If you are like most people taking charge of their estate planning, you want to make the transfer of your property and affairs to your beneficiaries as smooth as possible when you pass away. And like most of these people, you might think that a will is all you need to simplify the process.

While a will helps name the beneficiaries, it does not help you avoid probate. Therefore, once you pass away, your spouse and children or other beneficiaries might have to go through a long, costly, and frustrating probate process.

So how do you avoid probate in the first place? Our estate planning attorneys at Arnold Law will explain everything you need to know about avoiding probate.

What exactly is Probate?

Probate in Florida is a court-supervised legal process used to identify and distribute the property, assets, and debts of the deceased to his or her beneficiaries. Probate administration applies to probate assets (those that the deceased owned in their name or co-owned with another person, but without providing for automatic succession upon death).

Probate assets include any of the following:

- Bank or investment accounts solely in the deceased’s name

- A life insurance or retirement policy payable to the deceased’s estate

- Real estate titled in the deceased’s name or co-owned with another party as tenants in common (except for homestead property)

Florida recognizes three types of probate:

- Formal administration (formal probate)

- Summary administration which occurs for assets worth $75,000 or less or for a death that occurred at least two years ago

- Disposition without administration in which you skip the probate process. This applies when the deceased did not leave any real estate and the value of the remaining estate is less than the final expenses.

During formal probate, the court will appoint the administrator if one the will does not list one. If the deceased left a will, the claimants must file it with the local circuit court.

Under the court’s supervision, the administrator or personal representative should gather and inventory the deceased's assets. He or she must then pay any taxes and debts before distributing the remainder to the beneficiaries.

Probate ends after the estate’s distribution to the beneficiaries. The personal representative must present the court with the final accounting of the estate's assets and accounts and manage and distribute these assets to the beneficiaries. The court then orders the estate closed. Probate may take six months to one year and involve certain costs, including attorney fees and filing fees.

An estate goes to probate when the estate is in the deceased’s name only, even if they left a will or died intestate. If the deceased's will is proven to be valid, the court will oversee paying all the expenses of the estate and distributing the assets to the beneficiaries as per the terms of the will.

If the deceased died intestate, the probate court will identify the appropriate heirs and proceed to oversee the distribution of the estate’s assets and payment of its expenses. The distribution process under Florida law involves:

- The surviving spouse will receive the deceased’s entire estate if the deceased did not have any living children, grandchildren, or parents.

- The estate will go to the decedent’s surviving spouse and any surviving members of the surviving spouse’s immediate family.

- If the deceased was unmarried at the time of death, the immediate family members will receive his or her entire estate.

- When the person dies without any surviving close family or spouses, the state will find more remote heirs.

The probate process is much easier with a valid will as the probate judge has the instructions on how the deceased would have wanted to split his or her assets.

Fortunately, you can save your beneficiaries the trouble of going through probate by taking steps to avoid probate during the estate planning process. Some of the reasons you should avoid probate are:

- You reduce the costs your family has to incur through the probate process. Probate includes court costs, attorney fees, and taxes, payments to creditors, executor fees, and accounting and appraisal costs that arise when you go to probate. For an estate worth less than $40,000, the attorney fees may amount to $1,500. The attorney fees could be as high as 1% of the estate for estates valued over $10 million.

- Privacy: probate requires your loved ones to file in the public court, and the records arising from the proceedings are accessible to the public. This means that anyone can determine what share of your property each heir gets. To avoid such scenarios, you should take steps to protect your assets from going to probate.

- Control: when you have spent a lifetime working hard for your family, it would be a loss to lose control over the property distribution once you are gone. However, by taking steps to avoid probate and get your estate in order, you are maintaining control over your property. Your heirs will get the property you want them to get.

- You save your family time. Probate takes a minimum of 6 months, and in cases heirs cannot agree, the process may last years. To avoid such scenarios, you have to take some estate planning steps that will help you save your family the trouble, frustration, and expense that come with probate.

You can avoid probate in Florida through:

- Joint-tenancy

- Beneficiary designated accounts

- Revocable living trusts

- Enhanced life estate deeds

Let us look at how each method works.

Beneficiary Designated Accounts

When you go to the bank to open a new account, you complete a form indicating the account owner(s) with signature authority. You are also required to lament the beneficiary of that account when you pass away.

Choosing a beneficiary to your account requires you to sign a beneficiary designation form, which allows the named beneficiary to receive the funds remaining in your account after you pass away.

Life insurance and other financial products also require you to name a beneficiary to collect the death benefits arising from the policy. You can select a beneficiary for your retirement accounts, insurance policy, and investment accounts held with a financial institution.

Completing a beneficiary designation for your financial accounts helps avoid probate as the heir is clearly stated through the beneficiary designation, and that beneficiary is alive when you pass away.

If the beneficiary is still alive, they only need to present a certified death certificate alongside their identification details before the institution releases the funds or accounts.

If you are planning to use a beneficiary designation as a probate avoidance tool in Florida, you must ensure that you keep your beneficiaries updated. For instance, if a named beneficiary predeceases you, you must update the beneficiary designation to avoid the probate process. If an account has a deceased beneficiary, the other heirs must go through probate administration to receive the funds in your account.

You should also update your beneficiary designation if you update your last will. The beneficiary named on your financial accounts takes precedence where the heir to a financial account is different on the will and the beneficiary designation is held with a financial institution.

The beneficiary designation with the financial institution takes precedence because you have a contractual obligation with the financial institution or insurance provider and are legally bound to pass on your accounts to the designated beneficiary.

The beneficiary designation also avoids conflicts that might arise with joint ownership of accounts. For example, if the named beneficiary is also a joint owner of the account, they can use that account with or without your permission. However, when you designate a beneficiary on a Transfer or Payment on death terms, that beneficiary only obtains access to your account or investments after you pass on.

Having a beneficiary designated accounts for your retirement account leads to favorable tax treatment, unlike when you leave the account under a trust.

Joint Tenancy

In Florida, you can own property, assets, or accounts jointly with another person in one of these forms:

- Joint tenancy,

- Joint tenancy with the right of survivorship

- Joint tenancy in the entireties, and

- Tenancy in common

Tenancy in common occurs when more than one person is listed on the real estate title. When you and a partner own a property jointly, you may specify that you are tenants in common. In cases where you do not specify the type of tenancy, the court presumes it as tenancy in common by default.

Tenants in common have equal rights to the property, although these rights may vary depending on the agreement. Upon the death of one of the tenants in common, the interest in the jointly owned property transfers to the decedent's heirs.

Therefore, if Louise and Patrick own a real estate property as tenants in common, and Louise passes away, Patrick retains his ownership rights. Louise’s beneficiaries also have a claim to Louise’s share of the property.

Joint ownership in common often results in probate proceedings upon one of the co-owners ' death unless the deceased had their share of the property held by a revocable trust.

Joint tenancy in Florida is similar to tenancy in common, except that both parties must have the same percentage of interest in the real property. Like tenancy in common, joint tenancy will not help you avoid probate in Florida.

Joint tenancy with the right of survivorship is the best alternative when co-owning property with another party and avoiding probate. In this case, when one party dies, the other co-owner automatically inherits the ownership rights to that property.

In the earlier example, if Louise and Patrick owned a real estate as joint tenants with survivorship rights, Patrick would become the full owner of the real estate upon Louise's death. Patrick would only need to present Louise’s death certificate to the Property Appraiser's Office where the property is located to transfer the property into his name.

The catch with joint tenancy with survivorship rights is that the joint owner becomes the full owner of that property. Therefore, if you intend for your heirs to receive the property, you must list them as joint owners.

Tenancy by entireties is available only for married couples in Florida. It has the same features of joint tenancy with survivorship rights, meaning that ownership automatically transfers to the surviving spouse. However, if the second spouse dies without having transferred ownership to the beneficiaries, the estate will go through probate.

Avoiding probate through joint ownership with surviving rights must be an ongoing process if you intend to avoid probate. Therefore, you must always consult with an estate planning attorney about the steps you can take after the death of a joint owner to help you avoid probate.

Florida Lady Bird Deed / Enhanced Life Estate Deed

Some states allow a transfer on death deed for your real estate allowing the beneficiary to receive the real estate upon your demise automatically. Florida, however, lacks such a provision, meaning that you have to find other ways to avoid probate should you pass away.

Luckily, you can use the lady bird deed to transfer the property on death and avoid probate. A lady bird deed allows you to retain complete control over your property until you die. It also helps avoid probate as the rights of ownership automatically transfer to the remainderman upon your death.

Complete control over the property means that you do not have to consult the remainderman on taking a mortgage against the property, selling, or transferring the property.

Before we cover the advantages of a lady bird deed, let’s look at some of the downsides:

- It lacks asset protection, meaning that creditors may place a lien or levy on the remainder interest in the lady bird deed.

- You cannot use the lady bird deed to disinherit a spouse or minor children.

- It might lead to confusion on what to do if the remainder dies before the life tenant and the life tenant dies.

- It takes extra work to change the lady bird deed if you wish to change the designated remainder.

The advantages of having a lady bird deed for your property include:

- It helps avoid probate by transferring the property to the remainderman when you pass away.

- It exempts you from creditor attachment; therefore, creditors cannot force you to sell your home to satisfy a creditor's money judgment (lady bird deed allows you to benefit from Florida’s Homestead Protection).

- It allows you to qualify for homestead tax exemption

- It allows you to maintain ownership of the property. This is unlike fully transferring the property rights and ownership to a beneficiary who might mortgage, sell, or transfer the property.

- You do not need the permission of the remainder to sell or transfer the property.

It is a good idea to work with an estate planning attorney when obtaining a lady bird deed to ensure you have all the documentation you need. Some of the documentation includes a living will, a will, a healthcare directive, and a preneed guardian designation.

You also need to record the lady bird deed to protect yourself against the risk of losing the deed. A lady bird deed is revocable; therefore, you can cancel the deed if you change your mind.

You can include as many remainders as you want in the lady bird deed. For instance, if you have two children you want to inherit your home, you will name them as remainders and indicate their interest in the property. If one of the remainders dies after inheriting the property, their interest in the property will go through probate.

Revocable Living Trusts

A revocable living trust is an agreement you make to manage your assets while you are alive and distribute the remaining assets after your death. When you create a revocable living trust in Florida, you become a grantor, and the trustee is the person responsible for managing your trust estate. A trustee could be yourself, a bank, or a trust company to serve as the trustee. You must also mention the beneficiaries who will receive your assets and property after your demise. In addition to the beneficiaries, you must name a successor trustee who will be in charge of managing your estate after your death.

It is a good idea to have a revocable trust as an estate-planning vehicle if:

- You have money in the bank, investment, or as a retirement plan

- You own real estate

- You are married and do not have an estate plan

- You are divorced and haven’t modified your estate plan

- You own a business

- You have valuable family heirlooms

- You have children or grandchildren

A revocable trust allows you to modify or revoke the trust at any time, except when you are incapacitated, in which case the trustee manages your trust estate, including paying your bills and making investment decisions.

A revocable trust is a common estate-planning vehicle that is used in avoiding probate. It achieves this by transferring ownership of your assets to the trust; therefore, once you pass away, the assets you transfer to the trust do not go through probate.

Note that you MUST transfer your estate to the trust if they are to avoid probate.

The significant benefits of a revocable living trust include:

1. Control of Your Estate After You Die

A revocable living trust gives you control of your assets after you die as you have appointed someone who will take over the affairs of your estate after your death. You allow your family to transition with less frustration and confusion by taking care of their financial stability.

Your family will receive your assets within the shortest time possible after you pass away, with little to no costs. This is unlike what they would spend when going through the costly and time-consuming probate process.

You also have control over who inherits your property and accounts. A revocable living trust allows you to name the beneficiaries and the share they receive from your estate.

2. You Maintain Privacy

Probate proceedings are public. Anyone can attend the proceedings or access records of your assets if your estate goes through probate. However, with a revocable living trust, you save your family the burden and publicity that might arise from the asset distribution process. Only the trustee and your family will know about the transfer of property.

3. You Plan for Incapacity

For most people, estate planning comes to mind when thinking about their families after their death. However, incapacity should also be a driving factor for estate planning. Having a revocable living trust allows you to control your estate even after being incapacitated and cannot communicate your wishes. The trustee you appointed would be in charge of overseeing your assets.

Without a revocable living trust in place, your assets will go into guardianship to allow your family to access any of your property or accounts. When planning for incapacity, you should also consider having financial and medical powers of attorney to take care of your financial and medical decisions if you are incapacitated.

4. Your Children are taken Care Of

If you have children or grandchildren, you might want to secure their financial future by leaving an inheritance. However, if they are young, a revocable living trust is an excellent idea to ensure they are taken care of.

You can control exactly when your children receive their inheritance through a trust. For example, if you want them to be at least 25 before receiving their inheritance, the trust will manage their assets until they reach these milestones.

Find an Estate Planning Attorney Near Me

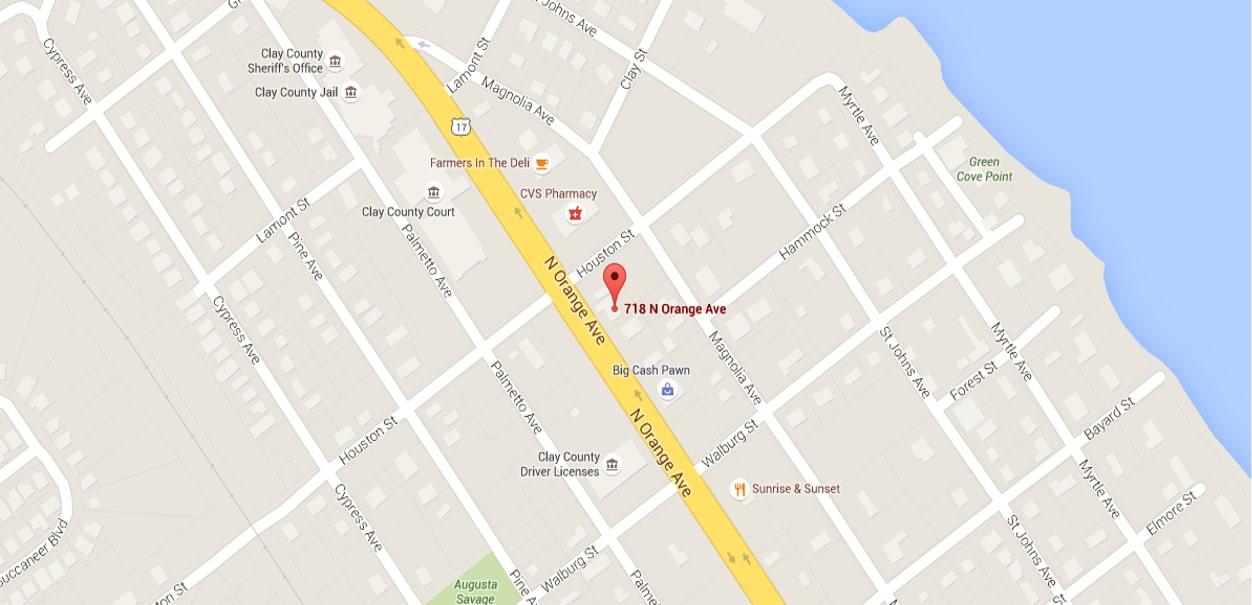

Planning your estate to avoid probate in Florida is a sound decision that will save your family from the expensive and time-consuming probate process. Asset planning vehicles such as designated beneficiaries to financial and investment accounts, revocable living wills, and certain forms of joint ownership will help you maintain control over your estate even after your death. Arnold Law helps Floridians plan their estate to avoid probate. We also help the deceased's family members with probate if any of your loved one's estates go into probate. Contact our probate and estate attorneys at 904-264-3627 for a free consultation.