a personal representative, the law requires that you have legal representation. Having an attorney by your side ensures that all estate issues are carried out according to the state laws. With legal guidance, you can carry out the following steps to closing the estate:

- Take possession of the financial effects, including computers, social media accounts, passwords, and other assets. If the deceased had a safe deposit box, your attorney would help you investigate the box's contents and decide where they fit.

- Lock all real estate properties to keep the assets safe

- Deposit the will with a court clerk. Florida law requires that a will be deposited with the court clerk within ten days following the owner's death. This ensures the document is not concealed from the heirs or altered. Change all dresses to the decedent's mail to ensure their assets are discovered and all pending bills are paid appropriately.

- Search the decedent's bank accounts to identify creditors and arrange their payments. However, it is vital to understand that paying creditors without legal guidance could raise more issues.

- Prepare a final tax return for the deceased and submit it to the IRS.

- Inventory the estate and present it to the heirs or probate court within sixty days.

Florida law does not limit the amount you must have for probate. If a person dies with assets in their name, these assets must be probated.

Court Approval of Settlements and Guardianship Rules in Florida

Florida law protects the child's interests when the court or insurance company settles a child injury case for more than fifteen thousand dollars. The court is more vigilant in vetting potential guardians to the exploitation claims in the past. The settlement laws seek to protect injured children and ensure that:

- The agreed settlement is fair and addresses the child's best interests

- Parents and guardians of the child do not spend the money before the child attains eighteen years

The court guidelines on a minor's settlement are based on the gross and net settlements. The gross settlement is the amount received for the child's injuries before deducting attorney fees and medical expenses. On the other hand, the net settlement is the amount that is left after all expenses are covered.

The other group of individuals that the law seeks to protect is disabled adults. Individuals who cannot execute legal documents cannot sign a settlement release. Sometimes, the family members of a disabled adult can execute a power of attorney to facilitate the transactions.

Wrongful Death Estate Administration

The only asset for most wrongful death cases in Florida will be the case. In such a case, a personal injury attorney can file the probate and advance the costs. However, when there are additional assets in that estate, you will need the services of a probate attorney.

Before filing for probate, you must talk to every potential deceased heir and agree to appoint a representative. If the deceased had already appointed a representative to their estate, you could allow that representative to continue the role. Only a single person can legally act as a representative of a wrongful death estate. However, if you are a parent of a minor child who is a victim of wrongful death, you and the other parent can act as co-representatives.

If you cannot appoint a personal representative among yourselves, each person who wishes to act as the administrator will petition the court. In this case, the judge will decide on the matter. A person is only allowed to act as a personal representative if they meet these conditions under the law:

- The person is a resident of Florida

- The representative is a parent, sibling, child, or close relative of the deceased

In addition to the above qualifications, the court could look into a person's criminal history. You cannot be a personal representative if you have a felony conviction. If the court allows you to act as the representative, you will receive a letter giving you the legal authority to take the necessary action on the estate.

After receiving the administration letter, the next step is to search for creditors. A deceased person's creditors have up to 90 days to respond to the published notice. Unless you agree, you are not obligated to pay for a decedent's debt. Therefore, you can object to their attempts to collect. In this case, the creditor must file a civil lawsuit against the estate. Most creditors are reluctant to file a claim or collect from a deceased person's estate. Therefore, objecting to their claims benefits you and the deceased's other heirs.

Another significant role of an estate administrator is to file a wrongful death claim. The statute of limitations for a wrongful death claim in Florida is two years. After filing the lawsuit, the personal representative will expect to undergo the discovery face of the lawsuit, where they must present necessary documents to prove the wrongful death.

Even when you are not the administrator of your loved one's estate, you may need to attend court mediations if you are an heir to the estate. If you cannot solve the case in mediation and the claim goes to court, you must present evidence of your relationship with the deceased to stand a chance of recovering compensation for the wrongful death.

It is important to understand that the court does not treat each survivor in a wrongful death claim equally. The level of loss you stand to suffer from the wrongful death plays a significant role in the amount you can recover.

Deceased Defendant Estate Administration

Personal injury lawsuits are a great way of recovering compensation caused by the negligence of another party in Florida. It is not uncommon for a defendant or liable party in a personal injury claim to die before the case ends. The death of a potential defendant in a Florida personal injury lawsuit will not extinguish the cause of action. If your loved one is the defendant, in this case, the plaintiffs or injured parties could file a claim against the personal representative of your loved one's estate. In a probate case that is opened after a person's death, the victims of the decedent's action can intervene in an already ongoing probate case.

An estate is not a separate entity that can act as a party in a civil lawsuit. Therefore, the personal injury claim will have no grounds if no one takes control of the estate or shows interest in managing it. Additionally, if the estate is opened after the statute of limitations for the lawsuit has elapsed, the plaintiffs may be unable to sue and recover compensation from your loved one's estate.

Some of the ways through which plaintiffs can recover from an estate that is not administered include:

- Convince one of the family members to enter the role of a personal representative. Since the state cannot act on its own in a lawsuit, having a personal representative allows the plaintiff to file the claim with the representative as the stand-in defendant. If the assets in the estate are insignificant, it is challenging to convince anyone to go through the process of opening the estate.

- Use a plaintiff as a personal representative. As a creditor to a deceased's estate, the plaintiff can act as a representative. However, they must serve a notice to the relevant parties. Due to the conflict of interest when the plaintiff serves as the estate representative, insurance companies could hire attorneys to fight the lawsuit.

- Use of a probate attorney. If a probate attorney is comfortable acting as an administrator, they can stand in for the defendant in the claim.

Am I Liable for My Deceased Loved One's Debts?

When a person dies, the estate they leave behind is responsible for covering their debts. Therefore, creditors will come for your loved one's bank accounts and other assets after death. Most of these debts go unpaid if the estate does not have sufficient funds to pay the creditors.

Although coming after an individual to recover a deceased person's debt is not legal, some creditors may still attempt to demand payment. However, you should not engage with these creditors. Reporting them to the authorities is the best action in this situation.

While a decedent's debts are paid from their estate, there are some circumstances under which you are liable for these debts, including:

You signed an obligation. If you open a joint account with another person, you may be liable to pay for debts under that account. For example, if you are on your spouse's credit cards as an account holder, their death makes you liable for their credit card debt.

You violated probate laws. If you take charge of a deceased loved one's estate, you have the liability to liquidate some assets and cover the debts. Failure to do this violates probate laws, and the creditors can push you to pay the dent from your pocket.

Death of a spouse. The rules of transfers of spousal debt are complex. Therefore, there are cases where creditors could come for you to pay the debts left behind by your deceased spouse.

Settlement of an Estate without a Will in Florida

Regardless of what someone says to you before death, dying without a will means that the assets left behind are divided according to the law. In this case, the government will dive into the property according to state and federal laws. The lack of a last will makes settling a decedent's estate more complicated for the heirs.

The court will distribute our loved one's properties in Florida according to succession laws. If your spouse dies and you have children, you will receive everything they leave behind. However, if the deceased has children from other relationships, you will receive 50% of the assets, and the other part goes to the children.

The court will allocate assets to the deceased's parents for unmarried couples. In cases where no surviving spouse but children are involved, the estate is divided equally among the children. It is important to understand that biological and adopted children have the same rights to a parent's estate after their death in Florida.

When a will is present, the deceased will have appointed an executor for their estate. However, with no will, the court is responsible for appointing an executor. Without a will, heirs will have little control over their inheritance. Additionally, the court-appointed executor must handle all the issues, from payment of taxes to sorting out creditors. Whether your loved one leaves behind a will or not, dealing with the estate will require the insight of a skilled probate attorney.

Special Needs Trust in Florida

A special needs trust is a document with inclusions designed to protect physically or mentally incapacitated individuals. The trust restricts how the funds will be utilized to avoid paying for provisions that the government provides. Leaving an inheritance to your disabled child or dependent could cause them to lose government aid. Therefore, having a special needs trust is critical.

Avoiding Probate

Probate court proceedings can be long, confusing, and costly for your loved ones. If your loved one leaves your property, you can avoid going through probate if the deceased loved one went through any of these steps of avoiding probate:

Living Trust

In Florida, you can avoid probate for any asset or real estate you own. However, you must create a trust document and name the person who will take over the trust after your death. When you create a living trust, you will transfer all the properties you need to leave to that person from personal ownership to the trust. Once the process is completed, all the property on the trust is controlled per the trust terms. After your death, your successor can transfer the contents of the trust to your beneficiaries without going through probate proceedings.

Joint Ownership

If you jointly own property with another person and the ownership includes a right of survivorship, the surviving owner will automatically assume property ownership if the other dies. Although this process could take a while, the transfer will not go through the trust. There are two types of joint ownership:

Joint tenancy. With property owned in joint tenancy, it is transferred directly to the surviving owners when the other one is deceased. Joint tenancy is common when a couple acquires real estate or another valuable item. In this case, each owner is a joint tenant and will receive full ownership after the death of their spouse.

Tenancy by the entirety. This type of ownership works the same as joint tenancy. However, it is only applicable to couples that are legally married.

Transfer-On-Death Securities

In Florida, you can register stocks in TOD form. When you register your account in the TOD form, the person you name as a beneficiary will automatically inherit the account after your death. The company deals directly with the brokerage and not the probate. For example, if a special needs child receives Medicaid, the trust must be executed in a way that does not diminish or compromise these health benefits.

However, special needs trust can supplement the provisions from the government by providing the following additional benefits:

- Electronic equipment, including TVs and computers

- Housekeeping

- Companionship

- Medical services and equipment

- Personal grooming

- Entertainment

A proper special needs trust must indicate the intent of the trust maker to help the special needs child without compromising their eligibility for government aid. The special needs trust is an important tool for estate planning and should never be left out of estate living trusts and family wills. The most crucial rule when drafting the special needs trust is that the agreement does not entitle the beneficiary to demand income from the principal.

Find a Skilled Probate Attorney Near Me

The death of a loved one is a challenging experience. It is more difficult when the negligence of another person causes the death. Following a person's death, the beneficiaries must figure out ways to handle the trust, including the claim for compensation for the wrongful death, protecting the estate from creditors, and protecting minors' interests. All deceased person's assets are handled in probate, a complicated law section. Therefore, seeking competent legal guidance is crucial.

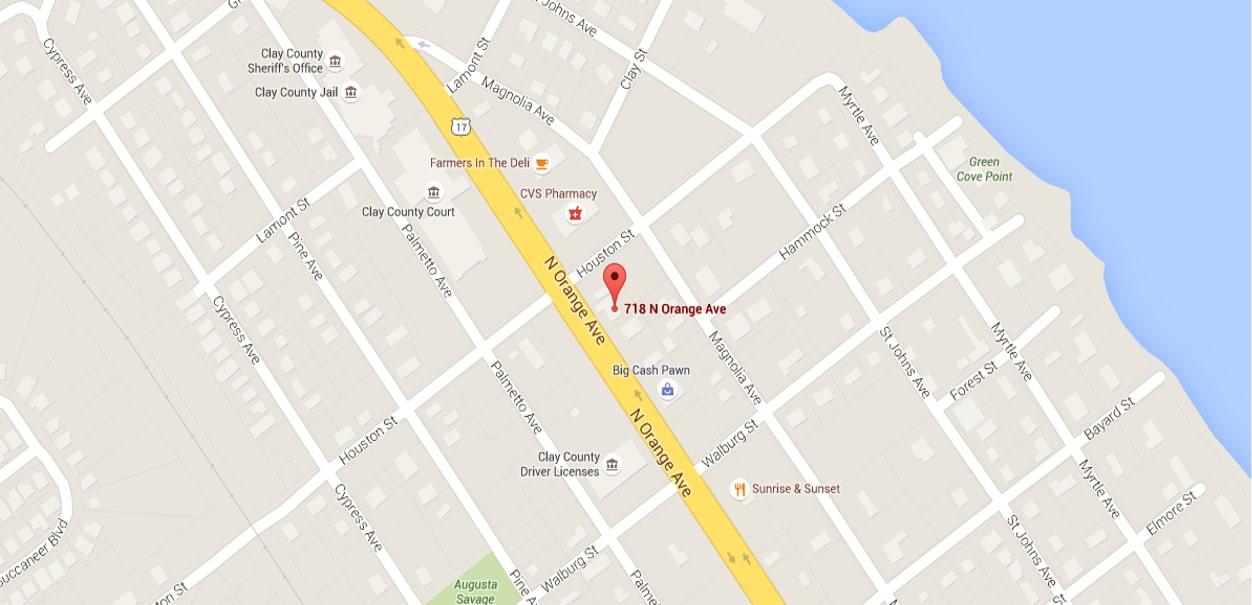

At Arnold Law, we understand how challenging the planning and execution of an estate can be in Florida. While you are already grieving the loss of your loved one, you must undergo the legal processes to sort out their estate following the will or government provisions in cases where there is no will. Our skilled attorneys guide all our clients to handle the settlement for different aspects of a decedent's will through probate to ensure the best outcome. Contact us today at 904-264-3627.