Estate planning is for more than just aging people. It is never too early to decide what should happen to your property in case of your demise. Estate planning involves determining the beneficiaries of your estate and to what extent each should benefit after your death. You can only transfer your estate to your heirs in a smooth and stress-free transition if you have a detailed estate plan. Often, estate planning can be complex and overwhelming. You need a dedicated legal advisor to assist you in implementing your plan. Arnold Law, Florida, has a knowledgeable team of attorneys that can walk with you and ensure your wishes hold.

Estate Planning

Estate planning is a series of activities that involve managing your financial situation if you become incapacitated or die. It involves the following:

- Settlement of debts and estate taxes.

- Bequeathing of assets to heirs.

- Guardianship of pets and minors.

Often, attorneys' experience comes in handy in estate planning. Some steps in estate planning include writing a will, reviewing your accounts, and listing your debts and assets. The estate planning process also determines how your assets will be preserved, managed, and distributed after your demise. Planning is not only a strategy meant for the wealthy. It would help if you considered estate planning irrespective of your net worth.

Some assets that could make up an estate include debts, pension schemes, life insurance, artwork, stocks, cars, and houses. The reasons for planning an estate include the following:

- Leaving a legacy for a charitable cause.

- Funding your children's or grandchildren's education.

- Providing for your surviving spouse and children.

- Preserving family wealth.

Benefits Of Estate Planning

Estate planning can assist families, beneficiaries, couples, and individuals avoid unforeseen and complex tax situations during the emotional period following your demise. Apart from naming beneficiaries and determining who will inherit your assets, estate planning can simplify thorny financial matters a beneficiary could face. Advanced estate planning tools can help protect an estate's assets while eliminating or minimizing federal estate taxes. The advanced tools include:

- Private foundations.

- Charitable giving.

- Trusts, and

- Other constructs.

You need a comprehensive estate plan if you have an estate and want to make sure it goes to the right people at the right time and minimize taxes on your estate. Most individuals find it frightening to consider their demise or incapacity, but you and your family must be ready for this inevitable possibility.

Using estate planning can prevent your money from being distributed following the state law and instead direct it to the recipients you specify after your passing. Additionally, it makes the transition as easy as possible and prevents your beneficiaries from incurring disproportionately high inheritance taxes.

Estate Planning Documents In Florida

Estate planning is an intricate process that involves more than just drafting a will. You will need some crucial estate planning documents to ensure your last wishes are honored. The primary records for estate planning include the following:

- Advance health care directive.

- A durable power of attorney.

- Provision of digital assets.

- List of essential documents.

- A will and testament.

- Revocable living trust.

- Preneed guardian designation.

- Estate tax planning.

Advance Healthcare Directive

Typically, an advanced healthcare directive is a written legal document highlighting your instructions regarding medical care when you become incapacitated. An advance healthcare directive will ensure that your last wishes hold when you become incapacitated and cannot make medical decisions. It is also one of the most important among all your estate planning documents. You can do the following with an advanced healthcare directive:

- Provide instructions for your health care — You can provide written instructions for your future medical care, including a life-sustaining treatment if you are terminally ill or permanently unconscious.

- Name a health care agent, also called Durable Power of Attorney for Health Care — Your appointed agent will have the power to make medical decisions on your behalf if you are incapacitated. An agent can be any person you wish.

An advanced directive can help prevent future disputes, although the above decisions can be challenging and uncomfortable. An advanced directive will ensure that your healthcare wishes go as planned.

Durable Power Of Attorney

You can appoint a person to make financial decisions on your behalf with a durable power of attorney. It is essential to make this decision if you are incapacitated and cannot make it on your own. Your agent will have the capabilities to step in and make financial decisions for you, like:

- Oversee your investments.

- Sell any real estate on your behalf.

- Maintain your mortgage.

- Pay your bills.

No agent can make these decisions on your behalf if you do not have a durable power of attorney. However, these decisions can apply if the court appoints a conservator or guardian. Unfortunately, the court appointing a guardian can be costly and lengthy. The court could also fail to choose the person you would have named.

Provision Of Digital Assets

When planning your estate, include a provision for your digital assets in today's digital world. Digital assets could consist of the following:

- Emails.

- Social media accounts.

- Electronically stored videos and photos.

- Website domain names.

When you fail to include a provision for digital assets in your estate plan, your family members will be unable to access your emails, videos, photos, social media accounts, and other digital items after your death.

List Of Essential Documents

Ensure that your loved ones can access your estate planning documents and other essential documents they will require to settle your affairs. It will be easier for your loved ones to fulfill your last wishes if you create a list of important documents and their locations. Essential documents could include:

- Retirement accounts.

- Real estate deeds.

- Birth certificates.

- Life insurance policies.

- Bank accounts.

Beneficiary Designations

A designated beneficiary is an individual that will inherit an annuity, a life insurance payout, and the balance of an account. Generally, beneficiary designations ensure that individuals of your choice inherit annuities, account balances, and life insurance payouts. You can have several beneficiaries if you wish and multiple secondary beneficiaries.

Letter Of Instruction

A letter of intent/letter of instruction is a document that outlines your wishes regarding the distribution of your property, medical care, and your funeral arrangements. Typically, a letter of instruction passes your wishes to family members after your death. This letter is not legally binding but can serve as a guide to the executor. You could use this letter to send messages to your loved ones because it is not a legal document.

Will and Testament

The most critical estate planning document is a will & testament because they highlight your final wishes. If you have possessions or property, which you would like to leave to specific charities, friends, or family members, you can document these wishes in your will. You can determine the following in your will & testament:

- Who will inherit specific family heirlooms.

- The distribution of your cash and assets.

- How your real estate will be distributed.

- Who will take custody of your dependent children.

Typically, this written document gives powers to decide who inherits what after you pass away. These documents are the foundation of an estate plan. They are essential tools that ensure your estate settlement goes as you desire. Without a will, the state will determine how to distribute your possessions and property after your death.

The following are the requirements for a will under Florida law:

- It must have the signature of everyone in the same room, including the testator and the witness.

- Must have two witnesses.

- Must have the signature at the end.

- It must be in writing.

- The testator must sign it.

Revocable Living Trust

Also referred to as a living trust, a revocable living trust, much like a will, dictates what happens when you are incapacitated. It permits you to transfer property to the trust while you are alive.

As the trust maker, you have the right to undo the trust while alive. This trait is why we call it revocable," You can sell the property, return any property you transferred to the trust, or place more property into the trust.

A revocable living trust also highlights what will happen when you cannot manage your affairs or become incapacitated. You can appoint a successor trustee to manage or step in your affairs on your behalf. However, your revocable living trust becomes irrevocable upon your death. In this case, your successor trustee takes over and implements your last wishes as you outlined.

Often, living trusts have merits over wills. One of the merits is that the information regarding your estate remains private. A revocable living trust can also prevent probate, which can be lengthy and expensive.

Declaration Of Preneed Guardian

If you do not appoint someone to serve as a guardian, the court could appoint any person you have never met or you do not like to make financial and medical decisions for you. If the durable power of attorney and health care surrogate designation fail, a preneed guardian designation names someone to serve on your behalf.

It could be hard for your dependent child to survive without a guardian if you and your child's foster parent die. However, the state could appoint a guardian if you fail to do so in your estate plan. The document should contain a first and second choice if you specify a guardian. If your initial preferences cannot fulfill the obligation, you can include more alternatives.

Estate Tax

Florida authorities impose an estate tax on the transfer of wealth at your death. The rules base their estate tax calculation on the value of your "gross estate." It is a record of everything you owned or had an interest in at the time of your death. Often, the fair market value of these properties applies. However, this is not necessarily what their values were when you acquired them or what you paid for them. The sum of all of these properties is your "gross estate." The inclusive asset could consist of the following:

- Business interests.

- Annuities.

- Trusts.

- Insurance.

- Real estate.

- Securities.

- Cash and other assets.

Certain deductions are allowed in arriving at your "taxable estate" once you have accounted for the gross estate. This happens in exceptional cases. The deductions could include the following:

- Qualified charities.

- Property that passes to surviving spouses.

- Estate administration expenses.

- Mortgages and other debts.

The value of some farms or operating business interests could be reduced for estates that qualify.

After computing the net amount, the amount of lifetime taxable gifts is added to the net amount, and the tax is calculated. The available unified credit could then reduce the tax.

However, some relatively simple estates do not need to file an estate tax return. They include:

- Jointly held property.

- Small amounts of other easily valued assets.

- Publicly traded securities.

- Cash.

Property Subject To Estate Tax

When a person dies, their property could be subject to federal estate tax. Your taxable asset interests constitute what is known as a gross estate. The gross estate is the value of the whole asset in which you had an interest at the time of your demise, plus other statutorily mandated property.

The value of the gross estate properties is often at the fair market price at your demise. Some of the rules that guide the inclusion of assets in your gross estate are as follows:

Life Insurance

The benefits of any life insurance on your life are included in the gross estate if:

- You held any incident of ownership in the policy, like the right to borrow against the policy, change the beneficiary, or surrender or cancel the policy.

- The policy benefits are payable directly or indirectly to your estate.

Jointly Held Property

Most people die while having joint ownership of property, joint rights of survivorship. Property owned jointly by husband and wife is the standard form of joint ownership in Florida. In this ownership and for tax purposes, one-half of the property's value is included in the gross estate of the joint tenant that dies first. The other one-half is not included in the gross estate.

There could be a situation where the joint property is held with the right of survivorship between individuals who are not couples, like brother-sister or parent-child. In this case, the entire value of any joint property will count in the estate of the joint tenant who dies first. However, it will not be inclusive if the estate can affirmatively provide convincing evidence that the surviving joint tenant supplied all, or some, of the amount used to buy the joint asset.

Property Owned Outright

The entire asset you own individually and outright after death is part of your gross estate.

Gross Estate Deductions

The federal estate tax allows some deductions from the taxable value of your gross estate after your death. The unlimited marital deduction is the most significant estate tax deduction. This deduction offers an estate tax deduction for the asset you leave for your surviving spouse. The unlimited marital deduction has two essential prerequisites. They include:

- The interest must be a deductible asset interest — In this case, your asset interest is only deductible to the extent such interest is included in ascertaining the gross estate's value. If an asset interest is not included in the gross estate, then its transfer to your surviving spouse is not eligible for a deduction.

- An interest must pass to your surviving spouse — This is where a marital bequest must be directed to the lawfully recognized partner. A bequest to a deceased or divorced partner does not warrant a marital deduction. Your surviving partner must also be a citizen of the United States.

The unlimited marital deduction came into effect in 1982. This provision eliminated the gift and federal estate tax on asset transfers between couples, treating them as one economic unit. Congress adopted the deduction to eradicate the problem of inflation pushing estates into higher tax brackets.

Under unlimited marital deduction, the value of an asset that can be transferred between couples is infinite. This means one partner can transfer the asset to the other partner while alive or after death without meeting any gift or federal estate tax liabilities on this first transfer. The transfer is conducted via unlimited deduction from gift and estate tax.

Unlimited deduction postpones the transfer's taxes on the asset inherited between couples until the second partner's demise. Typically, the unlimited marital deduction permits couples to delay meeting the estate taxes upon the first partner's death. Upon the passing of the second partner, all property in the estate that had been excluded will count in the second partner's taxable estate.

Probate

Probate is the process whereby your property is distributed after your death. The property could include financial investments, real estate, and bank accounts. Probate is the general administration of the estate of a deceased person without a will or according to a deceased’s will.

Often, an executor is named in the will, or if there is no will, an administrator is appointed to complete the probate process. This process involves gathering your property to pay any remaining liabilities on your estate and distributing the properties to beneficiaries.

How Probate Works

Probate is the evaluation and transfer of administration of estate previously owned by the decedent. When you die, the probate court often reviews your properties. This court makes a final judgment on distributing your assets to the beneficiaries.

Typically, a probate proceeding begins by analyzing if you left a legal will. In most situations, the decedent leaves documentation with clear guidelines on how their property should be divided after demise. However, in some cases, the decedent does not leave a will.

The Executor

A testator is a deceased person with a will. Upon the death of a testator, the executor has the mandate to initiate the probate process. The executor is often a family member, but the will can also provide information on a specific executor. The executor has the obligation of filing the will with the probate court. Courts have guidelines on when an executor should file a will after your death.

Filing usually initiates the probate process, and the court supervises the proceedings. The authenticity of your will is determined before the adoption of the will as the valid last testament. The court will officially appoint the executor named in the will, and he/she will have the power to act on your behalf.

Typically, a will designates a legal executor or representative that the court approves. The executor has to locate and oversee all your property and is obliged to estimate your estate's value using the date of death or the optional valuation date, as directed by the Internal Revenue Code (IRC). The executor must also meet any tax and debt you owe from the estate and is also responsible for filing your final personal income tax returns on your behalf.

The probate court supervises most assets subject to probate administration, but real estate is an exception. Therefore, real estate probate could require an extension to any county in which the real estate is located.

Probate Without a Will

When you die without leaving a will, it is said that you have died intestate. On the other hand, the court will consider an invalid will as an intestate estate. An intestate estate probate process involves distributing your assets according to the state's laws. Probate will not be necessary if you die without any assets. A probate court proceeding often commences with the appointment of an administrator.

Find a Probate & Estate Law Attorney Near Me

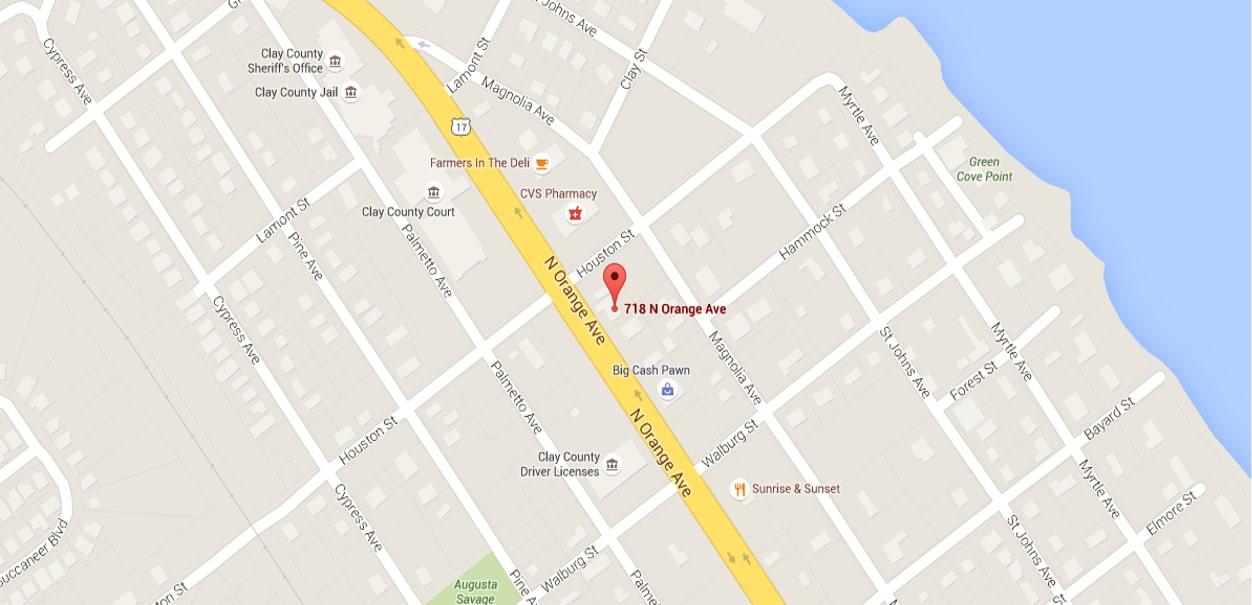

Estate planning offers you a chance to leave behind a legacy by enabling you to ensure your wealth ends up with the right people, protects your family, goes to the organizations you care about, or passes down your values. Therefore, you need accomplished experts to work with you to help you create an ideal estate plan. Arnold Law is a reputable firm in Florida with experienced legal professionals armed with a vast understanding of all aspects of estate planning. We will guide you through the estate planning process, including assisting you in determining the beneficiaries who will serve as stewards of your family wealth. Contact us at 904-264-3627 to schedule a consultation with one of our attorneys.