Buying property is certainly the most significant investment you could ever make. With this in consideration, you will want to insure it not only against fire damage, but also title defects that could enable someone else to claim your property.

We at Arnold Law, have a lot of expertise representing title insurance claims and can devise a litigation strategy to quickly settle even the most difficult insurance issues. We are also able to pass cost savings on to our clients. Our firm-wide concentration allows us to deliver consistent and high-quality services regardless of claim size. Get in touch with us if you have any issues regarding Florida title insurance.

Understanding the Basics of Title Insurance

Any real estate transaction requires a clear title. Before a title can be granted, title firms must conduct a search to see whether there are any claims or liens against it.

Previous owners as well as other entities may have legitimate as well as illegal claims against your property. Title issues may limit your ability to utilize the property and may result in financial loss. Your mortgage lender's security interest may also be jeopardized and that is why title insurance will shield both you and your mortgage company from risks that come with title problems.

A title search is a check of public documents to verify and confirm rightful ownership of a property and see if there are any claims against it. Incorrect surveys and unsolved building code violations are examples of flaws that can tarnish the title.

Both lenders and homebuyers are protected by title insurance against loss or damage caused by liens, encumbrances, or flaws in the title or real ownership of a property. Unlike typical insurance plans, which cover claims for events in the future, title insurance covers claims for previous events.

What is a Bad Title?

A bad title is one that is flawed. It makes it impossible for the titleholder to legally sell an asset or transfer it to another person. Bad titles are also known as clouded titles or titles with a break in the title chain, indicating that there are issues with that title. These problems may or may not be known to the titleholder.

A title may be termed bad for a variety of reasons. The phrase is most often used in real estate when a lien on the property, unpaid taxes, or failure to rectify a building violation can obscure the title. If the owner of a property fails to pay off the mortgage, the title may become clouded. Bad titles can also be caused by clerical mistakes, such as misspelling a name or failing to properly register a title.

The titleholder must have a clear title in order to lawfully transfer their property (and for the current owner to claim ownership). This implies they will have to work out any issues with the title. The receiving party does not lawfully own the property if a titleholder sells or transfers a defective title. In other words, before a bad title is transferred from one party to another, it must first lose its status as a bad title.

Possible Title Defects

Title firms examine title plants (a database of property information) or public documents providing a title insurance policy. The search identifies who owns the property, what obligations are owed to it, and the title's status. However, here are some of the title flaws you may encounter:

-

Inaccuracies in public records

-

Unknown Liens

-

Illegal Records

-

Unknown heirs

-

Forgeries

-

Encumbrances that have yet to be discovered

-

Unidentified easements

-

Dispute over Bounders/Survey

-

Unknown wills

-

Impersonation

Types of Title Insurance

There are two types of title insurance: lender's title insurance and owner's title insurance (including extended policies). Most lenders demand that the borrower acquire a lender's title insurance coverage to protect the lender in the event that the seller is unable to legitimately transfer ownership rights. The policy of a lender solely protects the lender from loss. The conclusion of a title search is indicated by the issuance of a policy, which provides some security to the buyer.

Because title searches are not perfect and the owner is still at peril of financial loss, extra protection in the form of an owner's title insurance policy is required. Owner's title insurance, which is an optional purchase, is frequently acquired by the seller to safeguard the buyer against title problems.

How Does Title Insurance Work?

An owner's title insurance policy might cover the costs of paying off a previously unknown lien or litigating against a lawsuit brought against you by someone claiming ownership of the property. It can also provide monetary compensation to a new owner who inadvertently purchases a property with a counterfeit deed from a fraudulent vendor who did not own the property. Furthermore, owner's title insurance safeguards your capacity to sell your house in the future if an issue is discovered during a subsequent title search.

However, title insurance does not cover all potential infringements on a homeowner's property rights. It does not shield you against title issues created by your own conduct, such as neglecting to pay the roofing company or failing to pay your property taxes. It also does not cover eminent domain, which is when the government seizes private property for apparently public reasons.

In other words, it does not cover concerns that arise after you purchase the property. It safeguards you against problems that would have influenced your decision to buy the property if you had known about them at the time.

Because a lender's policy does not protect you, you are probably less worried about how it works, but you could still be curious because you will have to pay for it.

Assuming you lose your house because it was sold to you illegitimately; you are not going to be able to keep up with your mortgage payments. The lender will have to submit a claim with its title insurance provider in order to recover the mortgage payments it expected from you.

In other cases, if you stopped paying your mortgage, the lender might foreclose and sell the house to collect its losses. However, if it is discovered that someone else owns the property, foreclosure is not an alternative.

Why You Need Title Insurance

Without title insurance, transacting parties are exposed to considerable risk in the case of a title problem.

Consider a homebuyer who finds the home of their dreams only to discover unpaid property taxes from the previous owner after closing. Without title insurance, the buyer bears the whole financial burden of this back tax demand. They must either pay the back taxes or risk losing their home to the taxation authority. Title insurance, in the same circumstances, protects the buyer for as long as they own (or have an interest in) the property.

Additionally, title insurance provided by the lender protects banks and other mortgage lenders from unregistered liens, unrecorded access rights, and other flaws. If a borrower defaults and there are any difficulties with the property's title, the lender will be protected up to the mortgage amount.

Before making a purchase, real estate investors should check to see whether the property has a defective title. Foreclosed homes, for example, may have a slew of unresolved concerns. To protect themselves against unanticipated claims against the title, buyers may consider obtaining owner's title insurance.

Owner's title insurance is optional, while lender's title insurance is necessary. If a claim emerges after the purchase, an owner's policy can protect you from losing your equity and your ability to remain in possession of the property. Even if you're purchasing a new home, flaws may exist due to past owners of the property and the builder's failure to pay all of its contractors.

These are among the problems that an owner's title policy can help you avoid:

-

Mistakes in property surveys

-

Disputes regarding boundaries

-

Errors in the deed

-

A previous owner broke the building code

-

Conflicting wills

-

Claims made by an ex-spouse who did not consent to the sale

-

Claims linked a fraudulent power of attorney

-

Contractors' liens, taxing entities' liens, and prior lenders' liens

-

Unpaid child support from a previous owner

-

Encroachments

-

Documents that have been incorrectly recorded

An owner's title insurance policy, like many other forms of insurance, might feel like a waste of money if you never use it. However, it's a reasonable amount to pay to safeguard your interests if your title is challenged after you have closed on your estate.

Purchasing Title Insurance

Title insurance is a one-time payment, not a recurring cost. An owner's policy is based on the purchase price of the house, whereas a lender's policy is based on the amount of the loan. According to the American Land Title Association (ALTA), these policies typically cost around 0.5 percent to 1.0 percent of the house's purchase price, or $1,500 to $3,000 on a $300,000 home.

In certain states, the cost of title insurance is the same regardless of which firm you choose. In some, however, searching around might save you money. It is up to you as a homebuyer to choose which title insurance firm suits you best.

You may receive recommendations from the seller or your real estate agent, but you should conduct your own research before acting on their advice. Because your lender's financial interests in the property are aligned with yours, you can trust their advice. Some lenders, on the other hand, have a financial stake in the title firms they refer borrowers to.

The owner's policy can be paid on behalf of the buyer by the seller. Who pays is frequently determined by local real estate tradition. Purchasing an owner's insurance at the same time as a lender's policy might result in a "simultaneous issuance charge," which lowers the cost of the owner's policy.

The rate calculators from Old Republic and Fidelity National can help you figure out how much the title insurance will cost in your location. You may also use First American Title's fee calculator or Stewart's rate calculator to receive a quick estimate. At the same time, you might be able to receive estimates for other closing services.

You can also use the advanced search option to locate a title insurance firm by doing an online search on the ALTA Registry for companies in your state. Fidelity, First American, Old Republic, or Stewart are among the largest title insurers. Make sure the company's financial strength and reputation are great.

What is a Title Insurance claim?

Individuals, lenders, or government organizations may claim an interest in your property when they file a title claim against it. For example, there might be a past mortgage on your property that your title company overlooked throughout its title search and that your home's previous owners did not pay. The lender behind that mortgage may file a title claim, demanding that you pay off the remaining balance of that mortgage.

If you do not have title insurance, that lender may be able to take possession of your property through the foreclosure process. If you have title insurance, you can submit a claim with your insurer and have the matter resolved by the title firm. Your insurer may pay off your debt or work out a deal with the lender that filed the claim so that you may keep your house without having to pay up the debt due by the previous owners.

Another prevalent kind of title insurance claim is property border disputes. Perhaps the previous owners of your home erected a fence that you thought was on your property but is really on your neighbor's land. Your neighbor may bring a lawsuit against you, ordering you to return the fence to your own land. To resolve this issue, you can submit a claim with your title insurance provider. Your title insurance may reimburse you for the cost of hiring a contractor to remove the old fence and replace it with a new one. This way, you will not have to pay for the problem out of your own wallet.

If you get a notification of a title claim in the mail, do not disregard it, even if the lender, person, or business filing the claim is unfamiliar to you. Remember that title insurance claims are filed against your property, not you, so the people engaged in a dispute may be unfamiliar to you. Ignoring the claim might lead to you having to pay someone else's debt or losing your home to foreclosure.

How Do Title Claims Arise?

There are various forms of title claims. Here are some of the most frequent ones you may encounter:

Property Boundary Disputes

In this case, neighboring property owners are claiming the same piece of land. This problem can occur when a previous owner subdivides a property or when the legal descriptions of the properties are incorrect.

It may be that a neighbor has erected a fence on your property. The title firm might try to acquire the disputed property on your behalf or compensate you for the value of the property that was lost.

Easements, Liens, and Land Interests

All interests in your land should be registered in the public records so that all prospective buyers are aware of the interest. Prior to the acquisition of the property, a title check is usually conducted to identify all of these interests.

Someone may also claim the right to drive over or through a section of your estate in order to get access to their property, a roadway, or another object of interest. An "easement" or "right-of-way" is the term for this sort of interest.

If you find out that a third party (such as the city, county, or cable company) has an interest in your property, such as an easement or right-of-way, the first thing you should do is check your title policy's exclusions to see if the interest was included as an exception to coverage.

You may have a title claim if the interest is not specified as an exemption to coverage. In order to "fix" the issue with your title, the title firm may try to remove the third party's interest in the property in order to resolve title disputes pertaining to previously undisclosed interests in your property. If the third party interest cannot be removed, the title firm may be liable for losses or damages in value of your property as a consequence of the third party interest. A title fault refers to any previously unknown interest in your property.

Liens

When a contractor, subcontractor, or materialman does work on real property, lien rights in the property are created to ensure that the contractor, subcontractor, or materialman gets paid promptly.

Code breaches and refusal to pay public utilities can result in lien rights in favor of cities and counties. The title insurance firm examines the public documents for these lien interests in readiness for closing and giving a title policy.

Generally, the seller will work to pay or otherwise address these types of liens prior to closing. If, after closing, you find a lien on your property that precedes your possession of the property and does not appear as an exception, your title company is found to be in violation of your policy.

The title firm will investigate the case to see if the closing agent paid the lien but no Release of Lien was recorded, or if the lien is invalid for any other reason. In theory, if you have a legitimate title claim, the title company will take whatever actions are necessary, including paying out the lien, to remove the lien from the title.

Defects in the Chain of Title

Although less prevalent than the preceding title claims, the title policy also covers faults with the chain of title. For example, the previous owner of the property may show up and say that your deed to the property is a counterfeit or that the realtor got it under false pretenses. The title insurance coverage offers to protect you against the property's title being vested in a way that was not what you expected.

Title Malfeasance

Title fraud can result in a claim being made against your title. Title theft is a serious matter; it occurs when an individual steals your identity by using your personal information, such as your Social Security number. This criminal then fabricates a phony title deed to give the impression that he or she is the owner of your property.

These criminals might file for a refinance on your house once they have established their false titles. They will then flee with the money from the refinancing. Other times, they will open a home equity line of credit in your name, often known as a HELOC.

Negligence in Title Search

When you apply for a mortgage, your title insurance company will conduct a title search, which you will pay for to look for any claims or liens against the house you are purchasing. This search is intended to safeguard you against future title claims.

However, title insurance firms may occasionally overlook a claim or lien during their searches. Again, your owner's title insurance policy should cover any future claims resulting from poor title searches. You should speak with a real estate attorney to ensure that you do not have to pay any fees or lose your house as a result of a title insurance company error.

Contact an attorney if you are uncertain of whether your property has a title claim. An attorney may go over your title policy and give you advice on the best line of action to take.

How Will Your Title Insurance Claim Be Resolved?

Every title claim is unique. However, if you have title insurance, your title insurer will attempt to fix the issue without you having to lose your house or pay out of pocket to cover outstanding taxes or bills.

Assuming your home's former owners did not pay their property taxes for three years, the title insurance company will pay these taxes so you will not have to repay the bills on your own.

If someone claims to have an ownership interest in your property, the title company will try to arrange a settlement in which you keep your home and are protected from any financial damage as a result of the claim.

However, keep in mind that title insurance only protects you from title claims relating to title issues that occurred prior to the purchase of your title insurance policy. Title insurance will not help you if you cease paying your taxes or mortgage. If you don't want to lose your estate to foreclosure, you'll have to pay up.

Title insurance is costly. However, it is a worthy investment. While title claims are uncommon, they do occur. If a government agency or an individual lodges a claim against your property, you'll be pleased you bought an owner's title policy.

Find a Title Insurance Lawyer Near Me

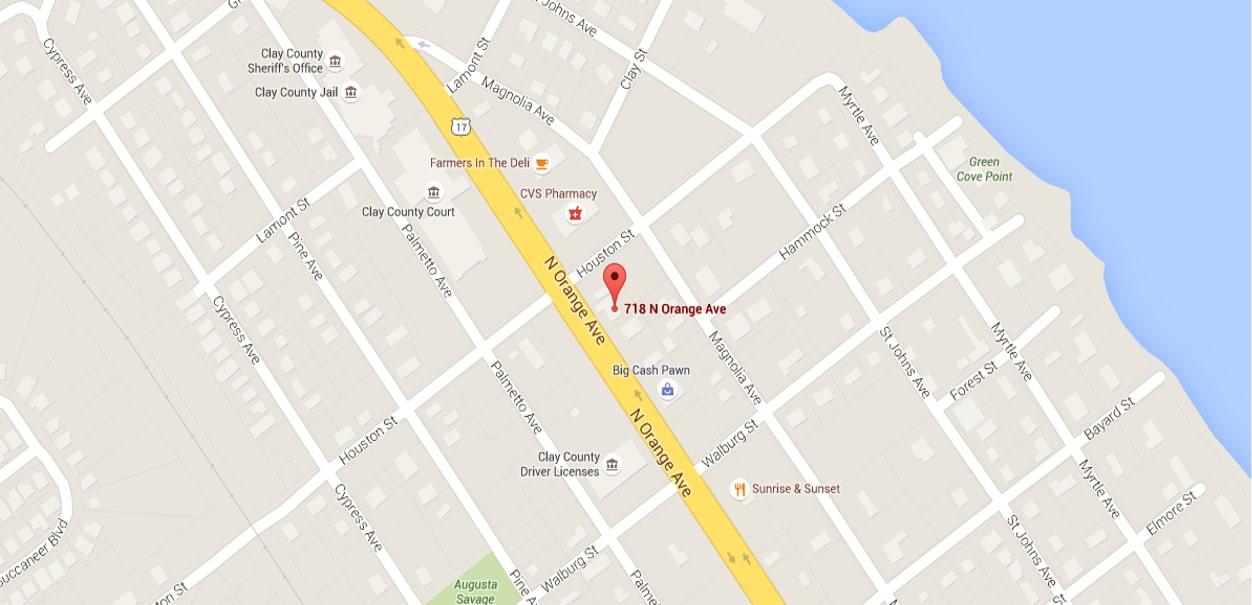

While engaging a lawyer may appear to be an unnecessary expense, they can really help speed up the title claim process. Arnold Law can assist you whether you are a seller, or creditor. Call us at 904-264-3627 if you have any questions regarding your title insurance claim.