You can establish a land trust for many reasons. One benefit is keeping your identity as the trust’s owner confidential, especially when making investments and purchases. It also makes it easier for heirs to inherit assets. The Florida land trust arranges that the property owner(s) is the beneficiary and tasks a trustee to hold equitable and legal title to the trust’s real property. The trustee can conserve, protect, encumber, lease, manage, and sell the real property. If you are considering a land trust, please consult Arnold Law. Our knowledgeable attorneys can assist you in understanding the pros and cons of a land trust and how to set one up.

How Does a Florida Land Trust Work

Florida Statute 689.071 regulates how land trusts work. It is also called the Florida Land Trust Act or the Florida Land Trust Statute.

A land trust is an agreement that conceals asset ownership from the public. The grantor establishes when they want to buy an asset or obtain a mortgage. You should choose the trustee who will hold your property’s legal title. Your trustee’s name will appear in public records and on your deeds.

Moreover, the trustee has title to your asset. They can sell, encumber, lease, and convey your asset without any other person’s involvement.

The beneficiary enters into an agreement with their trustee (trust agreement) that highlights:

- what the trustee can do with the asset,

- when, and

- how.

Therefore, you should select a trustworthy and reliable trustee.

How to Set Up Your Land Trust

The first step in setting up your Florida land trust is preparing and executing:

- Recording instruments like a deed of trust or deed

- A written land trust agreement — When preparing the relevant documents, you should identify and choose specific parties and terms, incorporate them into your agreement, and create trust. Here are the parties involved in a land trust:

a) Grantor

A grantor is the current owner of the estate.

The land trust can be created by:

- An individual

- A partnership

- A group

- A revocable trust

- An irrevocable trust

- Limited liability limited partnership

- A corporation

- A limited liability company (LLC)

- A living trust

Ensure you correctly identify the current owner in your paperwork to avoid challenges with property in the trust transfer or clouded titles.

Your trust can last for any definite or indefinite duration under the trust agreement terms. Typically, the period it will last depends on your financial goals.

You can revoke the land trust by directing your trustee to return the asset to your name.

b) Trust Corpus or Principal

It is the asset the grantor transfers into the land trust through a trust agreement and deed. The principal could be your real estate property alongside other related interests like a deed of trust, mortgage, or lease.

c) Trustee

A trustee is a party that executes and administers the land trust’s terms for the beneficiary’s benefit. A trustee can be another trust, an individual, a legal firm, or a business.

A trustee is a fiduciary and is obligated to manage the land trust’s property for the benefit of the beneficiary named in the trust with honesty and good faith. They are held to a high standard of conduct. The terms in the trust documents bind the trustee, and they should comply with the responsibilities and powers outlined in the trust. Otherwise, they will be held accountable for damages due to a breach of their fiduciary duty.

The trustee also holds title to properties in the trust for the beneficiary’s benefit. In other words, the trustee should protect and preserve the properties. The trust should outline the trustee’s powers. Typically, the trustee is tasked with the following:

- Retaining the trust assets

- Reinvesting the property

- Selling it

- Exchanging it

- Dividing it

- Conveying it

The trustee can be a legal entity like a corporation, an LLC, or even an individual.

While you can use your LLC as a trustee, the names of the registered agent and manager of the trustee are available to the public. Nevertheless, a resident can use an LLC formed in a different state to function as a trustee. The public cannot find the name of the LLC’s manager in another state when they search online. That way, the asset owner enjoys the privacy benefits of the trust while simultaneously serving as a trustee in their LLC.

d) Beneficiaries

These are legal entities or persons who will benefit from the assets in the land trust.

You can be both the beneficiary and trust maker. You can also name other beneficiaries to share your property’s beneficial interest, and they can name successor beneficiaries. Your land trust can hold title to at least one asset, and beneficiaries can have different interests in every land trust property.

You contribute the money to your land trust, and your trustee uses the amount to pay for the property. You could be required to guarantee the note if you use purchase money financing. The trustee only signs the mortgage. Your trustee is not liable for paying the mortgage. All benefits and income from the investment are owed to you, minus expenses and costs incurred by your trustee.

Cost of Establishing a Land Trust

Establishing a land trust is cost-effective for many individuals who want to hold their assets while remaining anonymous.

Typically, the initial setup can cost between $250 and $500. There are also attorney fees linked to trust administration, including expenses like bills and tax forms. The annual fee for maintaining the land trust costs approximately $300. However, the total cost incurred varies from one case to the next.

Regarding taxes, the land trust beneficiary should file tax returns as part of their personal income reports, although the trust is not taxed.

Advantages of Creating a Land Trust

Key advantages of a trust include:

It Offers Confidentiality

Anyone searching public records cannot find assets purchased via the trust. If you name a legal entity or different person as your trustee, your beneficial ownership interest in your trust remains concealed from the public and any person interested in your property, including creditors.

For instance, as a rental property owner, you can wish to hide your ownership from your tenants, so a property management company handles them instead of you. You might also want to conceal your identity during property purchase negotiations. Typically, sellers increase the selling price after learning the prospective buyer is wealthy.

Confidential Transfer of Ownership

You can only transfer title to the property through a mortgage or publicly recorded deed. Alternatively, you can convey your stake in the trust asset by confidentially assigning your beneficial interests by gift or sale. No one will see your transaction, know the purchaser’s name, or know the transfer cost if you sell your property.

Probate Avoidance

A trust can also avoid probate if, in your trust agreement, you name a beneficiary upon your death. An appropriately-drafted trust transfers beneficial interests in the same asset to successor beneficiaries in the trust agreement through a court proceeding.

Homestead Exemption

The trust beneficiaries are still eligible for homestead exemption for:

- Protection from forced sale by a judgment creditor, and

- Tax purposes

An Alternative to Partnership

People who invest in one property form a partnership, have an agreement that outlines the business arrangement and should file their partnership with the state. The limited partnership should be brought to the state and pay filing fees.

Alternatively, investors can express their business arrangements using their trust agreement terms with benefits and obligations assigned to various beneficiaries. Trusts are neither brought to the state nor pay fees.

Lien Avoidance

Your creditor’s judgment automatically becomes a lien on every real property in your name (other than the homestead). A beneficiary’s interest in a trust is not real property but personal. That means a lender with a judgment against a trust beneficiary cannot acquire a judgment lien on your trust asset by recording a judgment where your asset is located.

Disadvantages of a Land Trust

While a well-drafted trust agreement can offer asset protection, it is a myth that Florida land trusts protect owners from real and personal estate liabilities. Here is why:

Additional Tax Return Filing After the Grantor’s Demise

After the grantor dies, the IRS requires the trustee to acquire an Employer Identification Number and bring tax form 1041 annually. Sometimes, this can result in challenges for some trustees.

Asset Protection

Although your land trust makes your details inaccessible to the public, a judgment creditor can know the information once you are a judgment debtor. In this case, you should disclose your interest in your property.

While the judgment recording does not permit the lender to place any lien on the assets, they can use other ways to pursue your interests in the land trust.

Land Trust Comes with Homestead Exemption but Lowered Privacy

Beneficiaries of Florida land trusts are eligible for homestead exemption for creditor protection purposes. Although you can use the homestead exemption on a property in your trust, your identification detail will be listed on the property appraiser’s website in the county where the asset is situated. That means, even though land trust offers privacy, the public can access your name once you claim the homestead exemption.

While there are exceptions to hiding ownership details, these circumstances are few. You can obscure your information if you are a:

- Government employee

- Law enforcer

- Victim of a violent offense

- Prosecutor

- Public defender

- Registered guardian

How to Select a Trustee

When establishing your land trust, you should ask a fundamental question: Who can I rely on to administer the trust and act in my best interests? To help you, here are factors to consider when selecting a trustee:

Ability to Make Tough Decisions

One responsibility of a trustee is overseeing distribution to beneficiaries. Some trusts provide specific instructions about the nature of permissible distribution, while the trustee should decide the appropriate distributions in others. A trustee with a personal relationship with the beneficiary may not make objective decisions. Complex family dynamics like grief can make this responsibility more challenging.

Sometimes, an individual trustee might not be able to say “no" when needed, and their relationship might be affected if they do.

A trustee company is not prejudiced in deciding and can administer your land trust according to the applicable laws and trust terms. A seasoned trust officer makes significant decisions about distributions based on beneficiary intentions, circumstances, and the firm’s understanding of land trust provisions.

Acceptance of Liability

A trustee can be personally accountable even for unintentional behavior, provided it does not meet legal standards. Mishandling assets, a poor investment decision, failure to realize tax savings, conflicts of interest, and improper accounting are reasons a beneficiary can sue the trustee.

On the other hand, a trustee company has the right resources and insurance to avoid liability. The firm has a bookkeeping system that ensures thorough accounting of disbursements and receipts and offers accurate reports to the Internal Revenue Service (IRS) and beneficiaries.

Consistency of Service

Your trustee might not respond to your needs promptly, and you would not have recourse if they stopped responding.

For instance, your family member might find the responsibility time-consuming and overwhelming. Moreover, it can be challenging for your trustee to respond to your requests if they are on vacation. The service constituency becomes a significant issue if the trustee becomes incapacitated or ill. Replacing your trustee may be complex. It is because there are different degrees of incapacity, and verifying the trustee is no longer qualified for the role could be painful for you, your trustee, and their families.

If your trustee dies, you should appoint a representative. Before assuming the responsibilities, the representative can request an accounting to exonerate your trustee for their conduct during their term. During this time, your trust will remain unattended. Adjusting your trust portfolio will be expensive if the financial markets shift during this period.

You will not experience a break in service with your corporate trustee. The firm is continually available and dedicates its attention and time to the trust administrative duties.

The Trustee’s Expertise

An individual trustee, without expertise, can mismanage your assets or make mistakes. Auditors do not review the decisions of these trustees, and significant errors could remain undetected for years, leading to lawsuits or fines.

Regulatory government authorities and internal auditors check whether institutional trustees have properly managed trust property. They review fiduciary duty fulfillment, account management process, and compliance procedures. Also, corporate trustees have professionals in compliance, insurance, law, and accounting.

Cost Incurred

Institutional trustees usually charge fees equivalent to a given percentage of the land trust property’s value. The companies offer services for a bundled price.

While your individual trustee may not need fees to manage your land trust, they might consult professionals to help them with responsibilities and decision-making. Depending on the type of properties in your trust, the trustee can hire portfolio managers, accountants, and attorneys, increasing your overall cost.

You Have Two Trustee

You can choose both an individual and corporate trustee to administer your land trust. It permits family dynamics to play a role in distribution decisions while the corporate trustee performs the complicated administrative responsibilities.

You Can Use Many Land Trusts

You can place various properties in one trust. Regarding investment, where benefactors have an interest in every property, using one land trust eliminates hassle. It is also cost-effective to add assets to one land trust instead of setting up another one for each new property the benefactors buy.

However, you can set up another land trust if any of the following statements is true:

- You want to transfer your beneficial interests in one asset to another, or

- There are various beneficiaries to every property.

If two different assets are in one trust, you cannot transfer your beneficial interest in one asset to the other. Therefore, you should create two trusts. Setting up different trusts is easy but costly.

One thing you need to know when establishing your real estate land trust is that separating your assets could be beneficial. Assuming investors purchase five properties for rental and vacation purposes. Four of these homes are rented within two months, but one fails to obtain tenancy even after being advertised. While the four houses generate income, the remaining property lies empty, with bills like mortgage repayments accumulating.

If the home fails to secure tenancy, its overdue payments will be accrued from the other properties’ income. This option is effective in certain circumstances, so the revenue generated will be used and shared across all houses.

However, if a creditor calls in the home’s lien or lays a claim against any property, all the other assets would be deemed properties of the land trust, and a creditor can seize any.

To stop this from occurring, you should separate the assets. An effective way is categorizing your assets. For instance, in the above example, you can put vacation homes that generate seasonal income in one land trust and rental homes in another. You can isolate more challenging assets from the rest.

When combining your assets into one land trust, you should assess your real estate portfolio and investment goals.

Common Mistakes People Make When Creating a Trust

While creating a land trust can protect your property and privacy, making mistakes can invalidate the trust. Here is an overview of common mistakes to avoid.

Functioning as Your Own Trustee

The primary goal of a land trust is anonymity, and when you serve as a trustee in your land trust, you blow the benefit of keeping your name off the title. The public will know that you are associated with the properties if you are the trustee.

You should also avoid making this error due to the merger doctrine. According to the doctrine, if the beneficiary and trustee are the same people, the title merges back to your name as the grantor, and your trust ceases to be a title-holding estate planning instrument.

Informing the Lender

One advantage of a land trust is that it allows you to transfer assets into your trust without invoking the mortgage's due-on-sale clause. The lender cannot raise your loan amount once you transfer the title into the trust. Informing your creditor about transferring the title can result in confusion for them and additional costs.

Failing to Assign Interest

You should not hold a beneficial interest in the land trust. Otherwise, you will be held personally accountable if your trust is sued. You should assign your interest to an LLC to prevent blowing your accountability protection.

Using Your Home or Primary Address on Your Trust Tax Statements

When transferring title into the land trust, you should complete a Preliminary Change of Ownership Report. The report indicates that your trust owns the asset, and tax statements should be sent to the address provided. Providing your home or primary address makes it possible for the public to know your association with your assets.

Why You Should Hire an Attorney

Your trust lawyer is your guide through your financial planning process. They can walk you through the state’s estate planning laws, assess your goals and assist you in establishing a land trust that balances your needs and the law.

The lawyer is acquainted with estate planning, and when you consult them, they can dedicate their time to ensure you understand your financial goals and available options. Then they will create a legally binding and valid trust for you.

Finally, they will help you manage the trust so that it is effective. The attorney will ensure the trustee administers the trust according to your wishes, whether they are the trustee or not. It is particularly essential if the trust is unusually complicated.

Find a Knowledgeable and Qualified Probate and Estate Attorney Near Me

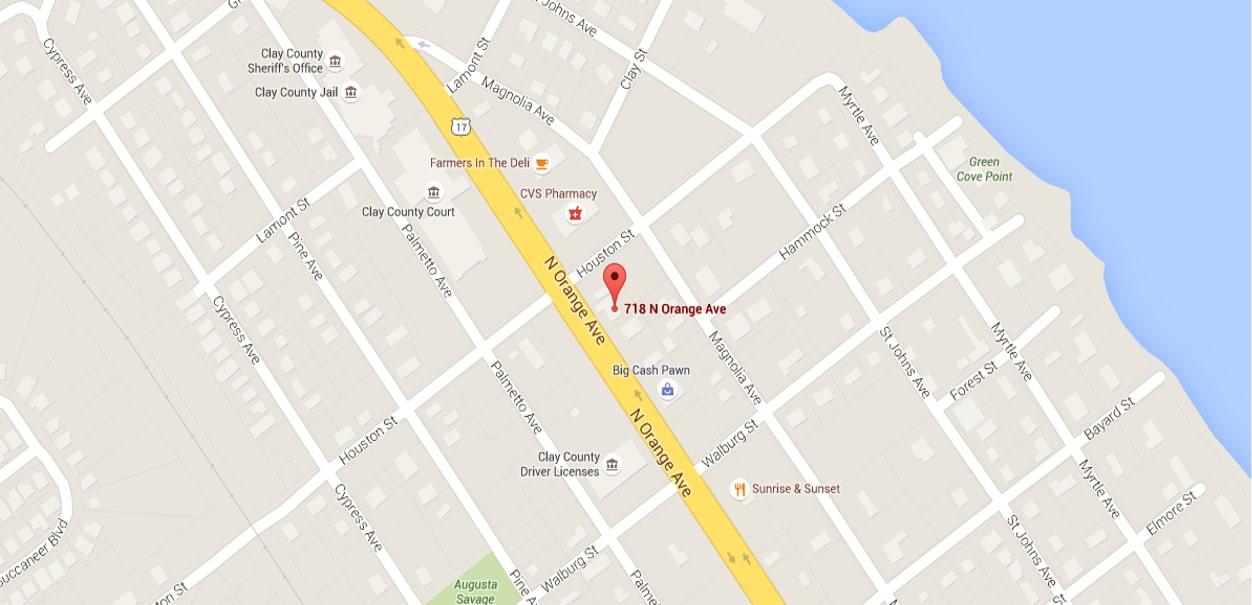

A Florida land trust is an essential real estate holding tool that converts real property interests into contractual interests. It gives you a layer of asset protection as an investor. However, setting up a land trust can be complicated, making it essential to seek legal assistance. Arnold Law is a qualified estate planning law firm with the experience and expertise to assist you in creating your trust, preparing the necessary paperwork, and working with an LLC. We can also explain the pros and cons of a land trust, allowing you to make an informed decision. To book your initial consultation and get answers to your questions, please call us at 904-264-3627.